The OECD's Base Erosion and Profit Shifting (BEPS) process is the pre-eminent global attempt to try and stop multinational corporations running rings around the world's tax authorities. We have argued before that the OECD, a club of rich countries, has not sufficiently taken the interests of … [Read more...]

Taxing corporations

Third of Australia’s big corporations pay less than 10% tax – report

The Price We Pay “near miraculous”

Harold Crooks' documentary film about tax avoidance has been selected as one of the six best documentaries submitted this year to the Toronto International Film Festival. In his review, critic Jason Gorber cites the balanced arguments, the … [Read more...]

Quote 2 of the day: shareholders, tax avoidance and refined sugar

A second quote of the day, this time from the Financial Times' Lombard column, a musing on the current U.S. focused news about corporate inversions: "Transactions sold on tax advantages should be sources of shareholder unease too. Governments can readily change their minds about corporate tax … [Read more...]

New book: fighting corporate abuse

A new book titled "Fighting Corporate Abuse: Beyond Predatory Capitalism" is to be published by Pluto. The authors include two TJN Senior Advisers, Prem Sikka and Sol Picciotto. The book offers public policies for tackling corporate abuses, as the blurb notes: … [Read more...]

Don’t sign OECD tax treaties: the case of Uganda

Update, Dec 9: Martin Hearson adds his own updated analysis of Uganda's tax treaties in a Powerpoint presentation here. A while ago we quoted U.S. tax expert Lee Sheppard excoriating OECD model tax treaties, in a fiery presentation which included such gems as: For multinationals, "there are … [Read more...]

BEPS – minor victories but we risk losing the war

The following are detailed thoughts on the OECD BEPS year one outcomes prepared by friends and colleagues at Eurodad (the European Network on Debt and Development). … [Read more...]

Quote of the day – on tax laws and corporate partners

From Marty Sullivan (pictured), a top U.S. tax expert, speaking last year: “What politicians keep forgetting is that you can’t ‘partner’ with the corporate community when it comes to writing the tax laws,” Sullivan explains. “They’re not partners — they are adversaries.” Someone ought to send a … [Read more...]

UNCTAD: the time for tax justice has come

A press release about the latest UNCTAD Trade and Development report 2014: "Governments, from rich and poor countries alike, should be able to finance the investment and other public spending required to meet the demands of their citizens for a more prosperous and secure life. Mobilizing domestic … [Read more...]

Corporate Deadbeats: How Companies Get Rich Off Taxes

A nice cover story in Newsweek from David Cay Johnston, worth remarking on because it's written so clearly and is a powerful indictment of what's going on in the corporate U.S. at the moment. A sample from the article: "How can a tax burden become a boon? Simple. Congress lets multinationals … [Read more...]

Public pressure works: new report

We've been emailed a paper entitled Public Pressure and Corporate Tax Behavior, Scott D. Dyreng of the Fuqua School of Business Duke University; Jeffrey L. Hoopes of Fisher College of Business Ohio State University; and Jaron H. Wilde, of Tippie College of Business University of Iowa. The … [Read more...]

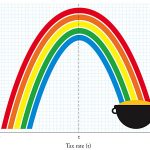

Feast of the Wingnuts: on the origins of the Laffer Curve

From the U.S. publication The New Republic, a timeless article entitled Feast of the Wingnuts: "All sects have their founding myths, many of them involving circumstances quite mundane. The cult in question generally traces its political origins to a meeting in Washington in late 1974 between Arthur … [Read more...]

Burger King’s “shift” from the U.S. to Canada: a move that will cost both countries

Watch Jon Stewart on corporate inversions. Hilariously serious From Prem Sikka: "The US$11 billion merger of Burger King and Canadian coffee and doughnuts chain Tim Hortons is the latest example of a tax inversion move. The deal will see BK transfer its company headquarters from the US to Canada … [Read more...]

Quote of the day: the purpose of corporations

From Prof. Colin Mayer of Oxford’s Saïd Business School, author of the book in the image: “The corporation is a rent extraction vehicle for the shortest-term shareholders.” That's quite a statement, and it comes via Martin Wolf in the Financial Times. The FT article discussing shareholder value … [Read more...]

Risk mining: what tax avoidance is, and exactly why it’s anti-social

Recently we wrote about a remarkable blog by Jolyon Maugham, a tax barrister, a view from the front lines, which we'll repeat again today, because it's so startling: "I have on my desk an Opinion – a piece of formal tax advice – from a prominent QC at the Tax Bar. In it, he expresses a view on the … [Read more...]