Prof. Thomas Rixen, who has written a lot about tax 'competition' (aka tax wars) in the past, has a new article looking at similar dynamics in the area of financial regulation. Entitled Why reregulation after the crisis is feeble: Shadow banking, offshore financial centers, and jurisdictional … [Read more...]

Tax Havens & Financial Crisis

Three lessons on the hidden cost of corruption – for the West

A guest blog by Sigrún Davíðsdóttir Corruption and corrupt business practices have often been portrayed as a problem only endured by poor countries, of little consequence to the developed West. The three following stories show that this is a wrong-headed, old-fashioned understanding, reflecting … [Read more...]

Anti-corruption summit: UK climbdown, but momentum grows

The UK government has failed to deliver a decisive blow against financial secrecy at its Anti-Corruption Summit. David Cameron failed to convince or compel leaders of British overseas territories and crown dependencies to end their hidden ownership vehicles, despite having called for such a move … [Read more...]

Lessons from Iceland, where offshore created an onshore bubble free of rules and regulations

Lessons from Iceland, where offshore created an onshore bubble free of rules and regulations A guest blog by Sigrún Davíðsdóttir In a matter of a few years tiny Iceland became the world’s most ‘offshored’ country, both proportionally in terms of the number of clients the banks “sent offshore,” and … [Read more...]

On Luxembourg’s contribution to financial instability

Since the global financial crisis erupted we've been running a web section called tax havens & financial crisis - which looks at the risks that tax havens pose to financial stability. Perhaps the strongest thread running through this page is the fact that tax havens provide escape routes … [Read more...]

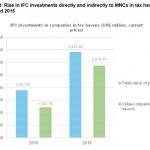

Oxfam: the International Finance Corporation and tax havens – new report

Monday 11th April Oxfam has launched a new briefing on the IFC and tax havens. This briefing will also be presented and discussed at our event at the World Bank CSO forum on Friday 15th of April at 11 am-12.30 in Washington DC. … [Read more...]

Following the Money: French Banks’ Activities in Tax Havens

Update: the English version is coming soon; the French version is here. The following press release is published by Oxfam France; CCFD-Terre Solidaire; and Secours Catholique-Caritas. The accompanying study uses the first fully available public Country-by-Country reporting data from French banks … [Read more...]

Offshore Ireland implicated in bank collapse, once again

Update: now on Naked Capitalism (and note the comments underneath.) Update 2, March 1: now with added video at the end: a Live Register report on the IFSC, from 2012. We have written a great deal about the role of Ireland and the Irish Financial Services Centre (IFSC) and its role as an … [Read more...]

HSBC opts to stay in ‘competitive’ London. (It was never going to leave anyway)

From the Fools' Gold blog, yesterday: There's been a lot of talk for a long time about a threat from globe-trotting HSBC to move its headquarters from London to Hong Kong. It seems there's been a resolution of the question for now, of sorts. As Bloomberg puts it: "HSBC Holdings Plc … [Read more...]

KPMG: Professional Chameleons Or Independent Public Auditors And Regulators?

A new guest blog by Atul K. Shah, Senior Lecturer, Suffolk Business School, University Campus Suffolk, UK. This is based on a paper Shah first presented at a Tax Justice Network Research Workshop at City University in June 2015, and it follows a more focused piece last month calling for a probe … [Read more...]

The Finance Curse: Britain and the World Economy, new paper

We've pointed to a draft of this before, but here is the final published version, in the British Journal of Politics and International Relations, a paper by two TJNers and Duncan Wigan of the Copenhagen Business School. (It's also available here.) The abstract goes like this: The Global … [Read more...]

Tax justice and human rights: an issue that’s been hiding in plain sight

A new paper by Advocate Paul R Beckett in the Isle of Man is adding to the small but fast-growing body of work on Tax Justice and Human Rights. Its crowd-thrilling title is The Representative Impact of the Isle of Man as a Low Tax Area on the International Human Rights Continuum from a Fiscal and … [Read more...]

Call for Papers – Research Workshop on Corruption and Tax Havens, London, April 2016

Call for papers for a Research Workshop on CORRUPTION AND THE ROLE OF TAX HAVENS City University London, 28th / 29th April 2016 In May 2016 the U.K Government will be hosting a global summit on corruption. Ahead of this event, the Association for Accountancy & Business Affairs,(i) City … [Read more...]

The ironic pillage of tax haven Puerto Rico by offshore hedge funds

Puerto Rico is a peculiar historical relic, whose relationship with the United States has strong echoes of the half-in-half-out relationships that the British Overseas Territories and Crown Dependencies enjoy with the mother country, the United Kingdom. This halfway-house link, which provides solid … [Read more...]

Time to investigate the Big 4 over the financial crash

A guest blog by Dr. Atul K. Shah, Senior Lecturer, Suffolk Business School. As background to this, it is useful to quote from the work of Prem Sikka, cited in Shah's research: "Successive governments have failed to investigate the firms, or prosecute their partners. Instead, the partners of … [Read more...]