TJN is a signatory to the following letter, and this press release: Press Release: CSOs protest as European Commission hires opponent of corporate transparency to assess corporate transparency After strongly opposing any publication of data from corporate country by country reporting, … [Read more...]

Enablers and intermediaries

Quote of the day: big accountancy firms have a human rights problem

From Prem Sikka our quote of the day comes from an article entitled Big accountancy firms have a human rights problem: "In many other organisations such subversion of the human rights would be considered to be a badge of shame. At major accountancy firms it is increasingly considered to be a sign … [Read more...]

Manhattan real estate: a little tax haven in America

From New York Magazine, a long article about the high-end New York property market, echoing recent stories (such as this one) about One Hyde Park and the British tax haven. "Those with less reflexively hostile reactions to foreign buying competition might still wonder: Who are these people? An … [Read more...]

Big Four firms officially sell out Hong Kong’s democracy movement

Updated with commentary from the Financial Times and Bloomberg: see below CNBC is reporting: "As a pro-democracy movement gains steam in Hong Kong, some worry the campaign could hurt the city's competitiveness and rattle its financial market." One could unpack that short sentence and probably … [Read more...]

The alternative offshore awards: an idea whose time has come?

From the Financial Secrecy Media Monitor: "Thanks to a promoted tweet from Jersey Finance comes news of the International Fund & Product Awards 2014, in which Jersey won the Best International Financial Centre award. Other winners were Standard Bank Offshore Group for Best International … [Read more...]

Campaign: Ireland’s tax model must stop hurting the global south

In 2012 ActionAid published a report estimating that a huge new tax loophole deliberately created by the UK government - which it seems is bringing in precious little in terms of jobs or tax revenues - is also likely to cost developing countries some £4 billion (US$6 billion) a year. Ireland's … [Read more...]

Big Bills: how our central banks nurture money launderers and kleptocrats

A question for our European readers. How many of you have ever spent or even seen a 500 Euro note? No, neither have we. Which is may seem odd, given that there are some 300 billion Euros' worth of these things out there, in circulation. Which raises the question: where are they all? … [Read more...]

London march: Join the new Tax Dodgers’ Alliance

From UK Uncut, a march planned for this Saturday (June 21): Come and join the newly formed 'Tax Dodgers Alliance'. Big businesses and the super wealthy are welcome. Bankers, lawyers, CEOs, new money, old money... What do we have in common? We're stinking rich & we don't want to share - our cash … [Read more...]

The Offshore Wrapper: a week in tax justice

The Offshore Wrapper is written by George Turner Football: a game of two halves - corruption and scandal The World Cup of scandal and corruption rolls on. This week Global Witness has exposed the role of the Brazilian Development Bank, Banco Nacional de Desenvolvimento Econômico e Social, in … [Read more...]

Insurance sector seeking to trick the OECD with giant secrecy loophole?

Update: with Gibraltar / Bermuda shenanigans. Last February the OECD, which has been mandated to set global financial transparency standards, presented a major report on a new global standard for transparency and to fight the scourge of tax evasion. We broadly welcomed the project, but noted … [Read more...]

On the non-perils of information exchange

Update: see TJN writer Nicholas Shaxson's Five Myths about Tax Havens, in the Washington Post, April 2016. Back in 2009 we wrote a long blog looking at tax havens' arguments that if they give up information to countries with poor governance, all sorts of disasters will ensue. We think it's … [Read more...]

Quote of the day: fiduciary duties

From Adam Kanzer of Domini Social Investments, in an article regarding a recent Google shareholder vote seeking the adoption of a responsible code of conduct to guide the company's global tax strategies: "Imagine a legal obligation, based on principles of prudence and loyalty, that compels us to … [Read more...]

Private equity: harnessing secrecy to fleece investors and taxpayers

The widely-read U.S. financial blog Naked Capitalism is running a fascinating post about the private equity industry, which involves the release of a number of apparently sensitive documents. The article notes: "For decades, private equity (PE) firms have asserted that limited partnership … [Read more...]

Credit Suisse: most of its victims haven’t seen any justice at all

There's been a lot of debate about the $2.6 billion (possibly tax-deductible, despite claims to the contrary) fine that Credit Suisse has paid for its systematic policies of attacking the U.S. tax system and fostering and, by implication, encouraging, criminal behaviour by thousands of U.S. … [Read more...]

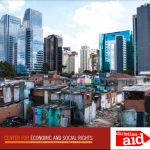

Human Rights Policy Brief: a Post-2015 Fiscal Revolution

The New York-based Center for Economic and Social Research (CESR) and Christian Aid have just published an important new paper entitled A Post-2015 Fiscal Revolution: Human Rights Policy Brief. It is a most useful contribution to the fast-growing community of researchers and research on the … [Read more...]