On International Women's Day, this is the first of two blogs on the subject of tax justice and gender. The short answer to the question in our headline is that cuts to the top rate of income tax hit women particularly hard, not just because their disproportionate role in childcare and other … [Read more...]

Aid, Tax & State-building

Switzerland’s financial secrecy brought under the human rights spotlight

Switzerland – arguably the world’s most important tax haven – may soon face scrutiny from the United Nations human rights system over its role in facilitating cross-border tax abuse. A coalition of civil society bodies has filed a submission to the Committee on the Elimination of Discrimination … [Read more...]

UN asks IMF, World Bank, to study illicit financial flows

Highlighting a powerful new(ish) study: the final report on illicit financial flows and human rights of the UN Independent Expert, Juan Pablo Bohoslavsky. It’s well worth reading the whole thing, but here are some of the top lines and just a few of the many important recommendations: Illicit … [Read more...]

Belgian tax treaties cost developing countries millions every year

New report 11.11.11: Belgian tax treaties cost developing countries millions every year A guest blog by Jan van de Poel As a consequence of dozens of unbalanced tax treaties, negotiated by the Belgian government, developing countries miss out on at least 35 million Euros on tax revenues each … [Read more...]

Quote of the day: South Africa’s Finance Minister

From the 2016 budget speech in South Africa, from Finance Minister Pravin Gordhan: "We will continue to act aggressively against the evasion of tax through transfer pricing abuses, misuse of tax treaties and illegal money flows. Drawing on the work of the OECD, the G20 joint project on base … [Read more...]

New project to share tax info in the Americas

TJN’s Andres Knobel participated in a conference in Panama on February 18-19, hosted by the Inter-American Centre of Tax Administrations (CIAT) & the German International Cooperation Agency (GIZ), and involving tax administrations from Barbados, Bolivia, Brazil, Canada, Chile, Colombia, Costa … [Read more...]

On the closure of the Argentinian think tank Cefid-AR

TJN laments the closure of the Centro de Economía y Finanzas para el Desarrollo de la Argentina" (Cefid-ar), an Argentine organisation heavily involved in research on illicit financial flows. Their work has shed light on capital flight from Argentina, estimating the figures of hidden money held … [Read more...]

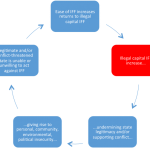

Illicit financial flows: the links to peace and security concerns

The UN Sustainable Development Goals (SDGs, the global framework guiding policy until 2030) include a target to reduce illicit financial flows (IFF), under SDG 16 on peace and security. Our research director, Alex Cobham, has written an article for the European Centre for Development Policy … [Read more...]

Call for Papers: Third Annual Amartya Sen Prize Competition

Call for Papers: Third Annual Amartya Sen Prize Competition Submission Deadline: August 29, 2016 The third Amartya Sen Prize is soliciting papers on the non-revenue impact of curbing illicit financial flows. Poor populations are hurt when rich individuals and multinational corporations … [Read more...]

PwC: using ‘competitiveness’ as crowbar to lobby for mining cos

From Fools' Gold: Recently we wrote an article entitled The Ideologists of the Competitiveness Agenda, in which we fingered the Big Four firm of accountants as among the most important vectors for the general idea that countries simply have to 'compete' in certain ways: namely, to shower goodies … [Read more...]

Taiwan – the un-noticed Asian tax haven?

This is a speculative blog based initially on a couple of conversations with people in the industry, with some supporting evidence. A (slightly tidied-up) conversation we've just had went along these lines: "You'll never guess what is the new Switzerland for Asia. And I mean big time. The Asian … [Read more...]

Review: new book on Capital Flight from Africa

Over at Uncounted, Alex Cobham (our Research Director) has written a review of a new tome for tax justice bookshelves: Capital flight from Africa: Causes, effects and policy issues, Ibi Ajayi & Léonce Ndikumana (eds.), 2015, Oxford University Press. His review begins: "This new volume … [Read more...]

New paper: tax treaties a ‘poisoned chalice’ for developing countries

Update, Jan 20: this blog has now been adapted and expanded in a post on Naked Capitalism. In 2013 we published an article entitled Lee Sheppard: Don't sign OECD model tax treaties! which looked at a presentation by one of the U.S.' top experts in international tax. Her fiery presentation … [Read more...]

The Finance Curse and Competitiveness: presentation at Max Planck Institute

This is the text of a lecture that John Christensen, Director of the Tax Justice Network (TJN), gave at the Max Planck Institute in Cologne this week. … [Read more...]

Short animation: tax is paid by everyone, for everyone

From TJN-Israel and law students at Israel's College of Law and Business, an excellent short animation reminding people of the roles that tax plays in civilised society. Enjoy. … [Read more...]