Update, Jan 20: this blog has now been adapted and expanded in a post on Naked Capitalism. In 2013 we published an article entitled Lee Sheppard: Don't sign OECD model tax treaties! which looked at a presentation by one of the U.S.' top experts in international tax. Her fiery presentation … [Read more...]

Taxing corporations

Quote of the day: White House slaps down foolish ‘innovation box’

Last October we published an article entitled The UK’s “Patent Box” – nasty, disingenuous and hypocritical tax law (via a longer piece we wrote on Naked Capitalism, entitled The “Patent Box” – Proof That the UK is a Rogue State in Corporate Tax.) This is about providing tax breaks for multinationals … [Read more...]

The secret EU Tax “Code” that needs to be cracked open

Guest Blog: The secret EU Tax "Code" that needs to be cracked open A guest blog by Tove Maria Ryding, Eurodad Yesterday Fabio De Masi, a German member of the European Parliament, filed a lawsuit against the European Commission after being denied the right to see the minutes from meetings in … [Read more...]

Lazonick: tax cheating is just part of Pfizer’s corrupt business model

Recently the U.S. pharma giant Pfizer announced a merger with the drugmaker Allergan, in a deal heavily motivated by tax cheating via a 'corporate' inversion - a corporate relocation to take advantage of (in this case Ireland's) lax tax regime. Much has been said on the topic, with U.S. … [Read more...]

The chaser’s guide to tax havens: a simple 1,413-step guide

Some offshore humour for a Monday morning: The Chaser's Guide to Tax Havens, from Australia. The magazine has an interesting history: "Ever since The Chaser started, back in 1999, we have strived to build our company on a solid foundation of inexplicable and highly technical tax losses." Back … [Read more...]

Three Tax Whistleblowers Who Changed The Game

The following blog was first published as part of a longer article in the Whistleblower Edition of Tax Justice Focus (available here). The article was authored by Professor William Byrnes, Associate Dean (Special Projects) Texas A&M University Law. A lawsuit filed by Daniel Schlicksup, a … [Read more...]

How the U.S.A. became a secrecy jurisdiction

This month we published our fourth Financial Secrecy Index (FSI), complete with a series of reports about each of the biggest tax havens and secrecy jurisdictions, looking into the political and economic histories of how and why they went offshore, who was involved, and where the bodies are … [Read more...]

New report: tax treaties in sub-Saharan Africa

Via Martin Hearson's website, here is a new report he authored for Tax Justice Network-Africa. As Hearson says, it’s based on field research done a year ago and has been a little while getting into print. Here’s a link to read it online at academia.edu Here’s a link to download the PDF Among many … [Read more...]

Crickhowell and the tax rebellion: the mouse that roared?

Update: the Crickhowell activists have set up a new website: Fair Tax Town. We're delighted to see that a forthcoming BBC TV programme will highlight a major tax injustice that we have long drawn attention to: that multinational corporations are killing small businesses partly by being able to … [Read more...]

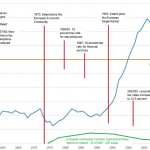

How Ireland became an offshore financial centre

This month we published our fourth Financial Secrecy Index (FSI), complete with a series of reports about each of the biggest tax havens and secrecy jurisdictions, looking into the political and economic histories of how and why they went offshore, who was involved, and where the bodies are … [Read more...]

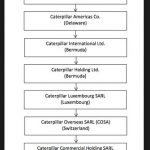

Still Broken: major new report on global corporate tax cheating

Update, Dec 7, 2015: a new paper in the Journal of World Business, which contains this: "Home country statutory corporate tax rates have a small impact on tax haven use. In general, corporate tax rates are an important factor in driving MNEs to set up tax haven subsidiaries. However, … [Read more...]

Guest blog: sun, sea, sand, tourism and fantasy finance

Where are you going on your next holiday? The chances are if you are flying to a Sun&Sea destination, it will be with a tax-dodging company. A guest blog by Linda Ambrosie. Listen to her on the Taxcast here. Do you recognize any of these names: Barceló, TUI or Melía?. In … [Read more...]

Fifty Shades of Tax Dodging: how EU helps support unjust global tax systems

A major new report written by civil society organisations in 14 countries across the EU, co-ordinated by Eurodad. Fifty Shades of Tax Dodging: the EU's role in supporting an unjust global tax system … [Read more...]

European Commission determines state sponsored tax avoidance schemes illegal

Today the European Commission is expected to announce that the 'comfort letters' signed between European tax havens and companies are a form of illegal state aid. … [Read more...]

The Offshore Wrapper: a week in tax justice #70

MTN’s Mauritian Billions A group of investigative journalists in Africa working with Finance Uncovered, a TJN supported project have discovered that Africa’s largest mobile phone network, MTN, has been moving billions of Rand in revenue to the island of Mauritius. … [Read more...]