From Prof. Prem Sikka, via email: "Auditing itself has become one of the biggest frauds of modern times. When was the last time company auditors drew attention to fiddles, tax dodging, money laundering or their own complicity in financial misdemeanours? The penalties for delivering duff audits, … [Read more...]

Finance Sector

Links May 18

Should tax targets for post-2015 be rejected? Uncounted - Alex Cobham's Blog Uncounted: has the post-2015 data revolution failed already? Uncounted - Alex Cobham's Blog UNESCAP and Government of Indonesia - Asia Pacific High Level Consultation for Financing for Development Equity BD Links … [Read more...]

Links May 15

OECD insists tax playing field will be level swissinfo See also: OECD approval uncertain over tax transparency request procedures STEP (note references to "stolen" rather than leaked data), and see recent blogs: When a tax haven invokes the ‘level playing field’, run for the hills, and Swiss … [Read more...]

Links May 14

Live! Tax justice TV drama! Global Alliance for Tax Justice View recent sessions of the UN Financing for Development negotiations, including the paragraph by paragraph debate of text relating to tax justice Lessons and legacies of the financial crisis in Latin America Global Alliance for Tax … [Read more...]

Links May 13

European Parliament's special tax committee running out of time The Parliament LuxLeaks special committee’s first country visit: Belgium is breaching EU tax law Sven Giegold Charged LuxLeaks journalist calls for more whistleblower protection Europe Online Magazine See also: Members of … [Read more...]

Links May 11

Upcoming EU presidency faces whistleblows and calls for transparency Eurodad See also: Letter to Ambassador of Luxembourg in Denmark, on tax avoidance and whistleblowers Exposing South Africa's "Lettergate" Scandal World Policy Blog See also: recent TJN blog South Africa’s diamond companies: … [Read more...]

How to threaten politicians, the City of London way

This article is all about the language of financial lobbying. The consensus that an "oversized financial centre is indispensible" is strong and at times brutally in-your-face in many countries with oversized financial centres. But this consensus can also be sophisticated and subtle, when needs … [Read more...]

The Economist has noticed the Finance Curse

Regular readers will know that we have a permanent webpage entitled The Finance Curse explaining how countries with oversized financial sectors suffer a range of harms that are rather similar to a so-called Resource Curse that afflict resource-rich countries, and for a wide range of similar … [Read more...]

Links May 8

Turkish finance minister Mehmet ?imsek: World should fight against tax evasion like it fights against terror Daily Sabah Estimating illicit funds in global tax havens moneylife Taking on the banks: a conversation with Anat Admati The New Yorker Lawmakers Embrace Patent Tax Breaks The Wall … [Read more...]

Links May 7

Optimistic about the state: Martin Wolf’s searing attack on the Competitiveness Agenda Fools' Gold - rethinking competitiveness Tax probes frustrate EU competition chief EU Observer Unitary Taxation: Tax Base and the Role of Accounting International Centre for Tax and Development Former JP … [Read more...]

Euro Trade unions spell out tax justice demands

This, from the European Trade Union Confederation (ETUC) dates from March 10th, but it remains fresh. It contains some excellent tax justice recommendations - including one surprising and interesting one, which we'll highlight in bold text: … [Read more...]

How do tax wars affect women?

Cross-posted from Fools' Gold: From the Association for Women's Rights in Development, a post related to a landmark meeting in Lima on tax justice and human rights: "The current “race to the bottom” in which tax competition among developing countries takes place to attract corporate and … [Read more...]

Is Singapore censoring critics of its tax haven status? Well, perhaps . . .

On April 30th we wrote a blog entitled Singapore spin: “we are not a tax haven.” They all say that. Then, this morning a news aggregator service provided us with this titillating tidbit: So we clicked on the link, to find this: … [Read more...]

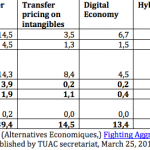

Two new reports challenge the OECD’s work on corporate tax cheating

The OECD, the club of rich countries that dominates international tax, is running a project known as Base Erosion and Profit Shifting (BEPS) which is supposed to fix some of the gaping holes in the international tax system. As we all know, transnational corporations (TNCs) are running rings around … [Read more...]

Avaaz in legal challenge to UK over Liechtenstein amnesty and HSBC scandal

From the Financial Times: "The UK tax authority faces a potential judicial review over its handling of the evasion scandal involving HSBC’s Swiss subsidiary, it emerged on Thursday. Lawyers acting for the international campaign group Avaaz have sent HM Revenue & Customs a letter asking for … [Read more...]