We're pleased to share this blog post (first published here) written by Nataliya Mykhalchenko for the Review of African Political Economy: Tax avoidance, tax evasion, tax heavens, illicit financial flows and global tax governance are real buzzwords that have come to dominate current international … [Read more...]

FAQ

The EU Tax Haven Blacklist – a toothless whitewash

Continuing our coverage of the EU Tax Haven Blacklist, we are reposting this article which first appeared in Public Finance International. The original can be found here: http://www.publicfinanceinternational.org/opinion/2017/12/eu-tax-blacklist-whitewash … [Read more...]

Dear mining companies, why do you use tax havens?

The Southern African Catholics Bishops Conference has written an open letter to 21 mining companies operating in South Africa asking each to explain why they use tax havens. Their full letter is here and it's worth reading. They point out, "we are not accusing companies of anything. We believe it … [Read more...]

Podcast: Decolonisation and the Expansion of Tax Havens, 1950s-1960s

We're sharing a fascinating lecture at the University of London's Institute of Historical Research The lecture has the intriguing title 'Funk Money': Decolonisation and the Expansion of Tax Havens, 1950s-1960s and was delivered by Associate Professor Vanessa Ogle of the University of California, … [Read more...]

The Spider’s Web: Britain’s Second Empire – released for home viewing

from hushhushvideo PRO on November 23, 2017 Watch trailer Genres: Documentary Duration: 1 hour 18 minutes Subtitles: 7 languages + Show Availability: Worldwide TJN's John Christensen and film director Michael Oswald (97% Owned, Princes of the Yen) co-produced this 78 minute … [Read more...]

#ParadisePapers: The Mauritian Connection

What do Angola’s sovereign wealth fund, the cast of British TV show Mrs Brown’s Boys, and Yale University’s investment in India have in common? The Paradise Papers reveal that they are all connected with offshore secrecy jurisdiction Mauritius, with the assistance of offshore law firm … [Read more...]

#ParadisePapers and the Big Four: in the words of a former insider

We're sharing in full an article by tax ethicist George Rozvany who racked up 32 years of experience at senior levels of Big 4 accounting firms and major corporations. We interviewed him previously on the Taxcast along with the award winning economics and finance journalist Michael West speaking on … [Read more...]

#ParadisePapers: The onshore heart of the offshore industry

We're sharing this blog in its entirety from Icelandic journalist Sigrun Davidsdottir's excellent Icelog. The Paradise Papers emphasises, yet again, that the damaging effect of offshore is much more pervasive that robbing countries of tax. Offshore creates a two-tier business environment, hiding … [Read more...]

Big Four accounting firms are key drivers of tax haven use, new research says

As scandals emerge from the Paradise Papers, the Big Four accountancy firms seem to have managed to stay largely out of the spotlight once again. But research released today shows that scrutiny of their practices is justified in the public interest. The new study is authored by Dr Chris Jones and … [Read more...]

#ParadisePapers: residency for sale to the rich and famous

Among the scandals exposed by the Paradise Papers is that of residency for sale, something I covered just last month (along with passports for sale) as a special feature in our monthly podcast and radio show, the Taxcast, which you can listen to below. The name Shakira Isabel Mebarak Ripoll showed … [Read more...]

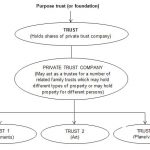

Enough evidence on trusts – where are the State’s actions?

Our two last papers on trusts (here and here) described trusts’ involvement in grand corruption and other cases that would anger any rational person. The Paradise Papers, and recent case law, shed outrageous new light on trusts’ role in worsening inequality, shielding assets from legitimate … [Read more...]

Are the activities uncovered in the Paradise Papers ‘legal’ – a plea to journalists

As the revelations from the Paradise Papers hit the news stands many journalists are asserting as fact that nothing illegal has taken place. The BBC in the UK are the most aggressive proponents of this line, but the issue has been raised in other countries too. On several interviews I have done … [Read more...]

Her Majesty the Queen of Offshore

It should come as no surprise that Her Majesty the Queen uses offshore tax havens as part of her wealth management strategy. The Queen is, after all, the head of state of the British Virgin Islands, the Cayman Islands, the Channel Islands, and Bermuda where the law firm Applebys was originally … [Read more...]

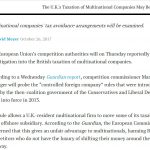

Result: European Commission to investigate UK tax treatment of MNCs

On 23rd January 2016, the then Chancellor of the UK Exchequer (finance minister) George Osborne announced (via twitter) that he had negotiated a tax settlement with Google. On examination we decided that this deal was shockingly poor value for UK taxpayers and, worse, almost certainly contravened … [Read more...]

Our paper “Trusts: Weapons of Mass Injustice?” – now available in Spanish

Our paper "Trusts: Weapons of Mass Injustice?" which we released and blogged about earlier this year is now available in Spanish. The English version of the paper is available here. The paper provoked critical attention from practitioners and from tax havens. Our response to their critiques is here … [Read more...]