US senators say more needs to be done after Credit Suisse conviction The Guardian See also: Credit Suisse Seen Keeping U.S. Bank License Bloomberg video - talks of the penalty being "political card playing", in that Credit Suisse are seen to be punished but they are still continuing as a bank in … [Read more...]

Corporate Tax

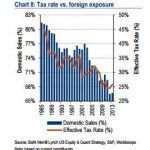

Tax chart of the day: US taxes

We've just blogged Citizens for Tax Justice's latest report on U.S. Fortune 500 companies and their unpaid taxes. Now, from the Financial Times, a chart. … [Read more...]

CTJ: U.S. Fortune 500 companies likely escaping $550bn in tax

From Citizens for Tax Justice: "American Fortune 500 corporations are likely saving about $550 billion by holding nearly $2 trillion of “permanently reinvested” profits offshore. Twenty-eight of these corporations reveal that they have paid an income tax rate of 10 percent or less to the … [Read more...]

Links May 22

Finnwatch report on tax responsibility of Finnish Pension Fund investments Report finds that Finnish pension funds tend to ignore global tax responsibility issues related to their investment activities. (Report in Finnish, with English language executive summary) Special Report: Under pressure, … [Read more...]

Why did the Australian government keep this tax symposium secret? (updated)

May 26: Updated with new details from the Sydney Morning Herald This concerns a meeting in Tokyo, hosted by the Australian Treasury, to discuss the G20's tax agenda. This involves not just the OECD's "BEPS" project to reform the international rules for taxing multinational corporations, but also … [Read more...]

Links May 20

DoJ Does Victory Lap on Credit Suisse Guilty Plea on Single Criminal Charge naked capitalism Very important insights. See also Credit Suisse escapes worst as it pleads guilty to U.S. charges Reuters - New York regulator decides not to revoke the bank's license, and top management stay in place, … [Read more...]

Hedge funds versus tax collectors: quote of the day

From U.S. tax professor Victor Fleischer, in an article looking at how hedge funds and their managers use Bermuda reinsurance vehicles for their tax shenanigans: "The chess match between tax collectors and fund managers will continue. The top 25 hedge fund managers have one advantage, though. … [Read more...]

Report: Switzerland’s role in Shell’s tax avoidance

From SOMO in the Netherlands: "There is not one drop of oil coming out of the Swiss mountains, but still Royal Dutch Shell has eight subsidiaries in Switzerland. Between 2001 and 2005 the Dutch-British oil multinational set up a range of subsidiaries in the country, although these entities are not … [Read more...]

The Offshore Wrapper: a week in tax justice

The Offshore Wrapper is written by George Turner Credit Swindle? "We were running a criminal enterprise, but we didn't know," is what reportedly Credit Suisse will soon admit in its long running dispute with the United States Justice Department over alleged involvement in assisting US … [Read more...]

Links May 19

Joining the Club: The United States Signs Up for Reciprocal Tax Cooperation Center for Global Development New Zealand: the Shell Company Incorporation Franchises (II) (and Ukraine) naked capitalism … [Read more...]

Mining for Gold: tax justice film

We are delighted to provide a short tax justice film covering the Tax Justice Network seminar on transfer pricing held in Dar es Salaam, Tanzania, last October. The full range of presentations are linked below the film, and will be permanently stored on our Transfer Pricing site. … [Read more...]

Vodafone subvertisement: taxes are for people, not for massive corporations

South Africa’s diamond companies: $11m royalties on $1.73bn of production

From 100 Reporters, an article about a major report from the University of Manchester, which is a fascinating case study in transfer pricing. The article begins: "At every step, from mine to ring finger, South Africa’s diamond industry is benefitting from royalty and export tax structures riddled … [Read more...]

Quote of the day – Google’s tax avoidance

From Domini Social Investments LLC, a corporate pioneer in the area of tax and social responsibility, which recently submitted a shareholder resolution to Google merely to adopt a set of principles on paying tax. The quote goes: "Investors should be asking Google and other multinationals to adopt … [Read more...]

Links May 15

Companies fear BEPS “tax chaos” Economia See also: Global business tax clamp-down could sting U.S. -IRS official Reuters - Is the U.S. undermining the interests of developing countries? See TJN Briefing on BEPS here and information on The BEPS Monitoring Group here. … [Read more...]