From Finance Uncovered, a TJN-founded project, a press release about a story that is (among other things) front page of South Africa's influential Mail & Guardian newspaper. Finance Uncovered reveals how Africa’s biggest cell phone firm shifts billions offshore The Finance Uncovered global … [Read more...]

Tax and corporate responsibility

New Christian Aid poll: 70% believe ‘legal’ tax avoidance is wrong

From Business World in Ireland: "Only 36% of people trust multinational companies to provide accurate tax information, while 70% believe multinational tax avoidance schemes to be morally wrong even if they are legal according to a new . . . survey, conducted on behalf of the charity Christian … [Read more...]

UK Prime Minister Cameron told: stop Jersey-registered shell company suing Romania in ‘corporate court’

A letter (see below) to the UK prime minister signed by TJN and other global justice campaign organisations, calls on David Cameron to stop a Canadian mining company using a Jersey ‘subsidiary’ to sue Romania for halting toxic gold mine, and warns that such cases will balloon under the proposed … [Read more...]

Luxembourg: the campaign on corporate tax has only just begun

From Eurodad: a wonderful sign that people are starting to gear up to challenge the many corporate tax abuses run out of secrecy jurisdictions like the European Dodgy Duchy of Luxembourg. … [Read more...]

TJN in The Economist: on the precious corporate income tax

Recently, we wrote an article welcoming a major intervention by The Economist magazine, which was arguing that rules allowing people and corporations to set interest payments against their tax bills is a historical anachronism whose time has now gone. … [Read more...]

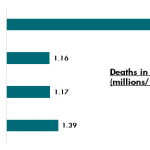

World No Tobacco Day: Marching to Big Tobacco’s tune?

Cross-posted with the Uncounted blog, by TJN's research director Alex Cobham. World No Tobacco day was on Sunday (yesterday.) World No Tobacco Day: Marching to Big Tobacco’s tune? Has World No Tobacco Day 2015 – this Sunday – been manipulated by Big Tobacco’s lobbying agenda? Where the tobacco … [Read more...]

The other FIFA scandal: poor countries and the tax-free bubble

We've just written about the role of Goldman Sachs in distorting U.S. sports and harming smaller players via tax cheating. Well, here is yet another thing to make you choke on your cornflakes: FIFA hurting poor countries though what we'd describe as aggressive, idiosyncratic tax cheating. … [Read more...]

Amazon to curb Luxembourg tax schemes: a sign of things to come?

Last Saturday The Guardian broke a story about the U.S. multinational Amazon: "From the start of this month the online retailer has started booking its sales through the UK. . . The group made $8.3bn (£5.3bn) of worldwide sales from British online shoppers but for 11 years all these internet … [Read more...]

Auditor rotation: the new merry-go-round

From Prof. Prem Sikka, via email: "Auditing itself has become one of the biggest frauds of modern times. When was the last time company auditors drew attention to fiddles, tax dodging, money laundering or their own complicity in financial misdemeanours? The penalties for delivering duff audits, … [Read more...]

Tax Justice demonstration in Luxembourg as EU tax body visits

Update 2: with a report on the demonstration in Luxemburger Wort, which in contrast to our earlier experiences of Luxembourg media, was quite balanced. Update1 : with a photo (below) of today's protest in Luxembourg. Some 50-60 people are reckoned to have attended, a good turnout … [Read more...]

Why Gender Equality Requires More Tax Revenue

This is the third post this week on the topic of gender, and to celebrate our arrival in the modern world we have created a new topic page, where you will permanently be able to access news and analysis in this area. Now we're delighted to host a guest blog by Diane Elson, Chair of the UK … [Read more...]

How do tax wars affect women?

Cross-posted from Fools' Gold: From the Association for Women's Rights in Development, a post related to a landmark meeting in Lima on tax justice and human rights: "The current “race to the bottom” in which tax competition among developing countries takes place to attract corporate and … [Read more...]

Lima: TJN director Christensen speech on tax justice and human rights

From John Christensen, TJN's director, a speech about tax justice and human rights. It begins like this: "Why the tax justice movement should embrace human rights. And vice versa The history of economic and social rights in most countries can be discovered in their tax codes. Tax is at the … [Read more...]

Shareholder value and the fiduciary duty of company directors: a view from Israel

This is our second Israel-related blog in the past week. From TJN-Israel and the Corporate Responsibility Institute at the College of Law and Business, a new report looking at a subject dear to our hearts: whether or not company directors are bound by their fiduciary duties to avoid tax. … [Read more...]

Big Pharma companies: extracting wealth from every angle they can find

(Updated with a reference to Google's scary "Patent Purchase Promotion" initiative.) From the Wall St. Journal, a story entitled Pharmaceutical Companies Buy Rivals’ Drugs, Then Jack Up the Prices: "On Feb. 10, Valeant Pharmaceuticals International Inc. bought the rights to a pair of … [Read more...]