From Corporate Observatory Europe, the basic background for our guest blog: "The proposed EU legislation on “Trade Secrets Protection”, which the European Parliament will vote next April 14, creates excessive rights to secrecy for businesses: it is a direct threat to the work of journalists and … [Read more...]

Taxing corporations

Take action to back corporate transparency in Europe

Update: see the report in The Guardian here; see Alex Cobham's mode detailed analysis of the failures of what's being proposed, here. We've been campaigning on so-called country by country reporting since 2003, and now world leaders, and many others, are beginning to introduce changes to bring … [Read more...]

Why is the CEO of IKEA Switzerland head of a UN panel on gender?

On March the UN Secretary-General’s High-Level Panel on Women’s Economic Empowerment held their inaugural meeting. The panel: “intends to put women’s economic empowerment at the top of the international agenda, including by defining actions to speed up progress under the 2030 Agenda for … [Read more...]

Google, Facebook and a gradual realignment to the post-BEPS landscape

Last week we wrote an article entitled Facebook ‘to pay more UK tax’. Let’s not get carried away, analysing an announcement by Facebook that it will restructure its operations so as to pay more tax in the UK. This follows earlier news (on which we also commented) that Google had reached a deal with … [Read more...]

US Fortune 500 cos hold $2.4trn offshore, dodging up to $695bn in tax

From Citizens for Tax Justice, a major new report: "A diverse array of companies are using offshore tax havens. . . All told, American Fortune 500 corporations are avoiding up to $695 billion in U.S. federal income taxes by holding $2.4 trillion of “permanently reinvested” profits offshore. In … [Read more...]

Facebook ‘to pay more UK tax’. Let’s not get carried away

Update: see Prem Sikka's article "Facebook looks set to pay more UK tax but it might not be as much as you think." The UK seems to be a bit of a canary in the mine on international corporation tax at the moment. This is because the British public is very, very exercised about these issues. The … [Read more...]

Will the US Implement Country by Country Reporting?

The BEPS Monitoring Group, an expert body (backed by TJN and others) that works on international corporate tax issues, has published its comments on draft US Treasury Regulations on Country by Country Reporting (CbCR, for an explanation for newcomers, see here). Given the large number of … [Read more...]

US official on the influence of NGOs on taxing multinationals

Tax Justice Network vs. Tim Worstall: a debate on corporate tax

Tim Worstall, a British commentator who has launched a number of vitriolic and personalised public attacks on TJN and TJN staff members in the the past, has been in debate with TJN's Research Director, Alex Cobham, on the subject of corporate tax. (For a flavour of the extraordinary level of … [Read more...]

Should we be giving tax breaks to tobacco companies?

From Citizens for Tax Justice in the U.S., a post that begins by discussing federal tax breaks for manufacturing corporations. And they ask: "Tobacco companies “manufacture” cigarettes—but do Americans, or lawmakers, really think it’s a good idea for the federal government to subsidise this … [Read more...]

Pfizer: tax dodger, price gouger

A new report from Americans for Tax Fairness concludes: "In addition to dodging its fair share of taxes, Pfizer—maker of Celebrex, Lipitor, Lyrica, and Viagra, among many other health-care products—has also been aggressively raising prescription drug prices, thereby straining patients and our … [Read more...]

Quote of the day: South Africa’s Finance Minister

From the 2016 budget speech in South Africa, from Finance Minister Pravin Gordhan: "We will continue to act aggressively against the evasion of tax through transfer pricing abuses, misuse of tax treaties and illegal money flows. Drawing on the work of the OECD, the G20 joint project on base … [Read more...]

Report: The treaties that cut taxes in poorest countries

New analysis: The treaties that cut taxes in some of the world’s poorest countries A guest blog by Lovisa Möller, ActionAid Today ActionAid releases battery of resources for academics, negotiators and activists that want to know more about the tax treaties that some of the world’s poorest … [Read more...]

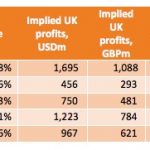

New analysis: why Google is paying just 2% tax rate in the UK

The Daily Mirror newspaper in the UK is running a story entitled Google is paying even LESS tax than thought as UK deal is just 2%. This is based on a new TJN analysis, based not on current tax rules but on what Google might pay if the UK were to adopt a fairer tax system that we've … [Read more...]

Global Tax Fairness: new book from Oxford University Press

This new book from Oxford University Press, edited by Thomas Pogge and Krishen Mehta, publishes fifteen chapters by leading tax justice scholars on different topics ranging from country-by-country reporting to unitary taxation, from automatic information exchange to tax wars, with clear and … [Read more...]