Yes, we can build an open and transparent tax system that works fairly for everyone. Do you know how multinationals shift their profits to dodge their taxes and how we can stop them? Our beautifully illustrated new videos tell you how, narrated in five different languages by our tax justice podcast … [Read more...]

Transfer Pricing

Pandemic of tax injustice in Ukraine

The Ukrainian government took the pandemic as an opportunity to further shift the tax burden from the rich to the poor, while Tax Justice Network's new illicit financial flows tool confirms the country is vulnerable to profits shifting to tax havens and bank deposits outflows. Guest blog from … [Read more...]

Edition 11 of the Tax Justice Network’s Francophone podcast/radio show: édition #11 de radio/podcast Francophone par Tax Justice Network

We’re pleased to share the eleventh edition of the Tax Justice Network’s monthly podcast/radio show for francophone Africa by finance journalist Idriss Linge in Cameroon. Nous sommes fiers de partager cette nouvelle émission de radio / podcast du Réseau Tax Justice, Tax Justice … [Read more...]

Taxing multinationals: a new approach

Our headline is also the title of an important new report by Public Services International, a global trade union federation, looking at the fast-changing international tax system. Co-authored by Public Services International's Daniel Bertossa and Sol Picciotto, a Tax Justice Network Senior … [Read more...]

‘Terrible Transactions’: How much does mining benefit the Brazilian state?

We're sharing here details of a study by the Instituto Justiça Fiscal (the Tax Justice Institute) in Brazil researched by economist Guilherme Spinato Morlin with coordination and advice from the Instituto Justiça Fiscal. Instituto Justiça Fiscal directors Clair Hickmann and João Carlos Loebens take … [Read more...]

The Corporate Tax Haven Index: solving the world’s broken tax system in our monthly podcast, the Taxcast

In this month's June 2019 podcast we look at the new Corporate Tax Haven Index released by the Tax Justice Network. What does it tell us about the global economy and the international tax system? And how can we fix it? We also look at how India is pushing the G20 into action on global tax rules - if … [Read more...]

Ten reasons why the Destination Based Cash Flow Tax is a terrible idea

This long blog will be periodically updated, in response to comments. Latest update: March 28, 2019. The international tax system for taxing multinational corporations is coming apart at the seams. We are now entering one of the most significant turning points in world tax history. As the IMF's … [Read more...]

European Commission orders Luxembourg to claim back 250 million in taxes from Amazon – TJN Reaction

There are two very welcome pieces of tax justice news today. Firstly, the European Commission has ordered the tax haven of Luxembourg to recover 250 million euros in taxes from Amazon, finding that the benefits extended to the company amount to illegal state aid. The support Amazon received, allowed … [Read more...]

Beginning of the end for the arm’s length principle?

The European Commission has released a statement which could well signal the beginning of the end for the OECD’s international tax rules, and the arm's length principle on which they are based. The current rules, which date to decisions taken at the League of Nations in the inter-war years, are … [Read more...]

Estimates on illicit flows to and from developing countries

Our friends at Global Financial Integrity have released their latest report on what they estimate to be the latest figures from 150 countries on illicit financial flows to and from developing countries for the period 2005-2014. Most of these flows arise from fraudulent trade mis-invoicing which, as … [Read more...]

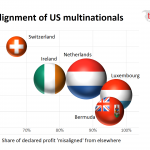

Is tax avoidance at the heart of Ireland’s economic miracle?

Coming out of the economic crisis Ireland was one of the best performing economies, with GDP growth rates of 8.5% in 2014 and an extraordinary 26.3% in 2015. But how much of this economic activity was real, and how much a fiction created by Ireland's tax haven status? A new paper by Heike Joebges … [Read more...]

Beware the siren song of “tax certainty”

Back in July the G20 club of powerful countries issued a communiqué in which they enthused about "the benefits of tax certainty to promote investment and trade," and they mandated the OECD and the IMF "to continue working on the issues of pro-growth tax policies and tax certainty." It's taken as a … [Read more...]

UN report recommends: go after tax havens, and protect whistleblowers

From the United Nations General Assembly, the fifth report of the Independent Expert on the promotion of a democratic and equitable international order. The summary goes like this: "The report focuses on impacts of taxation on human rights and explores the challenges posed to the international … [Read more...]

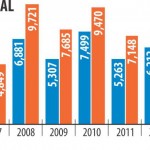

Report: new data disproves US corporations’ false narrative on taxes

From Americans for Tax Fairness, a major new report about corporate taxes in the United States. It's called Corporate Tax Chartbook: How Corporations Rig the Rules to Dodge the Taxes They Owe, and it contains many useful facts, such as this: Corporate profits are way up, and corporate taxes … [Read more...]

Apple’s tax affairs: a symptom of the robber-baron culture

Updated with further information about Brazil's decision - see below. Now also on Angry Bear, Middle Class Political Economist From the Financial Times: More precisely, a group of 185 American CEOs has sent letters, co-ordinated by the Business Roundtable lobby group, to the leaders of 28 EU … [Read more...]