A guest blog By Thomas Mortensen, with thanks. A bilateral ceasefire is due in Colombia in the coming weeks, hopefully December 16th. Tax is not the most obvious remedy for civil war but in the case of Colombia, it could go a long way. The country has suffered an internal armed conflict for more … [Read more...]

Aid, Tax & State-building

Still Broken: major new report on global corporate tax cheating

Update, Dec 7, 2015: a new paper in the Journal of World Business, which contains this: "Home country statutory corporate tax rates have a small impact on tax haven use. In general, corporate tax rates are an important factor in driving MNEs to set up tax haven subsidiaries. However, … [Read more...]

Guest blog: sun, sea, sand, tourism and fantasy finance

Where are you going on your next holiday? The chances are if you are flying to a Sun&Sea destination, it will be with a tax-dodging company. A guest blog by Linda Ambrosie. Listen to her on the Taxcast here. Do you recognize any of these names: Barceló, TUI or Melía?. In … [Read more...]

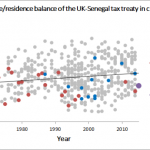

Will civil society shake up the world of tax treaties?

When a multinational company makes a cross-border investment, the relevant tax treaty between the two countries will generally sort out which country gets to tax which part of the ensuing activity and income streams. (Read more about tax treaties here.) A key question is this: how do the ensuing … [Read more...]

Finance Uncovered: how Africa’s biggest cell phone firm shifts billions offshore

From Finance Uncovered, a TJN-founded project, a press release about a story that is (among other things) front page of South Africa's influential Mail & Guardian newspaper. Finance Uncovered reveals how Africa’s biggest cell phone firm shifts billions offshore The Finance Uncovered global … [Read more...]

World Bank president: corporate tax dodging ‘a form of corruption’

From a speech by World Bank President Jim Yong Kim: "Some companies use elaborate strategies to not pay taxes in countries in which they work, a form of corruption that hurts the poor." That is a powerful statement from a powerful individual. This is indeed something that we've been arguing … [Read more...]

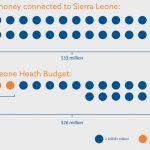

Christian Aid: new Swissleaks analysis shows harm to developing countries

An important new analysis from Christian Aid. Note the pull-out quote highlighting the problems with the OECD's Common Reporting Standard, or CRS. September 30 2015 NEW SWISSLEAKS ANALYSIS REVEALS HOW TAX HAVEN SECRECY HARMS DEVELOPING COUNTRIES New, detailed examination of the SwissLeaks files … [Read more...]

C20: new civil society policy paper on tax justice

Adapted from the Global Alliance for Tax Justice. Organisations from 91 countries from around the world, representing close to 500 civil society organisations and almost 5,000 individuals, have been working together for the last 18 months via the Civil 20 (C20) to engage with G20 governments on … [Read more...]

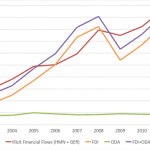

Report: Illicit Financial Flows Outpace Foreign Aid and Investment

Updated with new table: see below From Global Financial Integrity in Washington, D.C., via email: "Analysis of illicit financial flows (IFFs) by Global Financial Integrity (GFI) shows that in seven of the last ten years the global volume of IFFs was greater than the combined value of all … [Read more...]

Will Brazil’s “CPMF” financial transactions tax live another day?

For the decade that lasted up to 2007, Brazil levied a tax on financial transactions called the CPMF. It was a biggy: this tax raised nearly $20 billion in its last year of operation before it was killed off by a coalition of people opposed to it, some of whom are in this photo. The tax had two … [Read more...]

The West African Tax Giveaway: new report

An important joint report has been published by TJN-Africa and Actionaid looking at corporate tax incentives and their impact in the Economic Community of West African States (ECOWAS) -- and in particular Nigeria, Ghana, Cote d’Ivoire and Senegal. The report's first finding is that: I. … [Read more...]

Global tax body: “After 3 days of bullying, developing countries were run over”

The Third International Conference on Financing for Development just held in Addis Ababa has held negotiations for an internationally agreed position to support the post-2015 development agenda. One of the key areas of dispute this year was international tax. More specifically, TJN and others … [Read more...]

Quote of the day – Africa hit by global tax intrigues

Here's our quote of the day, via the Financial Transparency Coalition: “African nations are at the epicenter of the crisis of illicit financial flows, yet they are not even in the room when decisions are being made,” said Alvin Mosioma, Executive Director of the Tax Justice Network Africa. “A … [Read more...]

Stop the bleeding: new African tax justice campaign

Via the Global Alliance for Tax Justice: Last week the Interim Working Group of the African IFF Campaign Platform launched the “Stop the Bleeding” campaign in Uhuru park, a place historically associated with the struggle for freedom in Nairobi, Kenya. … [Read more...]

Tax Justice Research Bulletin 1(6)

June 2015. Surprising everyone by actually arriving within the stated month, here’s the sixth Tax Justice Research Bulletin – a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international tax, available in full over at TJN. This issue … [Read more...]