In this month's Taxcast: We discuss why we can’t afford the rich and challenge ideas about wealth, entrepreneurialism and investment. Also: ten years ago the Tax Justice Network was told it’d never happen, but this month British Members of Parliament voted to stop secret ownership of companies in … [Read more...]

Tax Havens

Our May 2018 Spanish language podcast: Justicia ImPositiva, nuestro podcast, mayo 2018

Welcome to this month’s latest podcast and radio programme in Spanish with Marcelo Justo and Marta Nuñez, downloaded and broadcast on radio networks across Latin America and Spain. ¡Bienvenidos y bienvenidas a nuestro podcast y programa radiofónica! (abajo en Castellano). In this month’s … [Read more...]

Veils of secrecy: enhancing tax and ownership transparency in development projects

We're sharing here new research from the Egyptian Initiative for Personal Rights which evaluates the role played by a member of the World Bank Group, the International Finance Corporation (IFC) in development projects. The full title of their research is Veils of secrecy: evaluating the IFC's role … [Read more...]

How come Mauritius is the biggest foreign investor in India?

We’re pleased to share a new study by Suraj Jaiswal for the Centre for Budget and Governance Accountability on Foreign Direct Investment in India and the role of tax havens. As their summary of this study says: Governments across the world are trying to attract Foreign Direct Investment (FDI) as a … [Read more...]

Taxing water and infrastructure in the UK

Michael Gove, the UK's Environment Secretary had some harsh words for the water industry recently. “They have shielded themselves from scrutiny, hidden behind complex financial structures, avoided paying taxes, have rewarded the already well-off, kept charges higher than they needed to be.” The … [Read more...]

The EU Tax Haven Blacklist – a toothless whitewash

Continuing our coverage of the EU Tax Haven Blacklist, we are reposting this article which first appeared in Public Finance International. The original can be found here: http://www.publicfinanceinternational.org/opinion/2017/12/eu-tax-blacklist-whitewash … [Read more...]

Dear mining companies, why do you use tax havens?

The Southern African Catholics Bishops Conference has written an open letter to 21 mining companies operating in South Africa asking each to explain why they use tax havens. Their full letter is here and it's worth reading. They point out, "we are not accusing companies of anything. We believe it … [Read more...]

Podcast: Decolonisation and the Expansion of Tax Havens, 1950s-1960s

We're sharing a fascinating lecture at the University of London's Institute of Historical Research The lecture has the intriguing title 'Funk Money': Decolonisation and the Expansion of Tax Havens, 1950s-1960s and was delivered by Associate Professor Vanessa Ogle of the University of California, … [Read more...]

The Spider’s Web: Britain’s Second Empire – released for home viewing

from hushhushvideo PRO on November 23, 2017 Watch trailer Genres: Documentary Duration: 1 hour 18 minutes Subtitles: 7 languages + Show Availability: Worldwide TJN's John Christensen and film director Michael Oswald (97% Owned, Princes of the Yen) co-produced this 78 minute … [Read more...]

#ParadisePapers: The Mauritian Connection

What do Angola’s sovereign wealth fund, the cast of British TV show Mrs Brown’s Boys, and Yale University’s investment in India have in common? The Paradise Papers reveal that they are all connected with offshore secrecy jurisdiction Mauritius, with the assistance of offshore law firm … [Read more...]

#ParadisePapers: The onshore heart of the offshore industry

We're sharing this blog in its entirety from Icelandic journalist Sigrun Davidsdottir's excellent Icelog. The Paradise Papers emphasises, yet again, that the damaging effect of offshore is much more pervasive that robbing countries of tax. Offshore creates a two-tier business environment, hiding … [Read more...]

Big Four accounting firms are key drivers of tax haven use, new research says

As scandals emerge from the Paradise Papers, the Big Four accountancy firms seem to have managed to stay largely out of the spotlight once again. But research released today shows that scrutiny of their practices is justified in the public interest. The new study is authored by Dr Chris Jones and … [Read more...]

#ParadisePapers: residency for sale to the rich and famous

Among the scandals exposed by the Paradise Papers is that of residency for sale, something I covered just last month (along with passports for sale) as a special feature in our monthly podcast and radio show, the Taxcast, which you can listen to below. The name Shakira Isabel Mebarak Ripoll showed … [Read more...]

Her Majesty the Queen of Offshore

It should come as no surprise that Her Majesty the Queen uses offshore tax havens as part of her wealth management strategy. The Queen is, after all, the head of state of the British Virgin Islands, the Cayman Islands, the Channel Islands, and Bermuda where the law firm Applebys was originally … [Read more...]

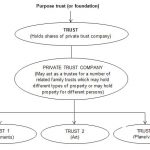

Our paper “Trusts: Weapons of Mass Injustice?” – now available in Spanish

Our paper "Trusts: Weapons of Mass Injustice?" which we released and blogged about earlier this year is now available in Spanish. The English version of the paper is available here. The paper provoked critical attention from practitioners and from tax havens. Our response to their critiques is here … [Read more...]