'Yanukovych Leaks' documents abuse of office DeutscheWelle Presidential residence owned by an Austrian company, which in turn was owned by a British firm, that was controlled by a trust in Liechtenstein. ' "If Yanukovych had run his country's affairs like he did his private life in Mezhyhirya, we … [Read more...]

Corporate Tax

Links Mar 14

Money laundering: Own up, owners The Economist Insight into the status and potential of beneficial ownership transparency, following this week's European Parliament vote "to back open registers for companies, trusts, foundations and practically any other corporate vehicle or legal arrangement that … [Read more...]

Tax Haven Free: new international network for tax haven free local governments

A while ago we wrote about efforts by French regions and councils to take action against tax havens. Other initiatives, elsewhere, have been bubbling up too. Now, from the newly created Tax Haven Free, an international network to encourage local governments to cut out tax havens from their … [Read more...]

Report: US government’s vast interest payments to tech giants on their offshore billions

From the Bureau of Investigative Journalism: "The US government makes vast interest payments to technology giants including Apple and Microsoft on the billions of dollars they shelter from tax offshore. A trawl of Securities & Exchange Commission (SEC) disclosures shows that Apple, … [Read more...]

US multinationals’ offshore cash piles grow $206bn

From Bloomberg: "The largest U.S.-based companies added $206 billion to their stockpiles of offshore profits last year, parking earnings in low-tax countries until Congress gives them a reason not to. … [Read more...]

Links Mar 11

European Parliament gives overwhelming ‘yes’ vote to end secret corporate ownership Eurodad See also: MEPs vote for public registers on company ownership European Voice - But, UK Prime Minister does not want the rules applied to trusts … [Read more...]

Links Mar 7

Swiss parliament relaxes terms for tax data exchange swissinfo "Parliament has approved a legal amendment that tax evaders will not always have to be told if Switzerland sends information about them to other countries." But to what extent is this just lip-service? How do trusts, foundations and … [Read more...]

IMF launches consultation on tax ‘spillover’

In a welcome step, the International Monetary Fund has announced it will be researching the consequences of existing and proposed changes to corporation tax regimes for lower income "source" countries. … [Read more...]

Links Mar 4

Black money: Switzerland refuses to share information on bank account holders, Delhi mulls strong response The Economic Times India, US to intensify cooperation in tax evasion cases The Economic Times … [Read more...]

UK healthcare and foreign aid: the links

From the UK-based Centre for Health and the Public Interest: "Those investigating the persistence of poverty in developing countries and those struggling to sustain high quality health care in the UK have more in common than we think." Why? Well, read on. … [Read more...]

Links Feb 28

Kenya: Tax Holidays Abused, Says NGO allAfrica Why Isn’t Africa’s Economic Growth Benefiting The Poor? Atlanta BlackStar … [Read more...]

Tax justice and modern-day colonialism: Areva vs. Niger

From Reuters, an excellent Special Report: "Niger has become the world's fourth-largest producer of the ore after Kazakhstan, Canada and Australia. But uranium has not enriched Niger. The former French colony remains one of the poorest countries on earth." … [Read more...]

Survey: the corporate tax debate is biting the corporations

From tax advisers Taxand, who have just conducted a global survey of corporate Chief Finance Officers (CFOs): 76% of survey respondents said that the exposure in the media of corporate tax planning activity has a detrimental impact on a company’s reputation 31% said that the intense media … [Read more...]

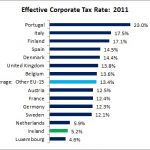

Read our lips: Ireland is a tax haven. Part xxvi

From Unite, Ireland (via Tax Research), a nice little graph showing effective corporate tax rates in Europe. We haven't seen this one before. Ireland, the Netherlands and Luxembourg - the Eurozone's three most notorious tax havens - are the clear abusers. … [Read more...]

Credit Suisse: industrial scale corruption in Switzerland

From The Guardian: "Senators Carl Levin and John McCain had harsh words for the Justice Department and the Swiss government, too, as they released a 178-page permanent subcommittee on investigation (PSI) report into offshore tax avoidance. … [Read more...]