Adapted from the Global Alliance for Tax Justice. Organisations from 91 countries from around the world, representing close to 500 civil society organisations and almost 5,000 individuals, have been working together for the last 18 months via the Civil 20 (C20) to engage with G20 governments on … [Read more...]

Transfer Pricing

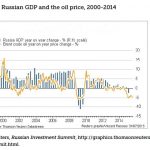

Russia’s offshore financial nexus, threatening financial stability and security

We have for years remarked on the role of the offshore system in promoting financial instability, not least for its propensity to enable financial players to get out from under financial regulations they don't like, then taking the cream from risky activities and shifting the risks onto others. … [Read more...]

Should Nation States Compete? – download the workshop presentations here

TJN recently held its annual research workshop in conjunction with the Association for Accountancy & Business Affairs and City University at City University London. You can download the presentations given at that workshop from the links below. Matthew Watson – ‘Following in John Methuen’s … [Read more...]

Tax Justice Research Bulletin 1(6)

June 2015. Surprising everyone by actually arriving within the stated month, here’s the sixth Tax Justice Research Bulletin – a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international tax, available in full over at TJN. This issue … [Read more...]

Exposed: $43 million tax dodge in world’s poorest country

From ActionAid, another excellent investigation into a corporate tax dodge in Malawi, which on some measures is the world's poorest country: Today [June 17] we’ve released an investigation into an Australian mining company called Paladin, operating in Malawi – the world’s poorest country. We … [Read more...]

Corporate tax and the OECD: joint statement to the G20

The BEPS Monitoring Group (BMG), a body supported by TJN and led by TJN Senior Adviser Sol Picciotto, is a civil society body monitoring the OECD's Base Erosion and Profit Shifting (BEPS) project. BEPS is fancy OECD-speak for 'international corporate tax dodging'. The platform has now produced a … [Read more...]

Juncker invites himself to Luxleaks hearing

This blog looks at a report from EurActiv about the so-called Luxleaks probes, which are looking at whether multinational companies using Luxembourg schemes (involving so-called 'tax rulings') violated European rules. Jean-Claude Juncker is not only head of the European Commission, but former … [Read more...]

Are the G7 really suggesting compulsory arbitration on international tax disputes?

Christian Aid sent us this email yesterday, and it's a shocker. Back in 2013, the G7 made some pretty strong commitments to tax justice, and we said then we'd be watching them carefully to see if they'd deliver. Well, on this evidence, they haven't: quite the opposite, in fact. It is worth … [Read more...]

International commission calls for corporate tax reform

When we look back, might today be the day that momentum swung decisively against current international tax rules? An independent commission made up of leading international economists, development thinkers and tax experts (see the graphic) has called for a radical overhaul of international … [Read more...]

Tax Justice Research Bulletin 1(5)

May 2015. Welcome to the fifth Tax Justice Research Bulletin, a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international taxation. This issue looks at a fascinating thesis on the different people and organisations that influence the … [Read more...]

Amazon to curb Luxembourg tax schemes: a sign of things to come?

Last Saturday The Guardian broke a story about the U.S. multinational Amazon: "From the start of this month the online retailer has started booking its sales through the UK. . . The group made $8.3bn (£5.3bn) of worldwide sales from British online shoppers but for 11 years all these internet … [Read more...]

Farewell, Margaret Hodge

Margaret Hodge, the fiery head of the UK's Public Accounts Committee, has been hauling the bosses of large multinational corporations over the coals for their egregious abuses of the UK tax system. Now, post-election, she is stepping down. Many tax professionals in the UK dislike, hate, or even … [Read more...]

A short FAQ on the European Parliament’s probe into tax rulings

We have just mentioned a demonstration today in Luxembourg, in the context of a visit there by the European Parliament committee tasked with following up on the LuxLeaks affair. (It's known as "The Committee on Tax Rulings and Other Measures Similar in Effect" or TAXE for short.) Christian Hallum … [Read more...]

Tax Justice demonstration in Luxembourg as EU tax body visits

Update 2: with a report on the demonstration in Luxemburger Wort, which in contrast to our earlier experiences of Luxembourg media, was quite balanced. Update1 : with a photo (below) of today's protest in Luxembourg. Some 50-60 people are reckoned to have attended, a good turnout … [Read more...]

The Tax Justice Research Bulletin 1(4)

Corrected: the earlier version referring to a Banque de France Report said "$8bn revenue loss" when it should have referred to an $8bn loss in tax base. The Tax Justice Research Bulletin By Alex Cobham. TJN (April 2015) - The Tax Justice Research Bulletin is a monthly series dedicated to … [Read more...]