In this year-end guest blog, Tristan Shirley explores the belief system that underpins tax avoidance by multinational corporations and reflects on the ethical failures revealed by their unbelievable behaviour. Almost every commuter on the train is reading the free paper. There is a surprised … [Read more...]

FAQ

Moneyland: plutocracy, contagion and crisis in the Tax Justice Network’s September 2018 podcast

In the September 2018 Tax Justice Network monthly podcast/radio show, the Taxcast: we talk to journalist Oliver Bullough about his new book, just out 'Moneyland: why thieves and crooks now rule the world, and how to take it back' We discuss the transnational elite that have broken free of … [Read more...]

Fintech, hotbed of offshore deregulation and crime

Reuters has just published an article titled Swiss watchdog to propose looser anti-money laundering rules for fintechs. (Fintech is short for "financial + technology" and it is about bringing technology into the financial sector.) Switzerland's move is, apparently: part of a drive to boost … [Read more...]

Tax “stability” short-changes Burkina Faso

A couple of years ago we wrote a blog entitled Beware the siren song of “tax certainty, which took apart a widespread consensus that it is important for countries to embrace 'tax certainty' and 'stability.' These motherhood-and-apple-pie terms hide a world of mischief: not least the fact that this … [Read more...]

Accounting for influence: how the Big Four are embedded in EU tax avoidance policy

The Corporate Europe Observatory has a report out today which is well worth reading. We've written and commented extensively on the Big Four accountancy firms and the damage they do, you can read more in our 'enablers and intermediaries' section. As our CEO Alex Cobham has said, they're "not the … [Read more...]

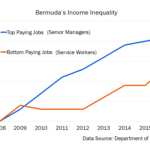

Bermuda: inequality and poverty in UK Overseas Territory

We're very pleased to share this important report on the British Overseas territory of Bermuda, written by Bermudian economist Robert Stubbs, formerly Head of Research for Bank of Bermuda. There are more details on him and his work at the end of this fascinating and timely report. which we reproduce … [Read more...]

UK overseas territories fight back against financial transparency measures

Ten years ago the Tax Justice Network was told it’d never happen, but recently British Members of Parliament voted to stop secret ownership of companies in British Overseas Territories. Unfortunately the Crown Dependencies were not included in the measure because, as we understand it, politicians … [Read more...]

Will the EU really blacklist the United States?

In our latest Financial Secrecy Index assessment, the United States moved up to second place. With its now unparalleled commitment to secrecy at scale, and its influence on international reforms, it has become the leading driver of tax abuse and corruption risk around the world. Years ago we … [Read more...]

Why we can’t afford the rich: our May 2018 podcast

In this month's Taxcast: We discuss why we can’t afford the rich and challenge ideas about wealth, entrepreneurialism and investment. Also: ten years ago the Tax Justice Network was told it’d never happen, but this month British Members of Parliament voted to stop secret ownership of companies in … [Read more...]

Our May 2018 Spanish language podcast: Justicia ImPositiva, nuestro podcast, mayo 2018

Welcome to this month’s latest podcast and radio programme in Spanish with Marcelo Justo and Marta Nuñez, downloaded and broadcast on radio networks across Latin America and Spain. ¡Bienvenidos y bienvenidas a nuestro podcast y programa radiofónica! (abajo en Castellano). In this month’s … [Read more...]

Unhappy meal: tax avoidance still on the menu at McDonald’s

We're sharing this press release from EPSU, the European Public Service Union which comprises 8 million public service workers from over 265 trade unions. Here's their joint statement on their new research on McDonald’s, entitled Unhappy Meal report. Today we release a new report on McDonald’s … [Read more...]

Video discussion: ‘Taming Digital Capitalism’ through public country by country reporting

There were some important debates in Brussels recently where Hans Böckler Stiftung held a two-day symposium with the European Trade Union Institute looking at the changes citizens in Europe are facing in the workplace and examining the challenges for the new leaders who will be in place as a result … [Read more...]

Veils of secrecy: enhancing tax and ownership transparency in development projects

We're sharing here new research from the Egyptian Initiative for Personal Rights which evaluates the role played by a member of the World Bank Group, the International Finance Corporation (IFC) in development projects. The full title of their research is Veils of secrecy: evaluating the IFC's role … [Read more...]

How come Mauritius is the biggest foreign investor in India?

We’re pleased to share a new study by Suraj Jaiswal for the Centre for Budget and Governance Accountability on Foreign Direct Investment in India and the role of tax havens. As their summary of this study says: Governments across the world are trying to attract Foreign Direct Investment (FDI) as a … [Read more...]

Taxing water and infrastructure in the UK

Michael Gove, the UK's Environment Secretary had some harsh words for the water industry recently. “They have shielded themselves from scrutiny, hidden behind complex financial structures, avoided paying taxes, have rewarded the already well-off, kept charges higher than they needed to be.” The … [Read more...]