A new paper by TJN Senior Adviser Sol Picciotto, for the International Center for Tax and Development (ICTD). Summary: This paper explores the issues raised for international tax rules of explicitly treating multinational enterprises (MNEs) as single or unitary firms. It first briefly explains … [Read more...]

Tax Treaties

Mauritius: India cracks down on a major tax evasion route

Update on this story available below on more recent developments India cracks down on a major tax evasion route A guest blog by Abdul Muheet Chowdhary The issue My award winning essay, written for a competition jointly held by the Tax Justice Network and Oxfam International, focused on how … [Read more...]

BEPS Monitoring Group on curbing tax treaty abuses

From the BEPS Monitoring Group, a TJN-backed civil society organisation tasked with monitoring the OECD's so-called "Base Erosion and Profit Shifting" (BEPS) proposals to crack down on international corporate tax avoidance. The (wonkish but important) submission here concerns so-called "non-CIV" … [Read more...]

Switzerland rejects request from Argentina on leaked HSBC accounts

From Argentina's La Nacion newspaper: "Switzerland has denied the Argentine judicial authorities information about 4,000 or so Argentine-owned bank accounts in Switzerland, saying that Argentina's request had no solid foundation." This concerns data revealed by an HSBC whistleblower, Hervé … [Read more...]

Belgian tax treaties cost developing countries millions every year

New report 11.11.11: Belgian tax treaties cost developing countries millions every year A guest blog by Jan van de Poel As a consequence of dozens of unbalanced tax treaties, negotiated by the Belgian government, developing countries miss out on at least 35 million Euros on tax revenues each … [Read more...]

Report: The treaties that cut taxes in poorest countries

New analysis: The treaties that cut taxes in some of the world’s poorest countries A guest blog by Lovisa Möller, ActionAid Today ActionAid releases battery of resources for academics, negotiators and activists that want to know more about the tax treaties that some of the world’s poorest … [Read more...]

Europe’s Anti Tax Avoidance Package: adding fuel to the fire?

The European Commission has announced: "The European Commission has today opened up a new chapter in its campaign for fair, efficient and growth-friendly taxation in the EU with new proposals to tackle corporate tax avoidance. The Anti Tax Avoidance Package calls on Member States to take a … [Read more...]

Links Jan 21

Revenue foregone through tax treaties in context Martin Hearson's Blog Read more on Tax Treaties here. MEPs want companies tax dodges repaid into EU budget euobserver See also: MEPs Say State Aid Probe 'Windfall' Should Be Divvied Up Tax-News Greater tax transparency: Interview with … [Read more...]

New paper: tax treaties a ‘poisoned chalice’ for developing countries

Update, Jan 20: this blog has now been adapted and expanded in a post on Naked Capitalism. In 2013 we published an article entitled Lee Sheppard: Don't sign OECD model tax treaties! which looked at a presentation by one of the U.S.' top experts in international tax. Her fiery presentation … [Read more...]

New website shows European countries that facilitate tax cheating

PRESS RELEASE FROM SOMO: Mapping Tax-free investments New interactive website shows which European countries facilitate tax dodging through mailbox companies. Today, the Centre for Research on Multinational Corporations (SOMO) launches a new interactive website that visualises bilateral … [Read more...]

New report: tax treaties in sub-Saharan Africa

Via Martin Hearson's website, here is a new report he authored for Tax Justice Network-Africa. As Hearson says, it’s based on field research done a year ago and has been a little while getting into print. Here’s a link to read it online at academia.edu Here’s a link to download the PDF Among many … [Read more...]

Still Broken: major new report on global corporate tax cheating

Update, Dec 7, 2015: a new paper in the Journal of World Business, which contains this: "Home country statutory corporate tax rates have a small impact on tax haven use. In general, corporate tax rates are an important factor in driving MNEs to set up tax haven subsidiaries. However, … [Read more...]

Fifty Shades of Tax Dodging: how EU helps support unjust global tax systems

A major new report written by civil society organisations in 14 countries across the EU, co-ordinated by Eurodad. Fifty Shades of Tax Dodging: the EU's role in supporting an unjust global tax system … [Read more...]

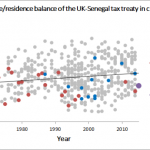

Will civil society shake up the world of tax treaties?

When a multinational company makes a cross-border investment, the relevant tax treaty between the two countries will generally sort out which country gets to tax which part of the ensuing activity and income streams. (Read more about tax treaties here.) A key question is this: how do the ensuing … [Read more...]

What will BEPS fix, and who will gain?

A guest blog by Sol Picciotto, co-ordinator of the BEPS Monitoring Group. What will BEPS fix, and who will gain? The launch this week of the final reports from the G20/OECD project on Base Erosion and Profit Shifting (BEPS) has sparked two frequently asked questions. The first is: can we give … [Read more...]