The new Dutch government is to announce that it will cut its corporate tax rate according to leaked details of the current round of coalition talks. This move is the equivalent to the country jumping into the race to the bottom pool with both feet. We've always highlighted the false narrative … [Read more...]

Corporate Tax

Interest deductions and tax avoidance – will BEPS solve the problem?

New rules to prevent corporations using debt and interest payments to lower their taxbills have been one of the outcomes of the OECD BEPS programme. However, how effective are these rules? And is the new debt cap proposed by the OECD likely to have any impact at all? Earnings stripping and … [Read more...]

European Commission orders Luxembourg to claim back 250 million in taxes from Amazon – TJN Reaction

There are two very welcome pieces of tax justice news today. Firstly, the European Commission has ordered the tax haven of Luxembourg to recover 250 million euros in taxes from Amazon, finding that the benefits extended to the company amount to illegal state aid. The support Amazon received, allowed … [Read more...]

Beginning of the end for the arm’s length principle?

The European Commission has released a statement which could well signal the beginning of the end for the OECD’s international tax rules, and the arm's length principle on which they are based. The current rules, which date to decisions taken at the League of Nations in the inter-war years, are … [Read more...]

KPMG and the false objectivity of the ‘Big Four’

This is cross-posted from Huffington Post, South Africa. It's time to recognise the big four firms for what they are - or we'll continue getting stung, says economist and Chief Executive of the Tax Justice Network, Alex Cobham. And so another international firm providing 'professional services' … [Read more...]

New UN tax handbook: Lower-income countries vs OECD BEPS

The UN has just released an updated edition of its United Nations Handbook on Selected Issues in Protecting the Tax Base of Developing Countries. While technical in style and cautious in approach, the UN tax handbook identifies a range of issues in which the OECD's Base Erosion and Profit Shifting … [Read more...]

New Job Openings at TJN: Researcher (African Hub, franco- & anglophone)

Tax Justice Network is recruiting two Africa-based researchers for our Financial Secrecy and Tax Advocacy in Africa (FASTA) project, which the Norwegian Agency for Development Cooperation (NORAD) intends to support. … [Read more...]

Open data for tax justice – designing a new CbCR database

This week, TJN participated in a design sprint in London organised by Open Knowledge International. The purpose of the sprint was to bring together coders and tax justice advocates to start work on building a database for the new country by country reporting data that we hope will be released in … [Read more...]

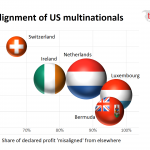

RB tax avoidance – company calls for public country by country reporting after Oxfam report reveals profit shifting

Oxfam has today released a report on tax dodging by RB, the company formerly known as Reckitt Benckiser and the maker of thousands of well known household products. The report looks at the 2012 restructuring of the company which saw it set up ‘hubs’ in the Netherlands, Dubai and Singapore, all … [Read more...]

Half measures mean Mauritius will continue to be a tax haven for the developing world

There was news this week that Mauritius has signed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI). This is an initiative from the OECD to allow countries to take measures designed to stop tax avoidance by multinational companies … [Read more...]

UN must defend target to curtail multinational companies’ tax abuse

The Tax Justice Network, The Independent Commission for the Reform of International Corporate Taxation, and the Global Alliance for Tax Justice call on the UN Secretary General to make sure the commitment to action on tax abuses by multinational companies remains part of the new UN Sustainable … [Read more...]

EU Parliament multinational transparency vote introduces ‘commercial confidentiality’ loophole

Yesterday the European Parliament held a crucial tax justice vote on making multinational companies with an annual net turnover of 750 million euros and above publicly report their activities, structures and tax payments on a country-by-country basis. That would mean no more secrecy around those … [Read more...]

New multilateral instrument to limit damage done by tax treaties

Today sees the signing ceremony of a new multilateral instrument (MLI) to limit the extent to which bilateral tax treaties create the conditions for large-scale multinational tax avoidance. The OECD's Pascal Saint-Amans told the Financial Times (£) that "treaty shopping will be killed". Treaty … [Read more...]

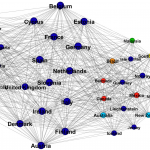

Public country-by-country reporting: it’s not about costs or trade secrets

A guest blog authored by Matti Ylonen [University of Helsinki and Aalto University Business School]. The European Parliament is currently debating a proposal for public country-by-country reporting (CBCR), and the vote was recently postponed to later in June. Under the original proposal of the … [Read more...]

Developing countries’ access to CbCR: Guess who’s (not) coming to OECD dinner

It's said that if you're not at the table, you're on the menu. Well, the OECD has just made available the list of activated relationships to automatically exchange country-by-country reports between countries. They use big figures like 700 relationships, but don’t get fooled by those numbers - … [Read more...]