In this new brief just published by the Sheffield Political Economics Research Institute authors John Mikler and Ainsley Elbra address the issue of global corporate tax avoidance and consider how multinational corporations can be made to pay their fair share of tax. … [Read more...]

Corporate Tax

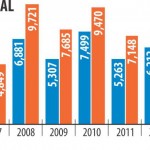

Estimates on illicit flows to and from developing countries

Our friends at Global Financial Integrity have released their latest report on what they estimate to be the latest figures from 150 countries on illicit financial flows to and from developing countries for the period 2005-2014. Most of these flows arise from fraudulent trade mis-invoicing which, as … [Read more...]

Do you want to know how much tax multinational companies pay?

Yes, so would we... And now there's an action today on twitter which we can all take to help this become reality. All EU banks have been obliged to report their profits and tax paid on a country by country basis since 2015. And not just to tax authorities behind closed doors, but publicly. Because … [Read more...]

President Trump visits La-La-Laffer Land

Taken as a whole, the tax plans just announced by US President Donald Trump, which include abolition of the inheritance tax, could represent the largest tax cut for billionaires and millionaires in US history. According to the President, this will stimulate growth and job creation. There's no … [Read more...]

Australian beer drinker tax vs the world’s biggest gas companies

Is it fair that Australians pay more tax on one beer than the oil and gas industry pays in petroleum tax on offshore gas in a year? Might a 10% royalty guaranteeing annual revenue of between $1.3 billion and $2.8 billion be a better way to go? These are the issues rightly raised by a report just … [Read more...]

Tax haven blacklisting in Latin America

As governments (slowly) get to grips with the fact that tax havens are inflicting great harm on economies and democracies across the globe, facilitating mega amounts of tax dodging, and vast movements of criminal money by way of the secrecy services some of them offer, the question of our times is … [Read more...]

Estimating tax avoidance: New findings, new questions

By Alex Cobham There are now a range of estimates of the global scale of tax avoidance. These include: the $600 billion annual tax loss estimated by IMF researchers Crivelli et al. (2015; 2016), which divides roughly into $400 billion of OECD losses and $200 billion elsewhere; the $100 … [Read more...]

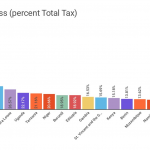

New estimates reveal the extent of tax avoidance by multinationals

New figures published today by the Tax Justice Network provide a country-level breakdown of the estimated tax losses to profit shifting by multinational companies. Applying a methodology developed by researchers at the International Monetary Fund to an improved dataset, the results indicate global … [Read more...]

Links Mar 17

The problems with measuring tax systems SPERI 'In debates about tax policy we need to de-emphasise the role of economics and measurement and rekindle the politics'. Blog by TJN's Nicholas Shaxson, author of Treasure Islands: Tax Havens and the Men Who Stole the World. Re-framing tax spillover … [Read more...]

Links Mar 13

Corporate taxation key to protecting human rights in the global economy CESR UN urges US to not exploit American Samoa The Guam Daily Post 'The United Nations has "strongly urged" the United States to refrain from using American Samoa as, among other things, a tax haven'. A significant shift? … [Read more...]

Links Mar 10

Public Beneficial Ownership Registries- A Shot In The Arm In The Fight Against Illicit Financial Flows Financial Transparency Coalition European Parliament takes on financial crime with tough proposals Sven Giegold More evidence in the case against Luxembourg FT Alphaville … [Read more...]

Links Mar 9

Taxes & Women's Rights? Global Alliance for Tax Justice See also: Happy International Women’s Day wrapup We managed tax transparency in Pakistan. Why not everywhere else?The Guardian By Umar Cheema. See Politicians and their tax returns: a new project from Finance Uncovered MEPs vote to … [Read more...]

The OECD – penalising developing countries for trying to tackle tax avoidance

The OECD’s new terms of reference to assess the implementation by countries of BEPS Action 13 related to Country-by-Country Reports (CbCR) may penalise countries, especially developing ones, that try to obtain by their own means the CbCR’s valuable data needed to tackle multinational tax … [Read more...]

Links Mar 3

Trusting the Process Kleptocracy Initiative KleptoCast interview with TJN's Andres Knobel about how trusts became the next frontier in dodging taxes and shielding assets Panama Papers: European Parliament tax avoidance fact-finding mission in Luxembourg Luxemburger Wort See also: MEPs’ mission to … [Read more...]

Links Mar 1

Book Review: Capital Without Borders: Wealth Managers and the One Percent by Brooke Harrington LSE Blogs "... an important work for our increasingly unequal world". - Listen to an interview with Brooke Harrington in our December 2015 podcast MP's from Africa and Asia pledge to collaborate in … [Read more...]