The International Advisor magazine has just reported: "Guernsey chief minister Peter Harwood resigned today, in the wake of publication of a critical article in the current issue of the British satirical and investigative publication, Private Eye." This refers to an excellent report entitled … [Read more...]

Corporate Tax

Fashion retailer’s tax dodges boost European inequality

Bloomberg tax star Jesse Drucker has another fine article out about the Spanish retailer Inditex, the parent of high street retail giant Zara. We would urge you to read it. Among many other things, it contains: "In the past five years, Inditex has shifted almost $2 billion in profits to a tiny … [Read more...]

Report: the Sorry State of U.S. Corporate Taxes, 2008-2012

A major new report from the indefatigable Citizens for Tax Justice in the U.S. The Executive Summary begins: The Sorry State of Corporate Taxes What Fortune 500 Firms Pay (or Don’t Pay) in the USA And What they Pay Abroad — 2008 to 2012 … [Read more...]

Links Feb 24

G20 Committed To 'Global Response' To BEPS Tax-News See also: G20 Agrees on Automatic Tax Data Sharing, OECD Says Bloomberg, and Multinationals unfazed by G20 tax crackdown The Conversation … [Read more...]

Links Feb 21

Members of the European Parliament take their first step to curb corporate secrecy and phantom firms Eurodad See also: MEPs vote to name trust beneficiaries in public registries STEP … [Read more...]

Links Feb 20

What Russian money sloshing back to Cyprus teaches us about tax havens Quartz "Building a financial system to serve foreign clients first doesn’t necessarily improve a country’s fiscal condition, as fiscal collapses in places like the Caymans have shown before." See also this months Taxcast … [Read more...]

The Fair Tax Mark – coming to the UK

Richard Murphy and Ethical Consumer today launch the Fair Tax Mark: "The world’s first independent accreditation scheme to address the issue of responsible tax." … [Read more...]

Links Feb 18

Tax evasion controversy shifts east swissinfo See also our blog on the failed Swiss "Rubik" deals. … [Read more...]

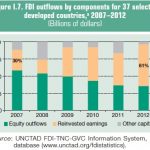

Foreign investment – smaller than you might believe

From Jesse Griffiths, Eurodad, with permission. Foreign investment – much smaller than you might believe You may have seen that foreign direct investment (FDI) was judged last month to have finally regained pre-crisis levels, and that a record percentage of all FDI – 52% - went to developing … [Read more...]

Links Feb 17

Tax havens: 'Why do we tolerate this?' devex Interview with Eva Joly, chair of the Committee on Development at the European Parliament … [Read more...]

Links Feb 14

Tackling tax evasion: First Standard Automatic The Economist See also: Global tax standard attracts 42 countries Financial Times (paywall) - reports cite TJN's response to the new OECD report on automatic information exchange … [Read more...]

New TJN briefing: OECD’s BEPS project for developing countries

TJN is pleased to publish a new briefing paper looking at the implications for developing countries of the OECD's widely referenced Base Erosion and Profit Shifting (BEPS) project, which is designed to find ways to tackle the deficiencies in the international tax system. It is available in English … [Read more...]

France’s CAC 40: over 1500 tax haven affiliates

From Le Monde: "The corporations in the CAC 40 [France's benchmark stock exchange index of the 40 biggest French stocks] have over 1,500 affiliates in tax havens, according to a study published on Thursday by the journal Project . . . cross-checked with authoritative studies data (the work of the … [Read more...]

Links Feb 13

OECD takes aim at tax anomalies across borders Irish Examiner OECD head Ángel Gurría said: "... the options are simple: If you cannot tax the big guys you are left with the little guys and middle class to tax, and even if you tax them up to their noses, it won’t be enough. And then politics … [Read more...]

Links Feb 12

BVI Considers Tough Prison Sentences For DataLeaks ICIJ Google Take Down Stuart Syvret Blogspot Rico Sorda "The Jersey oligarchs and their protectors in London think that they can do what no corrupt regime around the world had been able to do – and keep embarrassing exposures about them off the … [Read more...]