From the Fools' Gold blog, yesterday: There's been a lot of talk for a long time about a threat from globe-trotting HSBC to move its headquarters from London to Hong Kong. It seems there's been a resolution of the question for now, of sorts. As Bloomberg puts it: "HSBC Holdings Plc … [Read more...]

Finance Curse

KPMG: Professional Chameleons Or Independent Public Auditors And Regulators?

A new guest blog by Atul K. Shah, Senior Lecturer, Suffolk Business School, University Campus Suffolk, UK. This is based on a paper Shah first presented at a Tax Justice Network Research Workshop at City University in June 2015, and it follows a more focused piece last month calling for a probe … [Read more...]

The Finance Curse: Britain and the World Economy, new paper

We've pointed to a draft of this before, but here is the final published version, in the British Journal of Politics and International Relations, a paper by two TJNers and Duncan Wigan of the Copenhagen Business School. (It's also available here.) The abstract goes like this: The Global … [Read more...]

New Oxfam report: An Economy For the 1% – and how to reform it

In a new report on inequality, published today, Oxfam reveals that the richest one percent of the global population now owns more wealth that the rest of the world combined. In 2015, just 62 people had more wealth than the poorest half of the world's population, … [Read more...]

The ironic pillage of tax haven Puerto Rico by offshore hedge funds

Puerto Rico is a peculiar historical relic, whose relationship with the United States has strong echoes of the half-in-half-out relationships that the British Overseas Territories and Crown Dependencies enjoy with the mother country, the United Kingdom. This halfway-house link, which provides solid … [Read more...]

Time to investigate the Big 4 over the financial crash

A guest blog by Dr. Atul K. Shah, Senior Lecturer, Suffolk Business School. As background to this, it is useful to quote from the work of Prem Sikka, cited in Shah's research: "Successive governments have failed to investigate the firms, or prosecute their partners. Instead, the partners of … [Read more...]

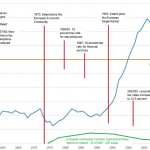

The Finance Curse and Competitiveness: presentation at Max Planck Institute

This is the text of a lecture that John Christensen, Director of the Tax Justice Network (TJN), gave at the Max Planck Institute in Cologne this week. … [Read more...]

Lazonick: tax cheating is just part of Pfizer’s corrupt business model

Recently the U.S. pharma giant Pfizer announced a merger with the drugmaker Allergan, in a deal heavily motivated by tax cheating via a 'corporate' inversion - a corporate relocation to take advantage of (in this case Ireland's) lax tax regime. Much has been said on the topic, with U.S. … [Read more...]

Jersey: the fall of a Finance-Cursed tax haven

A new article in the Guardian Long Reads series, entitled The fall of Jersey: how a tax haven goes bust. (Not as dramatic as this one, but still.) The article heavily features Jerseyman John Christensen, TJN's Director (along with Richard Murphy of Tax Research UK, who has been influential in … [Read more...]

New study: corporate tax cuts may have been ‘the greatest blunder’

The Canadian Center for Policy Alternatives has just published a new study entitled Do Corporate Income Tax Rate Reductions Accelerate Growth? It summarises: "This study examines the relationship between the Canadian corporate income tax (CIT) regime and various dimensions of economic growth. The … [Read more...]

John Christensen on rocking the boat in Jersey

In this blog, first published in the Whistleblower Edition of Tax Justice Focus (available here), TJN's director John Christensen, a former Economic Adviser to the island of Jersey, reflects on his experience of exposing a banking scandal, which involved him in a direct confrontation with senior … [Read more...]

How Ireland became an offshore financial centre

This month we published our fourth Financial Secrecy Index (FSI), complete with a series of reports about each of the biggest tax havens and secrecy jurisdictions, looking into the political and economic histories of how and why they went offshore, who was involved, and where the bodies are … [Read more...]

UK and China: the national security threat from the City of London

In March we wrote a short article (also discussed in our Taxcast) about the U.S.' ire about what US officials said was Britain's 'constant accommodation' with China." That followed an earlier article a TJN blogger wrote in The American Interest about Russia and the City of London. In both cases we … [Read more...]

Why a ‘competitive’ economy means less competition

From the Fools' Gold site: The 'competitiveness' of a country can be taken to mean many things. Many people, such as Martin Wolf or Paul Krugman, have argued forcefully that it is a meaningless or dangerous concept. On another level it's a question of language: you can make national … [Read more...]

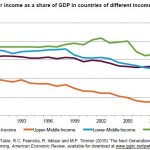

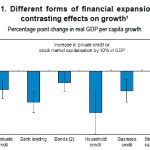

OECD: too much finance hurts growth — more on latest paper supporting Finance Curse thesis

From The Guardian: "Countries with bigger banking sectors suffer weaker growth and worse inequality, according to a report from the Organisation for Economic Co-operation and Development (OECD). After analysing 50 years of data across its 34 member-countries, economists at the Paris-based … [Read more...]