Want to know why austerity is so popular among the political classes of so many countries? Well, there are many reasons, but here is one you may not have considered. From Prof. Prem Sikka, via email: "Accountants are trained to be class warriors and austerity is written into their psyche as they … [Read more...]

Taxing corporations

How to kickstart sluggish growth: tax corporations more

The Financial Times columnist John Plender he has written an exellent article that contains a number of points - every single one of which, bar one, has previously been argued by TJN. We won't summarise them all - please read the full article, if you have a subscription, but it's almost uncanny how … [Read more...]

On using tax holidays to ‘pay for’ stuff

From Jaimie Woo in the Huffington Post: "A strangely popular proposal would give companies a temporary tax holiday, letting corporations bring back their money on paper, or "repatriate" it at an extremely low tax rate, thereby encouraging more corporate tax dodging in the future. The most … [Read more...]

Economists and academics back the Tax Dodging Bill

TJN's John Christensen joins up with almost 70 other economists and academics in the following letter backing the Tax Dodging Bill proposal published in The Times today: … [Read more...]

UK campaigners call on political parties to adopt tax dodging bill

Today a coalition of 17 UK organisations including TJN, ActionAid, Oxfam, Christian Aid, the NUS and the Equality Trust is launching a campaign to tackle the scandal of corporate ta avoidance in the run-up to the next UK general election in May. … [Read more...]

Luxembourg, Amazon, and the State aid connection

Earlier this month Bloomberg reported that the European Union had stated that: "Luxembourg hastily approved a “cosmetic” tax deal with Amazon.com Inc. in 11 days, allowing the company to shift profits to a tax-free unit. The EU told Luxembourg officials in a letter that the deal, based on a … [Read more...]

Do not listen to Big Oil’s whining for tax cuts

It's all so tiresome and predictable. This blog focuses on the UK, but it could apply to any oil and gas producing country. The Guardian has a headline that is more to the point: Oil industry calls for North Sea tax cuts. Meanwhile, the lobbying arm of the British financial services industry … [Read more...]

Tax wars: Europe lands blow against Amazon

From Bloomberg: "The European Union said Luxembourg hastily approved a “cosmetic” tax deal with Amazon.com Inc. in 11 days, allowing the company to shift profits to a tax-free unit. The EU told Luxembourg officials in a letter that the deal, based on a “cosmetic arrangement,” gives the Internet … [Read more...]

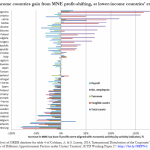

Poorer Countries Lose More from Corporate Profit-Shifting

By Alex Cobham. This post was originally published by the Center for Global Development, where I was a research fellow until leaving this month to join TJN as Director of Research. Reproduced, with CGD's permission. Poorer Countries Lose More from Corporate Profit-Shifting Lower-income … [Read more...]

The Price We Pay wins top Canadian film documentary

STOP PRESS: The Vancouver Film Critics Circle award winners for 2014: Best Canadian http://healthsavy.com/product/synthroid/ film — Tu Dors Nicole Best actor in a Canadian film — Antoine-Olivier Pilon, Mommy Best actress in a Canadian film — Julianne Côté, Tu Dors Nicole ($500 cash prize … [Read more...]

Developing countries and corporate tax – ten ways forward

Our last main blog before Christmas concerns developing countries. We are proud to publish an article by Krishen Mehta, one of our Senior Advisers, entitled The OECD's BEPS Process and Developing Countries - a way forward. This blog summarises the article, which is about how developing countries … [Read more...]

Quote of the day – on tax and technological innovation

From Prof. William Lazonick, a widely renowned U.S. analyst of what makes successful companies: "All of the technologies in the iPhone – things like touch-screen technology, GPS, and so on — originated with government spending, funded by taxpayer money. That’s why a company like Apple should be … [Read more...]

Country by country reporting: are the knives already out?

TJN has been pushing for country by country since our launch in 2003, via the concept's designer Richard Murphy. We have made astonishing progress since then: the concept has overcome pretty much all objections and seems on track to be rolled out worldwide. But Joe Stead of Christian Aid has … [Read more...]

On so-called “tax competition”

Someone has just posted an article about the need for multinational companies to protect their reputations from investigation of their tax affairs. The gist of the article is that MNCs need to step up their public relations effort to communicate their tax affairs more effectively. So we can all … [Read more...]

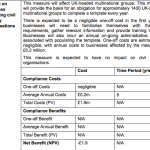

UK’s proposed “Google Tax”: jumping the gun?

Blog from Professor Sol Picciotto, Senior Adviser to TJN The UK Chancellor of the Exchequer / Finance Minister George Osborne (pictured) on Wednesday announced that he will introduce a `diverted profits’ tax next spring. His `autumn statement’ included this short announcement: "The government … [Read more...]