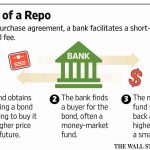

We have for years remarked on the role of the offshore system in promoting financial instability, not least for its propensity to enable financial players to get out from under financial regulations they don't like, then taking the cream from risky activities and shifting the risks onto others. … [Read more...]

Finance Curse

Why tax havens will be at the heart of the next financial crisis

Update: this has now been cross-posted at Naked Captalism This post examines another excellent in-depth investigation by Reuters into global financial stability issues, and the role of tax havens in this giant game of pain and plunder. The investigation uncovers, among other things, a whole lot … [Read more...]

As the murk grows, the UK rows back on money laundering checks

Updated with Cayman-related news. From Global Witness, a new report entitled Banks and Dirty Money: How the financial system enables state looting at a devastating human cost. It's got plenty of detail, but one eye-catcher is their look at the largest penalties given for money-laundering or … [Read more...]

UK parliament: stop money laundering through UK property

More precisely, what is known as an Early Day Motion, so far signed by 20 UK MPs: "That this House notes the recent screening of From Russia with Cash on Channel 4; expresses its concern that the proceeds of corruption are being laundered through the London property market via the use of … [Read more...]

New US study lends support to Financial Transaction Tax

A new report from the Tax Policy Center (TPC), a U.S. nonpartisan joint project of the Brookings Institution and the Urban Institute, looks at the potential revenue yields from a Financial Transactions Tax (FTT) and how the burden of the tax would fall on the U.S. population. It also notes that the … [Read more...]

Guest blog: how Switzerland corrupted its courts to nail Rudolf Elmer

Update, Oct 10, 2018 - Swiss top court knocks down bid to extend banking secrecy. Good news for Elmer, following his partial victory in 2016. Update, Jan 4, 2016: Elmer has won a partial victory, underlining the main point of this blog. In a civil suit brought by Elmer, the Swiss Federal Court … [Read more...]

Cayman papers in rare, savage attacks on UK and financial sector

Update: this post is now on Naked Capitalism. Update 2: cop a couple of interesting comments under this blog, including further reading. Not long after a newspaper editor critical of local financial sector corruption fled the Cayman Islands, followed by apparent "tombstones" death … [Read more...]

New IMF research: tax affects inequality; inequality affects growth

This new graph from the IMF is just the latest piece of research that follows on from the in-depth work of Thomas Piketty and others looking at the relationship between top income tax rates and inequality. The graph here makes the point adequately. Put crudely, the lower the top tax rate, the more … [Read more...]

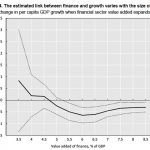

New OECD report backs TJN’s Finance Curse research

A new report from the OECD (hat tip: Dan Hind) contributes to what is now accepted wisdom in finance-and-growth circles: too much finance is bad for you. Our Finance Curse analysis explores this in detail. This blog is merely a pointer to the OECD study published a few days ago, which states: "The … [Read more...]

In memoriam: FIFA’s stench kills free speech in Cayman

More fallout from the toxic FIFA scandal (see here, here and here). … [Read more...]

Justice, interrupted: will bankers get off the hook ever more lightly?

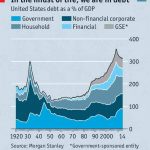

Two Economist blogs in a row: this time we've a fine excuse because their image comes from our TJN Senior Adviser, Jim Henry, who presented this data at the TJN-supported Illicit Financial Journalism Programme in London last week, and gave a preview last February in our Taxcast (see below): "just … [Read more...]

Economist: why it’s time to stop making debt tax-deductible

We've said this before, and we may have felt radical saying it at the time - but now it's The Economist saying it. It has an article entitled and subtitled A senseless subsidy: Most Western economies sweeten the cost of borrowing. That is a bad idea. Quite so. And the potential rewards it … [Read more...]

How to threaten politicians, the City of London way

This article is all about the language of financial lobbying. The consensus that an "oversized financial centre is indispensible" is strong and at times brutally in-your-face in many countries with oversized financial centres. But this consensus can also be sophisticated and subtle, when needs … [Read more...]

The Economist has noticed the Finance Curse

Regular readers will know that we have a permanent webpage entitled The Finance Curse explaining how countries with oversized financial sectors suffer a range of harms that are rather similar to a so-called Resource Curse that afflict resource-rich countries, and for a wide range of similar … [Read more...]

Is Singapore censoring critics of its tax haven status? Well, perhaps . . .

On April 30th we wrote a blog entitled Singapore spin: “we are not a tax haven.” They all say that. Then, this morning a news aggregator service provided us with this titillating tidbit: So we clicked on the link, to find this: … [Read more...]