We have for years remarked that one of our informal markers of a tax haven is loud tax haven denials. See our 'we are not a tax haven' blog for more. There's probably no place more vocal than Ireland, where there seems to be a veritable industry of tax haven deniers, which specialises in … [Read more...]

Transfer Pricing

Apple’s iPhone 7 launch: but what about the taxes?

Apple is launching its iPhone 7 today. In the context of the recent Apple tax scandal, and the imbroglio involving the company, the European Commission, and the U.S. Treasury, we thought we'd share some images that some of our partners have created, to celebrate the event. Before seeing the … [Read more...]

New report from UK parliament: tax justice to the fore

The UK's All Party Parliamentary Group on Tax has published a report entitled A more responsible global tax system or a ‘sticking plaster’? An examination of the OECD’s Base Erosion and Profit Shifting (BEPS) process and recommendations. They consulted us (among many others) and the result is a … [Read more...]

Finally, trade misinvoicing gets political

We recently helped publicise a report by the UN Conference on Trade and Development (UNCTAD) in our blog entitled Some countries “lose” 2/3 of exports to misinvoicing. As a reminder, trade misinvoicing is a form of money laundering that involves deliberately misreporting (on an invoice to customs) … [Read more...]

Guest blog: involve developing countries more in international tax co-operation

After Panama: developing countries need to be involved more closely in international co-operation on tax issues A guest blog by Christian von Haldenwang, German Development Institute / Deutsches Institut für Entwicklungspolitik (DIE) Bonn, July 4, 2016 - Two major mechanisms squeeze the tax … [Read more...]

Some countries “lose” 2/3 of exports to misinvoicing

From UNCTAD, the UN Conference on Trade and Development, via email: "Some commodity dependent developing countries are losing as much as 67% of their exports worth billions of dollars to trade misinvoicing, according to a fresh study by UNCTAD, which for the first time analyses this issue for … [Read more...]

New questions over Juncker’s role in Amazon Luxembourg affair

Jean-Claude, Juncker, the President of the European Commission, has long tried to distance himself from his role as one of the key architects of Luxembourg's crime-fueled tax haven factory. An excellent new investigation by Newsweek now reminds us of his efforts to display whiter-than-white … [Read more...]

Top tax expert: Big 4 “accountants of fortune” must be broken up

In March The Economist magazine rang alarm bells (again) about a rise in concentrated market power: a problem where the biggest firms get ever bigger and more like monopolies, making it easy to extract wealth from the rest of us (as opposed to creating wealth.) This, in turn fosters steeper … [Read more...]

Luxembourg on trial as Luxleaks whistleblowers await tomorrow’s verdict

Tomorrow afternoon the "LuxLeaks" trial will end and the two whistleblowers, Antoine Deltour and Raphaël Halet, as well as the journalist Eduard Perrin, will know whether they will be punished or not, for breaking Luxembourg's secrecy regime. They face up to 18 months in jail for exposing lurid … [Read more...]

Are European Union finance ministers about to deliver another stitch-up on corporate tax?

Update 3, June 21. The EU Press Release is here. Scornful comments continue to circulate. Update 2: This blog is turning into a series of updates in *italics*, with the original background discussion in plain text underneath. Currently, the situation is uncertain - two hours ago, Jeroen … [Read more...]

New paper: Taxing Multinational Enterprises as Unitary Firms

A new paper by TJN Senior Adviser Sol Picciotto, for the International Center for Tax and Development (ICTD). Summary: This paper explores the issues raised for international tax rules of explicitly treating multinational enterprises (MNEs) as single or unitary firms. It first briefly explains … [Read more...]

More sordid details about the Luxembourg tax cheat factory

If you read one story today, read this, from Private Eye. A couple of small excerpts reveal the extent to which tax havens like Luxembourg are 'captured states": Applications for the favourable rulings, Halet told the court, were sent every Wednesday at 1.30pm in batches of 30 to 40 and returned … [Read more...]

Luxleaks whistleblowers on trial in a week, face 10 years in jail

This is one of the clearest cases of tax justice versus tax haven 'justice.' From Change.org via the Support Antoine Deltour campaign: a call to get involved in support of the main #Luxleaks whistleblower, Antoine Deltour, and two others accused with him. Please share this: the case has seen … [Read more...]

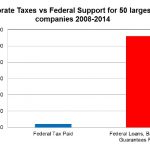

Graph of the day: the broken U.S. tax system

From Oxfam America's new report Broken at the Top: How America’s dysfunctional tax system costs billions in corporate tax dodging: Now read on. … [Read more...]

Taxing corporations: the Politics and Ideology of the Arm’s Length Principle

Last year we posted a presentation by Matti Ylönen looking at the politics of the international tax system. Now he has written us a guest blog, based on his paper co-authored with Teivo Teivainen, which was a co-winner of the Amartya Sen Prize in October 2015. Taxing corporations: the Politics … [Read more...]