OECD BEPS Webcast Update See the TJN briefing on BEPS here. Rather than write them off, developing countries should be included in new information exchange system Thomson Reuters India PM Modi government sets up special team to probe black money in tax havens VCCircle See also: SIT on Black … [Read more...]

Finance Sector

On the non-perils of information exchange

Update: see TJN writer Nicholas Shaxson's Five Myths about Tax Havens, in the Washington Post, April 2016. Back in 2009 we wrote a long blog looking at tax havens' arguments that if they give up information to countries with poor governance, all sorts of disasters will ensue. We think it's … [Read more...]

Stiglitz: how to use tax to build an economy

Nobel Laureate Joseph Stiglitz has just published a White Paper with the Roosevelt Institute entitled Reforming Taxation to Promote Growth and Equity. It is a fascinating and clear piece of work, distilling a number of powerful tax principles - and it includes a section on formula apportionment (or … [Read more...]

Quote of the day: fiduciary duties

From Adam Kanzer of Domini Social Investments, in an article regarding a recent Google shareholder vote seeking the adoption of a responsible code of conduct to guide the company's global tax strategies: "Imagine a legal obligation, based on principles of prudence and loyalty, that compels us to … [Read more...]

Private equity: harnessing secrecy to fleece investors and taxpayers

The widely-read U.S. financial blog Naked Capitalism is running a fascinating post about the private equity industry, which involves the release of a number of apparently sensitive documents. The article notes: "For decades, private equity (PE) firms have asserted that limited partnership … [Read more...]

Two lieutenants of leading EU finance critic defect to ‘the enemy’

That's from an article in the Financial Times, which begins like this: "The UK’s Investment Management Association has poached two key lieutenants of Sven Giegold, the German Green MEP who has been a scourge of the fund industry in recent years." This is of interest to us for two reasons: first … [Read more...]

Credit Suisse: most of its victims haven’t seen any justice at all

There's been a lot of debate about the $2.6 billion (possibly tax-deductible, despite claims to the contrary) fine that Credit Suisse has paid for its systematic policies of attacking the U.S. tax system and fostering and, by implication, encouraging, criminal behaviour by thousands of U.S. … [Read more...]

Links May 23

US senators say more needs to be done after Credit Suisse conviction The Guardian See also: Credit Suisse Seen Keeping U.S. Bank License Bloomberg video - talks of the penalty being "political card playing", in that Credit Suisse are seen to be punished but they are still continuing as a bank in … [Read more...]

Links May 22

Finnwatch report on tax responsibility of Finnish Pension Fund investments Report finds that Finnish pension funds tend to ignore global tax responsibility issues related to their investment activities. (Report in Finnish, with English language executive summary) Special Report: Under pressure, … [Read more...]

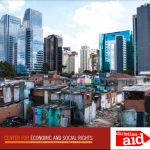

Human Rights Policy Brief: a Post-2015 Fiscal Revolution

The New York-based Center for Economic and Social Research (CESR) and Christian Aid have just published an important new paper entitled A Post-2015 Fiscal Revolution: Human Rights Policy Brief. It is a most useful contribution to the fast-growing community of researchers and research on the … [Read more...]

How Putin’s comrades washed their money in Switzerland and the UK

This is about an excellent Reuters investigation into a Russian state scheme to buy expensive medical equipment - and send money to Swiss bank accounts. It is worth reading in its entirety, but we will hone in on this bit: … [Read more...]

Credit Suisse and tax evasion: a fine is fine, but why no jail time?

Links May 20

DoJ Does Victory Lap on Credit Suisse Guilty Plea on Single Criminal Charge naked capitalism Very important insights. See also Credit Suisse escapes worst as it pleads guilty to U.S. charges Reuters - New York regulator decides not to revoke the bank's license, and top management stay in place, … [Read more...]

Hedge funds versus tax collectors: quote of the day

From U.S. tax professor Victor Fleischer, in an article looking at how hedge funds and their managers use Bermuda reinsurance vehicles for their tax shenanigans: "The chess match between tax collectors and fund managers will continue. The top 25 hedge fund managers have one advantage, though. … [Read more...]

Links May 19

Joining the Club: The United States Signs Up for Reciprocal Tax Cooperation Center for Global Development New Zealand: the Shell Company Incorporation Franchises (II) (and Ukraine) naked capitalism … [Read more...]