We have just mentioned a demonstration today in Luxembourg, in the context of a visit there by the European Parliament committee tasked with following up on the LuxLeaks affair. (It's known as "The Committee on Tax Rulings and Other Measures Similar in Effect" or TAXE for short.) Christian Hallum … [Read more...]

Taxing corporations

Tax Justice demonstration in Luxembourg as EU tax body visits

Update 2: with a report on the demonstration in Luxemburger Wort, which in contrast to our earlier experiences of Luxembourg media, was quite balanced. Update1 : with a photo (below) of today's protest in Luxembourg. Some 50-60 people are reckoned to have attended, a good turnout … [Read more...]

Do real investors chase corporate tax cuts?

Cross-posted with Fools' Gold. From the Financial Times, a report on a survey by the Tolley Tax Journal of businesses' responses to the UK's policy of savage cuts to the corporate income tax. It's about the UK, but it has wide international relevance. "More than six out of 10 respondents … [Read more...]

The Tax Justice Research Bulletin 1(4)

Corrected: the earlier version referring to a Banque de France Report said "$8bn revenue loss" when it should have referred to an $8bn loss in tax base. The Tax Justice Research Bulletin By Alex Cobham. TJN (April 2015) - The Tax Justice Research Bulletin is a monthly series dedicated to … [Read more...]

Why Gender Equality Requires More Tax Revenue

This is the third post this week on the topic of gender, and to celebrate our arrival in the modern world we have created a new topic page, where you will permanently be able to access news and analysis in this area. Now we're delighted to host a guest blog by Diane Elson, Chair of the UK … [Read more...]

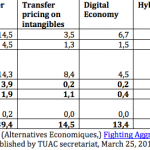

Two new reports challenge the OECD’s work on corporate tax cheating

The OECD, the club of rich countries that dominates international tax, is running a project known as Base Erosion and Profit Shifting (BEPS) which is supposed to fix some of the gaping holes in the international tax system. As we all know, transnational corporations (TNCs) are running rings around … [Read more...]

Why must tax treaties starve developing countries of revenue?

Martin Hearson, who has just been at a parliamentary hearing in Denmark, asks a very good question about tax treaties and developing countries: why exactly is it necessary for them to insist on stiffing developing countries of tax revenue? … [Read more...]

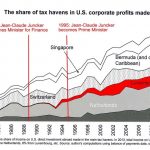

Singapore spin: “we are not a tax haven.” They all say that

From the Twittersphere, our Director of Research: … [Read more...]

The Offshore Wrapper: a week in tax justice #59

Our quirky weekly news round-up from the topsy-turvy world of tax havens. The piratical Duchy of Luxembourg charges journalist over LuxLeaks What does Jean-Claude Juncker think of this? Luxembourg, the country he led for 18 years and steered in the direction of becoming one of Europe's biggest … [Read more...]

Big Pharma companies: extracting wealth from every angle they can find

(Updated with a reference to Google's scary "Patent Purchase Promotion" initiative.) From the Wall St. Journal, a story entitled Pharmaceutical Companies Buy Rivals’ Drugs, Then Jack Up the Prices: "On Feb. 10, Valeant Pharmaceuticals International Inc. bought the rights to a pair of … [Read more...]

Transfer pricing: what developing countries are doing, China edition

Last December Krishen Mehta wrote us a longish article entitled Developing Countries and Tax - Ten Ways Forward. It outlines a series of measures that developing countries can consider as they seek to curb tax cheating by multinational corporations. This blog is really just a pointer to an article … [Read more...]

The Tax Justice Network podcast, April 2015

In the April 2015 Tax Justice Network podcast: How just are our tax systems towards women? A Taxcast chat with award-winning filmmaker Michael Winterbottom, about his new Russell Brand film The Emperor's New Clothes. Plus: one of the US' biggest corporations (and tax avoiders) is repatriating … [Read more...]

The Rumble Down Under: democracy v multinationals in Australia

This is just one part of what one might call the 'mega-capture' of political processes, around the world, by the Big Four accountancy firms. … [Read more...]

Report: a proposal to adopt unitary tax in Israel

From TJN Israel, a new report entitled A Proposal to Adopt a Reform in Taxing Multinational Corporations in Israel - Unitary Taxation. The summary is here, in English, and the longer report, in Hebrew, is here. The report explores why Israel's existing tax regime has difficulties in combating … [Read more...]

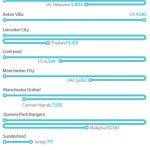

Veblen and Keynes comment on the UK Premier League

We've just written about the new Offshore Game report, covered extensively in The Guardian newspaper, and thought we'd note one of the nice little graphics about offshore ownership that The Guardian has created. … [Read more...]