From ActionAid, another excellent investigation into a corporate tax dodge in Malawi, which on some measures is the world's poorest country: Today [June 17] we’ve released an investigation into an Australian mining company called Paladin, operating in Malawi – the world’s poorest country. We … [Read more...]

Taxing corporations

European Commission half measures will exacerbate profit shifting

17th June 2015 - for immediate release European Commission half measures will exacerbate profit shifting Today’s Action Plan on Fairer Taxation sees the European Commission stall on transparency while giving tax sweeteners to multinational companies … [Read more...]

Corporate tax and the OECD: joint statement to the G20

The BEPS Monitoring Group (BMG), a body supported by TJN and led by TJN Senior Adviser Sol Picciotto, is a civil society body monitoring the OECD's Base Erosion and Profit Shifting (BEPS) project. BEPS is fancy OECD-speak for 'international corporate tax dodging'. The platform has now produced a … [Read more...]

Juncker invites himself to Luxleaks hearing

This blog looks at a report from EurActiv about the so-called Luxleaks probes, which are looking at whether multinational companies using Luxembourg schemes (involving so-called 'tax rulings') violated European rules. Jean-Claude Juncker is not only head of the European Commission, but former … [Read more...]

The Fair Tax Pledge is launched – please add your support and sign

Welcoming the launch of the Fair Tax Pledge - As described by Richard Murphy: The Fair Tax Pledge is a new idea from the Fair Tax Mark, of which I’m a director. The Fair Tax Mark is aimed at those businesses that are run as limited companies but we’ve always known that there are small, … [Read more...]

Are the G7 really suggesting compulsory arbitration on international tax disputes?

Christian Aid sent us this email yesterday, and it's a shocker. Back in 2013, the G7 made some pretty strong commitments to tax justice, and we said then we'd be watching them carefully to see if they'd deliver. Well, on this evidence, they haven't: quite the opposite, in fact. It is worth … [Read more...]

Luxembourg: the campaign on corporate tax has only just begun

From Eurodad: a wonderful sign that people are starting to gear up to challenge the many corporate tax abuses run out of secrecy jurisdictions like the European Dodgy Duchy of Luxembourg. … [Read more...]

TJN in The Economist: on the precious corporate income tax

Recently, we wrote an article welcoming a major intervention by The Economist magazine, which was arguing that rules allowing people and corporations to set interest payments against their tax bills is a historical anachronism whose time has now gone. … [Read more...]

International commission calls for corporate tax reform

When we look back, might today be the day that momentum swung decisively against current international tax rules? An independent commission made up of leading international economists, development thinkers and tax experts (see the graphic) has called for a radical overhaul of international … [Read more...]

Tax Justice Research Bulletin 1(5)

May 2015. Welcome to the fifth Tax Justice Research Bulletin, a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international taxation. This issue looks at a fascinating thesis on the different people and organisations that influence the … [Read more...]

Quote of the day – tax incentives as official tax evasion

This headline may seem odd. Conventionally tax evasion involves cutting taxes by breaking laws; using tax incentives is a different creature altogether: it involves cutting taxes by using the law. But this useful new report from the European parliament contains a twist on the conventional … [Read more...]

Amazon to curb Luxembourg tax schemes: a sign of things to come?

Last Saturday The Guardian broke a story about the U.S. multinational Amazon: "From the start of this month the online retailer has started booking its sales through the UK. . . The group made $8.3bn (£5.3bn) of worldwide sales from British online shoppers but for 11 years all these internet … [Read more...]

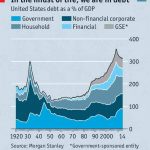

Economist: why it’s time to stop making debt tax-deductible

We've said this before, and we may have felt radical saying it at the time - but now it's The Economist saying it. It has an article entitled and subtitled A senseless subsidy: Most Western economies sweeten the cost of borrowing. That is a bad idea. Quite so. And the potential rewards it … [Read more...]

Farewell, Margaret Hodge

Margaret Hodge, the fiery head of the UK's Public Accounts Committee, has been hauling the bosses of large multinational corporations over the coals for their egregious abuses of the UK tax system. Now, post-election, she is stepping down. Many tax professionals in the UK dislike, hate, or even … [Read more...]

Bill Gates: corporate tax rates at 35% won’t stop the innovators

Via the Fools' Gold blog: A Bloomberg report on a Bill Gates interview: 'Gates scoffed at comparisons linking taxes and regulation to slower growth. “The idea that there’s some direct connection, that all these innovators are on strike because tax rates are at 35 percent on corporations, … [Read more...]