The political capture of rich countries in the fight against tax havens Oxfam France (In French) Ahead of the OECD's annual Forum in Paris, launch of a new report Arrangements Between Friends: Flaws in the OECD's Plan of Action Against Tax Havens India: Finance Minister Chidambaram warns … [Read more...]

Corporate Tax

Report: better tax rules could boost developing country corporate tax revenues by 100%

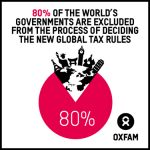

A new report from Oxfam, entitled BUSINESS AMONG FRIENDS: Why corporate tax dodgers are not yet losing sleep over global tax reform. It begins like this: "Tax dodging by big corporations deprives governments of billions of dollars. This drives rapidly increasing inequality. Recent G20 and OECD … [Read more...]

Links May 1

Credit Suisse unit draws US tax scrutiny swissinfo "For years, Credit Suisse used a secondary Swiss banking brand, Clariden Leu, to woo clients who wanted a smaller, more personalised experience. Now, its decision to keep that little-noticed unit separate has become an issue in the long-running … [Read more...]

New Germany-UK tax treaty undermines OECD tax reforms

A little-noticed new protocol to the Germany-UK tax treaty needs dragging into the daylight, since it appears to be a sneaky effort to undermine reforms by the OECD, the club of rich countries that oversees the international tax system. … [Read more...]

Stop press: large U.S. multinational decides to pay some tax

As expert after expert - and citizen after citizen - agrees: the international tax system is broken. Multinational corporations run rings around even the most sophisticated and well-resourced tax authorities, producing democracy-killing results such as the fact that General Electric paid a minus 11 … [Read more...]

Links Apr 30

Credit Suisse, BNP Paribas U.S. Charges Said to Be Weighed Bloomberg Businessweek "Prosecuting the companies would break with a past practice of brokering settlements with large banks that are considered integral to the financial system." See also: Two Giant Banks, Seen as Immune, Become Targets … [Read more...]

Links Apr 29

India: Govt refuses to name account holders in tax haven despite Supreme Court order The Times of India "Why is the government reluctant to share the names of Indian tax evaders having accounts in LGT Bank in Liechtenstein with the Supreme Court even when it amounts to contempt of court?". See … [Read more...]

Pfizer and Astrazeneca merger shows US and UK both lose from UK’s predatory tax regime

Update: see this must-read post from Citizens for Tax Justice in the U.S., entitled Why Does Pfizer Want to Renounce Its Citizenship? From Tax Research UK: "The financial press is full of stories about Pfizer this morning, and its planned takeover of Astrazeneca. A recurring theme is the tax … [Read more...]

Links Apr 28

International community continues making progress on tax transparency OECD Global Forum on Transparency and Exchange of Information for Tax Purposes issues 12 new reports. See here for background and resources on Information Exchange Bahamas claims FATCA exemption for foundations STEP "The … [Read more...]

The Offshore Wrapper: A week in Tax Justice

The Offshore Wrapper is written by George Turner "In Formula One, everyone cheats. The trick is not to get caught." … [Read more...]

Publicis and Omnicom: a merger driven by tax abuse?

Reuters is carrying a fascinating story with a less than fascinating headline: "Push for tax-avoidance curbs in G-20 threatens Publicis-Omnicom deal." Last July Paris-based Publicis and New York-headquartered Omnicom announced plans to merge to create the world's biggest advertising group, which … [Read more...]

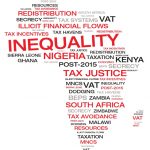

New report: Inequality, Tax and a Rising Africa?

From Tax Justice Network for Africa and Christian Aid, a new report entitled Africa rising? Inequalities and the essential role of fair taxation. It investigates income inequality in Ghana, Kenya, Malawi, Nigeria, Sierra Leone, South Africa, Zambia and Zimbabwe: there has been little definitive … [Read more...]

Links Apr 25

UK Prime Minister's letter to the Overseas Territories on beneficial ownership See also: Transparency call to 'tax havens' The Courier, recent TJN Blog On Britain’s new honesty box for corporate fraudsters, and Turks and Caicos Islands Considers Public Beneficial Ownership Register Tax-News … [Read more...]

PWC survey: most CEOs back country by country reporting

From Reuters: "Most chief executives globally would support the publication of country-by-country financial information to help stamp out corporate tax avoidance, a survey showed on Wednesday. … [Read more...]

Links Apr 24

India to provide info on US tax evaders Business Standard "However, US refuses to share data on foreign assets of Indian entities" … [Read more...]