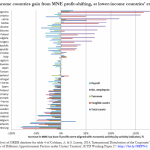

By Alex Cobham. This post was originally published by the Center for Global Development, where I was a research fellow until leaving this month to join TJN as Director of Research. Reproduced, with CGD's permission. Poorer Countries Lose More from Corporate Profit-Shifting Lower-income … [Read more...]

Tax Treaties

Country by country reporting: are the knives already out?

TJN has been pushing for country by country since our launch in 2003, via the concept's designer Richard Murphy. We have made astonishing progress since then: the concept has overcome pretty much all objections and seems on track to be rolled out worldwide. But Joe Stead of Christian Aid has … [Read more...]

Some quotes of the week: don’t sign OECD tax treaties

Via Martin Hearson, who has done a useful new blog on Uganda's tax treaties entitled Uganda’s tax treaties: a legal and historical analysis. The article is by Mr. Hearson (of the London School of Economics) and Jalia Kangave of the East African School of Taxation. For aficionados of tax and … [Read more...]

New reports on OECD and developing countries: progress, but far to go

A couple of days ago the OECD published a document called The BEPS Project and Developing Countries: from Consultation to Participation which has three key elements: first, inviting ten developing countries to participate directly in its Committee on Fiscal Affairs and subsidiary bodies; second, to … [Read more...]

Hidden Profits: The EU’s role in supporting an unjust global tax system 2014

From Eurodad, an important new report, whose press release goes: Hidden Profits: The EU's role in supporting an unjust global tax system 2014 This report – the second in a series of three annual reports – brings together civil society organisations (CSOs) in 15 countries across the EU. Experts in … [Read more...]

Why the Netherlands is the world’s largest source of FDI

Dutch FDI assets in 2012 were even larger than the United States', on some metrics. This guest blog from Francis Weyzig explains what is going on. Why the Netherlands is the world’s largest source of FDI Luxembourg is in the spotlight these days because so many multinationals shift their … [Read more...]

Denmark’s tax treaties: time for change

Tax treaties are international agreements between countries that share out taxing rights between countries when there's cross-border investment between them. The international tax treaty system is strongly based on models created by the OECD, a club of rich countries, and it shouldn't be a great … [Read more...]

Austria’s tax treaties: reducing developing countries’ revenues?

We've written a fair bit about tax treaties in the past few days, and have also updated and slightly expanded our tax treaties page. Now, in the spirit of the week, we offer a guest blog from Martina Neuwirth of the Vienna Institute for International Dialogue and Cooperation (VIDC,) highlighting a … [Read more...]

African low income countries demand fair share of tax

From Tove Maria Ryding at Eurodad, via email: At a media event in Washington last week, finance ministers of francophone low-income countries (DRC and Cameroon) demanded a "fair share of global tax revenues" and a "high-level meeting under UN auspices". … [Read more...]

TJN Africa takes Kenya government to court over Mauritius treaty

Kenya's Star newspaper is reporting that TJN-Africa has gone to the High Court in Nairobi to stop a double tax treaty between Kenya and Mauritius, which is supposed to come into effect in July 2015. Not only do tax treaties with tax havens like Mauritius often allow multinational corporations to … [Read more...]

How Finland’s tax treaties contradict its development policies

Update for tax treaty aficionados: we are reminded that the Vienna Institute for International Dialogue and Cooperation (VIDC) published this study of Austrian tax treaties in April: Austrian Tax Treaties signed with Developing Countries - a Legal and Economic Analysis. From Finnwatch, a report … [Read more...]

Developing countries and tax treaties: learning from mistakes

From Martin Hearson, whom we quoted recently on a related topic: "One big theme from the interviews I conducted on my recent African trip is that tax officials in developing countries are really starting to raise concerns about some of their tax treaties. This is particularly true of treaties with … [Read more...]

Don’t sign OECD tax treaties: the case of Uganda

Update, Dec 9: Martin Hearson adds his own updated analysis of Uganda's tax treaties in a Powerpoint presentation here. A while ago we quoted U.S. tax expert Lee Sheppard excoriating OECD model tax treaties, in a fiery presentation which included such gems as: For multinationals, "there are … [Read more...]

BEPS – minor victories but we risk losing the war

The following are detailed thoughts on the OECD BEPS year one outcomes prepared by friends and colleagues at Eurodad (the European Network on Debt and Development). … [Read more...]

UNCTAD: the time for tax justice has come

A press release about the latest UNCTAD Trade and Development report 2014: "Governments, from rich and poor countries alike, should be able to finance the investment and other public spending required to meet the demands of their citizens for a more prosperous and secure life. Mobilizing domestic … [Read more...]