From The Guardian, a major new story whose introduction runs as follows: "Research by the Guardian and the Tax Justice Network reveals 28 English clubs with substantial shareholdings overseas, opening up the football leagues to criticism for allowing ownership structures that could be used for … [Read more...]

Taxing corporations

Quote of the day – tax avoidance as red flag for investors

From the Financial Times, our quote of the day: "investors were viewing the aggressiveness of a company’s tax planning as a proxy for accounting risks and the company’s broader management style." Which is just as we have always said. Tax avoidance is shortcut behaviour: the opposite of … [Read more...]

‘National Competitiveness’: a crowbar for corporate and financial interests

This was originally posted yesterday at the new Fools' Gold site, which is dedicated to understanding how nations do or don't 'compete'. The term "UK PLC" -- the 'PLC' bit standing for Public Limited Company -- evokes notions that whole countries behave like corporations. It is routinely trotted … [Read more...]

Tax Justice Research Bulletin 1(3)

By Alex Cobham, TJN's Director of Research March 2015. Welcome to the third Tax Justice Research Bulletin, a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international tax. This issue looks at new papers on the responsibilities … [Read more...]

Do lower tax rates curb tax cheating? Really?

It's a good question. Now, an Australian story, via The Guardian: "Treasurer Joe Hockey has said Australia is “losing control of our destiny from a taxation perspective” because of “holes” in the tax treatment of multinational corporations, as a parliamentary committee prepares to grill global … [Read more...]

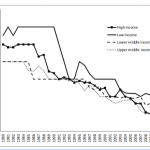

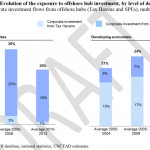

UNCTAD: multinational tax avoidance costs developing countries $100 billion+

The UN Conference on Trade and Development (UNCTAD) has just published a major new study on corporate tax in developing countries, which contains a wealth of new information analysis as well as some important headline numbers: notably that developing countries lost around $100 billion per year in … [Read more...]

An African civil society perspective on Financing for Development

From the Uncounted blog, run by TJN's Director of Research, Alex Cobham The African regional consultation on Financing for Development (FfD) took place at the start of the week (like the European one). The submission from TJN-Africa puts particular emphasis on inequality, including women’s rights, … [Read more...]

What is competitiveness? #1 – Robert Reich

From the Fools' Gold blog, an article that speaks for itself What is Competitiveness? #1 Robert Reich This is the first in an ongoing series of articles we are planning, to explore what competitiveness is, from the perspective of particular public figures or intellectuals. For the first in this … [Read more...]

The Tax Justice Network Podcast, March 2015

The Tax Justice Network Podcast, March 2015 In the March 2015 Taxcast: Democracy for sale - how our politics rely heavily on tax haven-friendly donors. Also, we ask: why is HSBC shutting down offshore accounts in Jersey? Are we in the final few years of the corporate income tax? Is Australia's … [Read more...]

New Report: Ten Reasons to Defend the Corporate Income Tax.

UPDATES 2018 - Tax incentives in mining: minimising risks to revenue, OECD/Intergovernmental forum on mining, minerals, metals, and sustainable development. "Tax incentives are costly, leading many countries to forgo vital revenues in exchange for often illusive benefits. . . there is little … [Read more...]

New study outlines trillions handed out in U.S. corporate welfare bonanza

From Good Jobs First in the U.S., a new study looking at the many and varied grants, tax credits and subsidies harvested by large companies. (Also see our Taxcast interview of Greg Leroy, along with an interview with Kevin Farnsworth, who has done similar work on corporate welfare for the … [Read more...]

Pulling the plug: how to stop corporate tax dodging in Europe and beyond

From Oxfam, a new report whose headline we've copied. As the introduction notes: "Making tax fair is one of the key solutions if we want to tackle the growing problem of inequality. Data from 40 countries shows the potential of well-designed, redistributive taxation and corresponding … [Read more...]

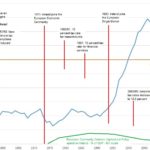

Did Ireland’s 12.5 percent corporate tax rate create the Celtic Tiger?

From the Fools' Gold Blog, a new TJN-backed project on 'competitiveness'. This article has also been cross-posted with Naked Capitalism. Update 2, 2020: New World Bank measures of wellbeing show Ireland lagging significantly behind its major European peers. Update 1, 2019: This issue is explored … [Read more...]

New Expert Global Commission Responds to One-Sided Tax Debate

This press release was put together by a group of organisations including TJN. Expert Global Commission Responds to One-Sided Tax Debate; Inaugural Meeting to drive changes ahead of Post-2015 Ambition Responding to widespread anger about corporate tax avoidance, the impacts of such avoidance … [Read more...]

Event: can low income countries ever tax transnational corporations?

From the Institute of Development Studies: Wednesday 11 March 2015 13:00 to 14:30 IDS, Convening Space Mick Moore will talk as a political realist and Alex Cobham, Research Director of the Tax Justice Network, as a magical realist. About the series Inequalities in various forms have been … [Read more...]