Enablers and intermediaries

Tax haven USA: new Bloomberg story adds urgency to reform needs

Bloomberg is running a story entitled The World’s Favorite New Tax Haven Is the United States, which closely follows the line that TJN has been taking, particularly since our big Loophole USA blog a year ago, and our subsequent USA Report for the Financial Secrecy Index last October. Expanding … [Read more...]

2016 Tax Justice and Human Rights Essay Competition

Tax Justice Network and Oxfam are joining together to launch a tax justice and human rights essay competition for legal students and professionals. With tax justice rising up the human rights agenda, we want to hear your ideas on how human rights law can be used in the fight against tax dodging. … [Read more...]

Tax justice and human rights: an issue that’s been hiding in plain sight

A new paper by Advocate Paul R Beckett in the Isle of Man is adding to the small but fast-growing body of work on Tax Justice and Human Rights. Its crowd-thrilling title is The Representative Impact of the Isle of Man as a Low Tax Area on the International Human Rights Continuum from a Fiscal and … [Read more...]

The ironic pillage of tax haven Puerto Rico by offshore hedge funds

Puerto Rico is a peculiar historical relic, whose relationship with the United States has strong echoes of the half-in-half-out relationships that the British Overseas Territories and Crown Dependencies enjoy with the mother country, the United Kingdom. This halfway-house link, which provides solid … [Read more...]

Time to investigate the Big 4 over the financial crash

A guest blog by Dr. Atul K. Shah, Senior Lecturer, Suffolk Business School. As background to this, it is useful to quote from the work of Prem Sikka, cited in Shah's research: "Successive governments have failed to investigate the firms, or prosecute their partners. Instead, the partners of … [Read more...]

Wealth management: tax avoidance is just the tip of the iceberg

Recently we wrote a blog about some rather unique research carried out by Brooke Harrington, an Associate Professor at Copenhagen Business School who trained to become a wealth manager in order to study it properly. This week, Naomi Fowler interviewed her for our latest Taxcast. We think it is worth … [Read more...]

New website shows European countries that facilitate tax cheating

PRESS RELEASE FROM SOMO: Mapping Tax-free investments New interactive website shows which European countries facilitate tax dodging through mailbox companies. Today, the Centre for Research on Multinational Corporations (SOMO) launches a new interactive website that visualises bilateral … [Read more...]

Ex-money launderer Kenneth Rijock offers tips for whistleblowers

In this article, first published in the Whistleblower Edition of TJN's newsletter, Tax Justice Focus, convicted money launderer Kenneth Rijock (author of The Laundry Man, Penguin, 2013) offers some practical advice to those who might be considering blowing the whistle on their employers. Helpful … [Read more...]

Survey: corruption rife among accountants.

From Accountancy Age in the UK: "The research - by global job board CareersinAudit.com - quizzed 1696 accountants around the planet, including 400 in the UK, showed that 48% had either been pressurised (or knew of someone that had) by a manager or partner to ignore an adjustment that should have … [Read more...]

The private banking fairy tale: a whistleblower’s story

This article was originally published in the Whistleblower Edition of Tax Justice Focus (November 2015) Whistleblowing by finance professionals has begun to make significant inroads into the sector’s culture of secrecy and collusion. Here UBS whistleblower Stéphanie Gibaud describes the costs to … [Read more...]

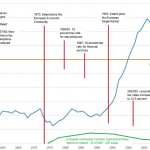

How the U.S.A. became a secrecy jurisdiction

This month we published our fourth Financial Secrecy Index (FSI), complete with a series of reports about each of the biggest tax havens and secrecy jurisdictions, looking into the political and economic histories of how and why they went offshore, who was involved, and where the bodies are … [Read more...]

Reporting a crime is not a crime

UPDATE: Since publishing this blog on 26th November 2015 the Swiss Federal Court in Bellinzona has sentenced HSBC whistleblower Herve Falciani to five years in prison. Mr Falciani, who was tried in absentia, was charged with data theft, industrial espionage and violation of Swiss banking secrecy … [Read more...]

Tax Justice Focus – The Whistleblower edition

The latest edition of our newsletter Tax Justice Focus, with a special focus on whistleblowers, is now available for download here. Guest edited by Mary Alice Young of the University of the West of England, this edition is both an exploration of the difficulties confronting people who want to … [Read more...]

How Ireland became an offshore financial centre

This month we published our fourth Financial Secrecy Index (FSI), complete with a series of reports about each of the biggest tax havens and secrecy jurisdictions, looking into the political and economic histories of how and why they went offshore, who was involved, and where the bodies are … [Read more...]