As we've documented, the United Kingdom plays a central - if not the central - role in the modern global system of offshore tax havens, or secrecy jurisdictions. Now here's a post from ActionAid, looking at (yet) another aspect of all this. Cross-posted, with permission. Tax dodging and the … [Read more...]

Corporate Tax

Tax, corporate responsibility and human rights: new paper

From the Boston University Law Review, a paper by Jasmine Fisher entitled Fairer Shores: tax havens, tax avoidance and corporate social responsibility. Its introduction contains this: "The doctrine of corporate social responsibility provides a logical rationale for multinational corporations to … [Read more...]

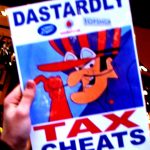

Alliance Boots: tax cheats

BOOTS AVOIDING TAXES RISKS PUBLIC HEALTH JOIN WAR ON WANT, UNITE, MEDACT AND CHANGE TO WIN TO PROTEST BOOTS’ TAX AVOIDANCE AND ITS IMPACTS ON PUBLIC HEALTH … [Read more...]

Links Jun 6

EU to Decide Next Week on Irish, Dutch Tax-Breaks Probe Bloomberg UK fails to block proceeds of corrupt Nigerian oil deal Global Witness See also: UK leads charge in some key battles against corruption – now others must follow Global Witness … [Read more...]

Links Jun 5

The World's Movement Toward Tax Transparency Bloomberg BNA Even the Weak Anti-Abuse Measures Contemplated by OECD Are Too Much for Republican Tax Writers Citizens for Tax Justice See also: Republicans Join Business in Warning on Global Tax Talks Bloomberg, and addressing spin in Developing … [Read more...]

Links Jun 4

Anonymous Shell Companies Are Part of the Problem, Too: Often Used to Inject Dark Money Into Campaigns FACT Coalition New Zealand: the Shell Company Incorporation Franchises (V) (and Panama and Switzerland) naked capitalism … [Read more...]

Links Jun 3

The BEPS Monitoring Group: Submission on Hybrid Mismatch Arrangements Mauritius agrees to treaty revision with India STEP See also: India and Mauritius to Begin Automatic Exchange of Tax-Related Information India Briefing … [Read more...]

Almost all Spanish multinationals use tax havens – Report

Via The Guardian: "Almost all of the 35 companies listed on the Spanish stock exchange use tax havens, according to a report from Observatorio RSC, an organisation that monitors corporate social responsibility. The figures, based on company reports for 2012, show a 31.9% increase in the use of tax … [Read more...]

Directors’ duties and tax avoidance: a view from the U.S.

Last year we obtained a legal opinion from Farrer's & Co which concluded that it was not possible to construe a director's duty to maximise benefits to a company to include a positive duty to avoid tax. This opinion has helped to nail the urban myth (widely propagated by tax planners to their … [Read more...]

Tax haven Britain: Boots Alliance and the use and abuses of Limited Liability Partnerships

Last year our friends at War on Want published a report revealing that Boots the Chemists - a fixture of most U.K. high streets - had dodged over £1 billion in the six preceding years since it was taken over by the Alliance group. War on Want have now sent a letter to HM Revenue and Customs (which … [Read more...]

In 2009-10, over 98 pct of Google’s and Oracle’s subsidiaries disappeared

. . . disappeared from view, that is. From the Social Science Research Network, an academic paper from last year: "From 2009 to 2010, 98 percent of Google’s and 99 percent of Oracle’s subsidiaries disappeared from the Exhibit 21s filed with their SEC Form 10Ks. However, a March 2012 search of … [Read more...]

Links May 29

OECD BEPS Webcast Update See the TJN briefing on BEPS here. Rather than write them off, developing countries should be included in new information exchange system Thomson Reuters India PM Modi government sets up special team to probe black money in tax havens VCCircle See also: SIT on Black … [Read more...]

Stiglitz: how to use tax to build an economy

Nobel Laureate Joseph Stiglitz has just published a White Paper with the Roosevelt Institute entitled Reforming Taxation to Promote Growth and Equity. It is a fascinating and clear piece of work, distilling a number of powerful tax principles - and it includes a section on formula apportionment (or … [Read more...]

Quote of the day: fiduciary duties

From Adam Kanzer of Domini Social Investments, in an article regarding a recent Google shareholder vote seeking the adoption of a responsible code of conduct to guide the company's global tax strategies: "Imagine a legal obligation, based on principles of prudence and loyalty, that compels us to … [Read more...]

The Offshore Wrapper: a week in tax justice

The Offshore Wrapper is written by George Turner Ireland is not a tax haven Michael O’Leary is the opinionated, controversial chief executive of Dublin-based low cost airline, Ryanair. In typical forthright style, O’Leary believes Ireland “has been unfairly singled out” as a tax haven for … [Read more...]