The Offshore Wrapper is written by George Turner Credit Swindle? "We were running a criminal enterprise, but we didn't know," is what reportedly Credit Suisse will soon admit in its long running dispute with the United States Justice Department over alleged involvement in assisting US … [Read more...]

Taxing corporations

Mining for Gold: tax justice film

We are delighted to provide a short tax justice film covering the Tax Justice Network seminar on transfer pricing held in Dar es Salaam, Tanzania, last October. The full range of presentations are linked below the film, and will be permanently stored on our Transfer Pricing site. … [Read more...]

Quote of the day: Elizabeth Warren

Regarding corporations paying their way, the trailblazing U.S. senator Elizabeth Warren: You built a factory out there? Good for you. But I want to be clear. You moved your goods to market on the roads the rest of us paid for. You hired workers the rest of us paid to educate. You were safe in your … [Read more...]

Another reason why corporations may want to be taxed properly

. . . via top-ranked U.S. tax professor Reuven Avi-Yonah, in a paper entitled Just Say No: Corporate Taxation and Social Responsibility. It is US-focused, but has wide relevance. This, in fact, can be seen as another justification of imposing tax on the corporation: Rather than bear any social … [Read more...]

European voters: make tax dodging an election issue

From our friends at Eurodad: Eurodad … [Read more...]

Why companies put together for tax reasons will be fragile

A while ago we explained how tax avoidance by multinational corporations is like refined sugar in the human body: empty financial calories with adverse long-term health effects. Now we have an article from Financial Times columnist John Gapper, who has looked at the tax-arbitrage nonsense … [Read more...]

Ethical shareholders call on Google to stop its tax abuses

The Domini Social Equity Fund and its partners have submitted a shareholder proposal to Google for its annual meeting on May 14th urging it to do something about its systematic tax abuses. We just blogged a petition in support of this proposal, which we'd urge readers to sign. The shareholder … [Read more...]

Petition: Google, pay your taxes!

A petition, with over 100,000 signatures so far, begins like this. "Google isn’t paying its taxes. The multi-billion dollar corporation has been under scrutiny for shifting using shell companies in Bermuda, Ireland and elsewhere to shelter at least $33 billion of revenue. … [Read more...]

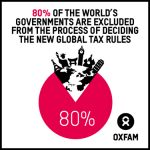

Report: better tax rules could boost developing country corporate tax revenues by 100%

A new report from Oxfam, entitled BUSINESS AMONG FRIENDS: Why corporate tax dodgers are not yet losing sleep over global tax reform. It begins like this: "Tax dodging by big corporations deprives governments of billions of dollars. This drives rapidly increasing inequality. Recent G20 and OECD … [Read more...]

New Germany-UK tax treaty undermines OECD tax reforms

A little-noticed new protocol to the Germany-UK tax treaty needs dragging into the daylight, since it appears to be a sneaky effort to undermine reforms by the OECD, the club of rich countries that oversees the international tax system. … [Read more...]

Pfizer and Astrazeneca merger shows US and UK both lose from UK’s predatory tax regime

Update: see this must-read post from Citizens for Tax Justice in the U.S., entitled Why Does Pfizer Want to Renounce Its Citizenship? From Tax Research UK: "The financial press is full of stories about Pfizer this morning, and its planned takeover of Astrazeneca. A recurring theme is the tax … [Read more...]

Publicis and Omnicom: a merger driven by tax abuse?

Reuters is carrying a fascinating story with a less than fascinating headline: "Push for tax-avoidance curbs in G-20 threatens Publicis-Omnicom deal." Last July Paris-based Publicis and New York-headquartered Omnicom announced plans to merge to create the world's biggest advertising group, which … [Read more...]

New report: Inequality, Tax and a Rising Africa?

From Tax Justice Network for Africa and Christian Aid, a new report entitled Africa rising? Inequalities and the essential role of fair taxation. It investigates income inequality in Ghana, Kenya, Malawi, Nigeria, Sierra Leone, South Africa, Zambia and Zimbabwe: there has been little definitive … [Read more...]

Submission to OECD on transfer pricing and developing countries

The BEPS Monitoring Group, which TJN took the lead in establishing last year in the wake of the OECD's ground-breaking initiative, has just published this report: BMG Submission to OECD on Transfer Pricing Comparability Data and Developing Countries. This report responds to the OECD Report on … [Read more...]

European Investment Bank exposes “hypocritical nature of western financial institutions”

The Guardian has published an article, picked up by media across the world, about the NGO follow-up to revelations in 2011 that the European Investment Bank had lent money to the Zambian firm Mopani Copper Mines (a.k.a. Glencore) which avoided paying tens of millions of dollars in local tax. At … [Read more...]