Yes, we can build an open and transparent tax system that works fairly for everyone. Do you know how multinationals shift their profits to dodge their taxes and how we can stop them? Our beautifully illustrated new videos tell you how, narrated in five different languages by our tax justice podcast … [Read more...]

Tax Competition

Taxing wealth – how to triumph over injustice: Tax Justice Network October 2019 podcast

In this month's episode we speak to Gabriel Zucman about his new book with co-author Emmanuel Saez - The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay. Plus, as Extinction Rebellion holds protests around the world over the climate emergency, we point the finger at the … [Read more...]

The Corporate Tax Haven Index: solving the world’s broken tax system in our monthly podcast, the Taxcast

In this month's June 2019 podcast we look at the new Corporate Tax Haven Index released by the Tax Justice Network. What does it tell us about the global economy and the international tax system? And how can we fix it? We also look at how India is pushing the G20 into action on global tax rules - if … [Read more...]

Tax “stability” short-changes Burkina Faso

A couple of years ago we wrote a blog entitled Beware the siren song of “tax certainty, which took apart a widespread consensus that it is important for countries to embrace 'tax certainty' and 'stability.' These motherhood-and-apple-pie terms hide a world of mischief: not least the fact that this … [Read more...]

Video discussion: ‘Taming Digital Capitalism’ through public country by country reporting

There were some important debates in Brussels recently where Hans Böckler Stiftung held a two-day symposium with the European Trade Union Institute looking at the changes citizens in Europe are facing in the workplace and examining the challenges for the new leaders who will be in place as a result … [Read more...]

#ParadisePapers and the Big Four: in the words of a former insider

We're sharing in full an article by tax ethicist George Rozvany who racked up 32 years of experience at senior levels of Big 4 accounting firms and major corporations. We interviewed him previously on the Taxcast along with the award winning economics and finance journalist Michael West speaking on … [Read more...]

#ParadisePapers: The onshore heart of the offshore industry

We're sharing this blog in its entirety from Icelandic journalist Sigrun Davidsdottir's excellent Icelog. The Paradise Papers emphasises, yet again, that the damaging effect of offshore is much more pervasive that robbing countries of tax. Offshore creates a two-tier business environment, hiding … [Read more...]

Result: European Commission to investigate UK tax treatment of MNCs

On 23rd January 2016, the then Chancellor of the UK Exchequer (finance minister) George Osborne announced (via twitter) that he had negotiated a tax settlement with Google. On examination we decided that this deal was shockingly poor value for UK taxpayers and, worse, almost certainly contravened … [Read more...]

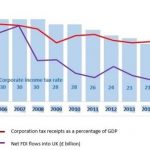

The Dutch government cuts its corporate tax rate…

The new Dutch government is to announce that it will cut its corporate tax rate according to leaked details of the current round of coalition talks. This move is the equivalent to the country jumping into the race to the bottom pool with both feet. We've always highlighted the false narrative … [Read more...]

UK coalition government driven by corporation tax cutters

The minority UK government elected last week is scrambling to agree a 'confidence and supply' agreement with a tiny party from Northern Ireland called the DUP (originally the Democratic Unionist Party). The DUP has attracted considerable attention in the past 24 hours because of its Protestant … [Read more...]

Paying a ‘Fair Share’: new brief on taxing multinational companies

In this new brief just published by the Sheffield Political Economics Research Institute authors John Mikler and Ainsley Elbra address the issue of global corporate tax avoidance and consider how multinational corporations can be made to pay their fair share of tax. … [Read more...]

The problems with measuring tax systems

The following blog by TJN's Nicholas Shaxson (currently on a book writing sabbatical) was originally posted on the SPERI blog and is re-posted here with permission. In debates about tax policy we need to de-emphasise the role of economics and measurement and rekindle the politics … [Read more...]

Brexit Britain: what does the public think about tax haven plans?

In January 2017 Britain's finance minister Philip Hammond and prime minister Theresa May signalled that Britain could deepen its role as a tax haven if it left the European Single Market post-Brexit. … [Read more...]

UN report recommends: go after tax havens, and protect whistleblowers

From the United Nations General Assembly, the fifth report of the Independent Expert on the promotion of a democratic and equitable international order. The summary goes like this: "The report focuses on impacts of taxation on human rights and explores the challenges posed to the international … [Read more...]

Ecuador’s president calls for global tax body

Updated with additional information about Correa's administration and exposés in the Panama Papers scandal; scroll down. Ecuador's president Rafael Correa has published a significant statement about international tax governance, and specifically the prospect of creating a global tax organisation. … [Read more...]