From Prof. Prem Sikka, via email: "Auditing itself has become one of the biggest frauds of modern times. When was the last time company auditors drew attention to fiddles, tax dodging, money laundering or their own complicity in financial misdemeanours? The penalties for delivering duff audits, … [Read more...]

Enablers and intermediaries

Euro Trade unions spell out tax justice demands

This, from the European Trade Union Confederation (ETUC) dates from March 10th, but it remains fresh. It contains some excellent tax justice recommendations - including one surprising and interesting one, which we'll highlight in bold text: … [Read more...]

How do tax wars affect women?

Cross-posted from Fools' Gold: From the Association for Women's Rights in Development, a post related to a landmark meeting in Lima on tax justice and human rights: "The current “race to the bottom” in which tax competition among developing countries takes place to attract corporate and … [Read more...]

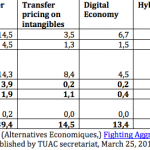

Two new reports challenge the OECD’s work on corporate tax cheating

The OECD, the club of rich countries that dominates international tax, is running a project known as Base Erosion and Profit Shifting (BEPS) which is supposed to fix some of the gaping holes in the international tax system. As we all know, transnational corporations (TNCs) are running rings around … [Read more...]

Lima: TJN director Christensen speech on tax justice and human rights

From John Christensen, TJN's director, a speech about tax justice and human rights. It begins like this: "Why the tax justice movement should embrace human rights. And vice versa The history of economic and social rights in most countries can be discovered in their tax codes. Tax is at the … [Read more...]

Shareholder value and the fiduciary duty of company directors: a view from Israel

This is our second Israel-related blog in the past week. From TJN-Israel and the Corporate Responsibility Institute at the College of Law and Business, a new report looking at a subject dear to our hearts: whether or not company directors are bound by their fiduciary duties to avoid tax. … [Read more...]

HSBC whistleblower Falciani, on tax havens and whistleblowing

This video comes from The Guardian: "HSBC files whistleblower Hervé Falciani: 'This money comes from mafia, http://premier-pharmacy.com/product-category/anti-inflammatories/ drug traffickers, blood diamonds and tax evasion' " Alternatively, you can watch it here. … [Read more...]

Working people pay taxes – corporations must pay their share!

Public service trade unions and the Global Alliance for Tax Justice invite members to join in marching this May Day under the banner “Working people pay taxes – corporations must pay their share!” … [Read more...]

Transfer pricing: what developing countries are doing, China edition

Last December Krishen Mehta wrote us a longish article entitled Developing Countries and Tax - Ten Ways Forward. It outlines a series of measures that developing countries can consider as they seek to curb tax cheating by multinational corporations. This blog is really just a pointer to an article … [Read more...]

How Swiss banks moved their evasion experts to Latin America

An interview with Swiss banking whistleblower Stéphanie Gibaud in the Buenos Aires Herald (hat tip: Jorge Gaggero). It's fascinating. We'll post just a couple of excerpts here, and advise readers to look at the whole thing. For instance: "I did public relations for the bank, which means you … [Read more...]

Tax Justice Research Bulletin 1(3)

By Alex Cobham, TJN's Director of Research March 2015. Welcome to the third Tax Justice Research Bulletin, a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international tax. This issue looks at new papers on the responsibilities … [Read more...]

The Tax Justice Network Podcast, March 2015

The Tax Justice Network Podcast, March 2015 In the March 2015 Taxcast: Democracy for sale - how our politics rely heavily on tax haven-friendly donors. Also, we ask: why is HSBC shutting down offshore accounts in Jersey? Are we in the final few years of the corporate income tax? Is Australia's … [Read more...]

New Report: Ten Reasons to Defend the Corporate Income Tax.

UPDATES 2018 - Tax incentives in mining: minimising risks to revenue, OECD/Intergovernmental forum on mining, minerals, metals, and sustainable development. "Tax incentives are costly, leading many countries to forgo vital revenues in exchange for often illusive benefits. . . there is little … [Read more...]

Six questions about HSBC and the Jersey connection

From the BBC in Jersey: "HSBC is closing all accounts in Jersey for customers living in the UK, as part of industry-wide efforts to check identity and address details, to ensure off-shore accounts aren't being used to hide money. Jersey's Chief Minister Ian Gorst insists that banks have to … [Read more...]

Where did Zimbabwe’s diamond revenues go?

From Tax Justice Network Africa, via its Afritax feed, a video showing a Zimbabwean member of parliament, James Maridadi, taking the Minister of Finance to task on revenue from Marange Diamonds. The brief exchange is worth watching, not least for the Minister's evasive manoeuvres. But it's … [Read more...]