The new Dutch government is to announce that it will cut its corporate tax rate according to leaked details of the current round of coalition talks. This move is the equivalent to the country jumping into the race to the bottom pool with both feet. We've always highlighted the false narrative … [Read more...]

FAQ

European Commission orders Luxembourg to claim back 250 million in taxes from Amazon – TJN Reaction

There are two very welcome pieces of tax justice news today. Firstly, the European Commission has ordered the tax haven of Luxembourg to recover 250 million euros in taxes from Amazon, finding that the benefits extended to the company amount to illegal state aid. The support Amazon received, allowed … [Read more...]

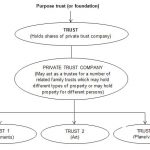

“Trusts: Weapons of Mass Injustice?” A response to the critics

On February 13th, 2017 TJN published a paper titled "Trusts: Weapons of Mass Injustice?", which has attracted critical attention from practitioners and tax havens. This is our response. Our paper, “Trusts: Weapons of Mass Injustice?”[1] asks some deep and searching questions about the role trusts … [Read more...]

The City of London: Capital of an Invisible Empire

In July 2017 director Michael Oswald’s latest film, The Spider’s Web: Britain’s Second Empire was premiered at the Frontline Club in London. It has since had several screenings in London and public screenings can be organised from November onwards. This fascinating interview just published in … [Read more...]

Whistleblower Rudolf Elmer may soon release account data from Julius Baer bank

For twelve years now whistleblower Rudolf Elmer has been fighting Swiss banking secrecy, with court case after court case. He's been imprisoned, victimised, and his family has been harassed. His reputation has been systematically ripped apart in a way that we believe has been intended as a deterrent … [Read more...]

The Brexit tax haven threat – rescinded?

Back in January, the UK Chancellor of the Exchequer (the finance minister), Philip Hammond, used an interview with the German newspaper Welt am Sonntag to raise what has become known as the Brexit tax haven threat: if the EU doesn't give the UK a good deal, the UK will lead a race to the bottom to … [Read more...]

New research on key role major economies play in global tax avoidance

An important new study on Offshore Financial Centres (OFCs) from the University of Amsterdam has made some fascinating discoveries, challenging, as the Financial Secrecy Index has, the popular misconception that tax havens are only palm fringed little islands and exposing that in fact major … [Read more...]

Half measures mean Mauritius will continue to be a tax haven for the developing world

There was news this week that Mauritius has signed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI). This is an initiative from the OECD to allow countries to take measures designed to stop tax avoidance by multinational companies … [Read more...]

Will the G20 ever end the global problem of tax avoidance and tax evasion?

Ahead of the G20 Summit in Hamburg this week our own George Turner has published this op-ed in the German newspaper Die Tageszeitung today. The article discusses why, despite sustained political engagement from world leaders, we are still some way from solving the problem of tax avoidance and tax … [Read more...]

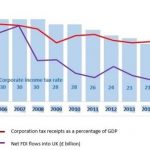

UK coalition government driven by corporation tax cutters

The minority UK government elected last week is scrambling to agree a 'confidence and supply' agreement with a tiny party from Northern Ireland called the DUP (originally the Democratic Unionist Party). The DUP has attracted considerable attention in the past 24 hours because of its Protestant … [Read more...]

Whistleblower Ruedi Elmer vs. the Swiss ‘Justice’ System

We've regularly covered the battles of whistleblower Rudolf Elmer against the Swiss “justice” system. As we've said before, and as has so often been the case with those brave enough to risk all to challenge injustice and corruption, the bank was the criminal, not Rudolf Elmer. He wrote a guest blog … [Read more...]

Evading Tax and Avoiding Tax Evasion: for decades British governments have shied away from tackling cross border crime

Guest blog authored by Dr Michael Woodiwiss (Arts and Cultural Industries, University of the West of England) and Dr Mary Alice Young (Bristol Law School, University of the West of England) In the 1920s, an embryonic tax collecting organisation was steadily growing in the US. The Internal … [Read more...]

The U.K. post-general election: strong, stable and still kind to criminals

The British Prime Minister Theresa May has called a snap general election. We'd like to share with you the thoughts of Dr Mary Alice Young (Bristol Law School, University of the West of England) and Dr Michael Woodiwiss (Arts and Cultural Industries, University of the West of England) on the … [Read more...]

Paying a ‘Fair Share’: new brief on taxing multinational companies

In this new brief just published by the Sheffield Political Economics Research Institute authors John Mikler and Ainsley Elbra address the issue of global corporate tax avoidance and consider how multinational corporations can be made to pay their fair share of tax. … [Read more...]

Coming Soon: The Spider’s Web – a film about Britain’s tax haven empire

#RogueLondon Film maker Michael Oswald and TJN's John Christensen have co-produced a new film about Britain's tax haven empire. Titled The Spider's Web: Britain's Second Empire, the film is ready for release. It draws heavily on Nick Shaxson's ground-breaking book Treasure Islands and uses … [Read more...]