Two major reports are worth highlighting here. First, and most recently, from the U.S. Permanent Subcommittee on Investigations (via Senator Carl Levin), a report on tax avoidance by U.S. multinational Caterpillar: "Caterpillar Inc., an American manufacturing icon, used a wholly owned Swiss … [Read more...]

Taxing corporations

Shareholders to get chance to vote on Google’s tax policy at AGM

From Responsible Investor, a story about a shareholder resolution about Google’s tax strategies has been placed by a group of responsible investors onto the agenda of its forthcoming annual shareholder meeting. "The proposal calls on the company’s board to “adopt a set of principles to address the … [Read more...]

Tanzania: parliamentary inquiry on tax abuses, tax havens, illicit flows

Adapted from an email from Tove Maria Ryding, Eurodad: Good news from Tanzania - the Public Accounts Committee there has kicked off an inquiry on tax evasion and avoidance, amid severe concerns about illicit financial flows and capital flight. We might have some interesting times … [Read more...]

EU steps up probe into tax haven activities. Hit ’em hard

From the Financial Times: "Brussels has stepped up its probe into alleged illegal sweeteners offered to multinationals by expanding the investigation to cover arrangements for patent-holders and ordering Luxembourg to reveal its promises to specific companies. … [Read more...]

Tax Justice Focus 2014 – the COUNTRY-BY-COUNTRY REPORTING edition

This edition of Tax Justice Focus is guest edited by Richard Murphy, the originator of the idea of country-by-country reporting. A little more than a decade after he first began to develop the concept, Murphy has brought together authors from the Organisation for Economic Co-operation and … [Read more...]

Report: US government’s vast interest payments to tech giants on their offshore billions

From the Bureau of Investigative Journalism: "The US government makes vast interest payments to technology giants including Apple and Microsoft on the billions of dollars they shelter from tax offshore. A trawl of Securities & Exchange Commission (SEC) disclosures shows that Apple, … [Read more...]

US multinationals’ offshore cash piles grow $206bn

From Bloomberg: "The largest U.S.-based companies added $206 billion to their stockpiles of offshore profits last year, parking earnings in low-tax countries until Congress gives them a reason not to. … [Read more...]

IMF launches consultation on tax ‘spillover’

In a welcome step, the International Monetary Fund has announced it will be researching the consequences of existing and proposed changes to corporation tax regimes for lower income "source" countries. … [Read more...]

UK healthcare and foreign aid: the links

From the UK-based Centre for Health and the Public Interest: "Those investigating the persistence of poverty in developing countries and those struggling to sustain high quality health care in the UK have more in common than we think." Why? Well, read on. … [Read more...]

Tax justice and modern-day colonialism: Areva vs. Niger

From Reuters, an excellent Special Report: "Niger has become the world's fourth-largest producer of the ore after Kazakhstan, Canada and Australia. But uranium has not enriched Niger. The former French colony remains one of the poorest countries on earth." … [Read more...]

Survey: the corporate tax debate is biting the corporations

From tax advisers Taxand, who have just conducted a global survey of corporate Chief Finance Officers (CFOs): 76% of survey respondents said that the exposure in the media of corporate tax planning activity has a detrimental impact on a company’s reputation 31% said that the intense media … [Read more...]

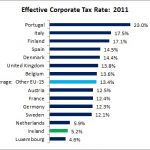

Read our lips: Ireland is a tax haven. Part xxvi

From Unite, Ireland (via Tax Research), a nice little graph showing effective corporate tax rates in Europe. We haven't seen this one before. Ireland, the Netherlands and Luxembourg - the Eurozone's three most notorious tax havens - are the clear abusers. … [Read more...]

Guernsey milking and the offshore stock exchange

The International Advisor magazine has just reported: "Guernsey chief minister Peter Harwood resigned today, in the wake of publication of a critical article in the current issue of the British satirical and investigative publication, Private Eye." This refers to an excellent report entitled … [Read more...]

Fashion retailer’s tax dodges boost European inequality

Bloomberg tax star Jesse Drucker has another fine article out about the Spanish retailer Inditex, the parent of high street retail giant Zara. We would urge you to read it. Among many other things, it contains: "In the past five years, Inditex has shifted almost $2 billion in profits to a tiny … [Read more...]

Report: the Sorry State of U.S. Corporate Taxes, 2008-2012

A major new report from the indefatigable Citizens for Tax Justice in the U.S. The Executive Summary begins: The Sorry State of Corporate Taxes What Fortune 500 Firms Pay (or Don’t Pay) in the USA And What they Pay Abroad — 2008 to 2012 … [Read more...]