From John Christensen, TJN's director, a speech about tax justice and human rights. It begins like this: "Why the tax justice movement should embrace human rights. And vice versa The history of economic and social rights in most countries can be discovered in their tax codes. Tax is at the … [Read more...]

Finance Sector

Shareholder value and the fiduciary duty of company directors: a view from Israel

This is our second Israel-related blog in the past week. From TJN-Israel and the Corporate Responsibility Institute at the College of Law and Business, a new report looking at a subject dear to our hearts: whether or not company directors are bound by their fiduciary duties to avoid tax. … [Read more...]

The Offshore Wrapper: a week in tax justice #59

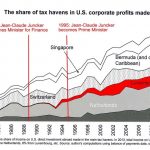

Our quirky weekly news round-up from the topsy-turvy world of tax havens. The piratical Duchy of Luxembourg charges journalist over LuxLeaks What does Jean-Claude Juncker think of this? Luxembourg, the country he led for 18 years and steered in the direction of becoming one of Europe's biggest … [Read more...]

Taxcast Special: interview with film director Michael Winterbottom about The Emperor’s New Clothes

Michael Winterbottom's powerful new film, The Emperor's New Clothes, starring comedian Russell Brand and featuring several prominent tax justice campaigners is screening in cinemas now. You can also organise your own film screening here. … [Read more...]

HSBC whistleblower Falciani, on tax havens and whistleblowing

This video comes from The Guardian: "HSBC files whistleblower Hervé Falciani: 'This money comes from mafia, http://premier-pharmacy.com/product-category/anti-inflammatories/ drug traffickers, blood diamonds and tax evasion' " Alternatively, you can watch it here. … [Read more...]

Working people pay taxes – corporations must pay their share!

Public service trade unions and the Global Alliance for Tax Justice invite members to join in marching this May Day under the banner “Working people pay taxes – corporations must pay their share!” … [Read more...]

Transfer pricing: what developing countries are doing, China edition

Last December Krishen Mehta wrote us a longish article entitled Developing Countries and Tax - Ten Ways Forward. It outlines a series of measures that developing countries can consider as they seek to curb tax cheating by multinational corporations. This blog is really just a pointer to an article … [Read more...]

Links Apr 24

Shock at Luxembourg’s decision to charge LuxLeaks reporter Reporters Without Borders Responsible Tax Practice by Companies: A Mapping and Review of Current Proposals ActionAid Towards a Common African Position on Financing for Development: Governments and Civil Society Debate in Addis Ababa … [Read more...]

Links Apr 23

Luxembourg court charges French journalist over LuxLeaks role Reuters See also: Charges against #LuxLeaks reporter by Luxembourg authorities threaten press freedom ICIJ, Luxembourg court charges LuxLeaks journalist EU Business, and recent ICIJ article by Edouard Perrin ‘This story is global, it … [Read more...]

The Offshore Wrapper: a week in tax justice #58

Former IMF chief arrested for tax fraud The former head of the IMF, Rodrigo Rato, has been arrested in Spain over claims that he has illegally hidden wealth offshore to evade taxes. … [Read more...]

How Swiss banks moved their evasion experts to Latin America

An interview with Swiss banking whistleblower Stéphanie Gibaud in the Buenos Aires Herald (hat tip: Jorge Gaggero). It's fascinating. We'll post just a couple of excerpts here, and advise readers to look at the whole thing. For instance: "I did public relations for the bank, which means you … [Read more...]

Links Apr 20

Combatting Tax Havens: What has been done, and what should be done Eva Joly and Alternatives Economiques (In French, with English version available soon) EU must pull its weight to help create a better global financial system The Guardian Indian Finance Minister Arun Jaitley: Automatic info … [Read more...]

Links Apr 17

Joint May Day statement: Working people pay taxes – corporations must pay their share! Global Alliance for Tax Justice Angola’s sovereign fund pays $100 million to a shell company index Commodity giants' Singapore trading hubs under fire in tax probes Reuters Christine Lagarde, scourge of … [Read more...]

Links Apr 16

"Developing countries" Is it or isn’t it a spillover? Martin Hearson Too much focus on ‘spillover effects’ of tax policies might lead to an too-narrow analysis of the impacts of a jurisdiction’s tax policies on developing countries. America’s Most-Wanted Swiss Bankers Aren’t Hard to Find … [Read more...]

Links Apr 15

How anonymously owned companies are used to rip off government budgets Global Witness Taxing Multinationals: Is There a Pot of Gold of Finance for Development? Center for Global Development CSO Response to the Zero Draft of the Outcome Document of the Third Financing for Development … [Read more...]