Last week we wrote an article entitled Facebook ‘to pay more UK tax’. Let’s not get carried away, analysing an announcement by Facebook that it will restructure its operations so as to pay more tax in the UK. This follows earlier news (on which we also commented) that Google had reached a deal with … [Read more...]

Transfer Pricing

Facebook ‘to pay more UK tax’. Let’s not get carried away

Update: see Prem Sikka's article "Facebook looks set to pay more UK tax but it might not be as much as you think." The UK seems to be a bit of a canary in the mine on international corporation tax at the moment. This is because the British public is very, very exercised about these issues. The … [Read more...]

Will the US Implement Country by Country Reporting?

The BEPS Monitoring Group, an expert body (backed by TJN and others) that works on international corporate tax issues, has published its comments on draft US Treasury Regulations on Country by Country Reporting (CbCR, for an explanation for newcomers, see here). Given the large number of … [Read more...]

Tax Justice Network vs. Tim Worstall: a debate on corporate tax

Tim Worstall, a British commentator who has launched a number of vitriolic and personalised public attacks on TJN and TJN staff members in the the past, has been in debate with TJN's Research Director, Alex Cobham, on the subject of corporate tax. (For a flavour of the extraordinary level of … [Read more...]

Quote of the day: South Africa’s Finance Minister

From the 2016 budget speech in South Africa, from Finance Minister Pravin Gordhan: "We will continue to act aggressively against the evasion of tax through transfer pricing abuses, misuse of tax treaties and illegal money flows. Drawing on the work of the OECD, the G20 joint project on base … [Read more...]

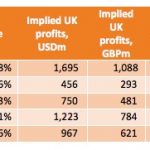

New analysis: why Google is paying just 2% tax rate in the UK

The Daily Mirror newspaper in the UK is running a story entitled Google is paying even LESS tax than thought as UK deal is just 2%. This is based on a new TJN analysis, based not on current tax rules but on what Google might pay if the UK were to adopt a fairer tax system that we've … [Read more...]

Image of the day: IKEA

From the European Green Party: The full report finds that IKEA structured itself to dodge €1 billion in taxes over the last 6 years using onshore European tax havens. … [Read more...]

Why Google (and other multinationals) are still not paying their fair share of corporation tax

This guest blog by Tommaso Faccio of Nottingham business school complements a guest blog we ran on Friday by Sol Picciotto, also about Google's all-important tax affairs. Why Google (and other multinationals) are still not paying their fair share of corporation tax Google says that it pays the … [Read more...]

Which countries have the right to tax Google’s income?

Recently, amid the furore over Google's surprisingly low tax payments in the UK and in other countries, it has been suggested, as one observer put it to us: "The claim is that international tax law accrues profits to where products are created, and not where sales are made. For example, a UK … [Read more...]

PwC: using ‘competitiveness’ as crowbar to lobby for mining cos

From Fools' Gold: Recently we wrote an article entitled The Ideologists of the Competitiveness Agenda, in which we fingered the Big Four firm of accountants as among the most important vectors for the general idea that countries simply have to 'compete' in certain ways: namely, to shower goodies … [Read more...]

Europe’s Anti Tax Avoidance Package: adding fuel to the fire?

The European Commission has announced: "The European Commission has today opened up a new chapter in its campaign for fair, efficient and growth-friendly taxation in the EU with new proposals to tackle corporate tax avoidance. The Anti Tax Avoidance Package calls on Member States to take a … [Read more...]

TJN calls for public country by country reporting. A few hours later . . .

This morning Alex Cobham, TJN's Director of Research, called for public country-by-country reporting, in an interview with the BBC's flagship Today programme (19:20ish). "Country-by-country reporting: that was actually a Tax Justice Network proposal, going back to our establishment in 2003; but … [Read more...]

Google’s taxes and the economic illiteracy of the Mayor of London

No, not the Lord Mayor of London, but the Mayor of London, a certain Boris Johnson, who's frequently tipped to be Britain's next Prime Minister. Given that Britain is arguably the most important player in the global offshore system, this man's opinions deserve close scrutiny. The topic at hand is … [Read more...]

The secret EU Tax “Code” that needs to be cracked open

Guest Blog: The secret EU Tax "Code" that needs to be cracked open A guest blog by Tove Maria Ryding, Eurodad Yesterday Fabio De Masi, a German member of the European Parliament, filed a lawsuit against the European Commission after being denied the right to see the minutes from meetings in … [Read more...]

Apple CEO Tim Cook: wilfully not understanding tax

From the Financial Times: "Apple’s chief executive said accusations the company was avoiding paying taxes by holding more than $180bn of its cash balances outside the US were “total political crap. Apple pays every tax dollar we owe”. To which there is a very simple answer. They don't owe it … [Read more...]