In the August 2018 Tax Justice Network monthly podcast/radio show, the Taxcast: Why are so many Bermudians leaving their beautiful island? And why have inequality levels become so extreme despite it's huge offshore services centre? We speak to Bermudian economist Robert Stubbs and hear from … [Read more...]

Corporate Tax

Blacklist, whitewashed: How the OECD bent its rules to help tax haven USA

We’ve criticised for years the farcical nature of ‘tax haven’ blacklists, whether EU or OECD ones. They all turn out to be politicised, misleading and ineffective. If you want an objectively verifiable ranking you need look no further than the Tax Justice Network’s Financial Secrecy Index. But … [Read more...]

A firewall to protect EU citizens from the Big Four accountancy firms and the tax avoidance lobby: the Tax Justice Network’s July 2018 podcast

In the July 2918 Taxcast: we look at a proposal for a firewall to protect EU citizens from the Big Four accountancy firms and the tax avoidance lobby: we look at a new report from the Corporate Europe Observatory we discuss UN Special Rapporteur on Extreme Poverty and Human Rights Professor … [Read more...]

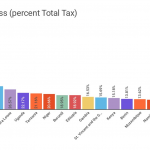

Progress on global profit shifting: no more hiding for jurisdictions that sell profit shifting at the expense of others

The world's largest economic actors are also the least transparent. Multinational companies and their big four advisers have been so effective in lobbying for opacity that their reporting requirements are actually less than is required from even small and medium-sized, purely domestic businesses. … [Read more...]

Country by country reports: why “automatic” is no replacement for “public”

A critical battle is currently being waged in the international tax policy arena over the implementation of country by country reporting, a reporting process that deters and detects tax avoidance by multinational companies, among other things, by requiring companies to provide a global picture of … [Read more...]

Accounting for influence: how the Big Four are embedded in EU tax avoidance policy

The Corporate Europe Observatory has a report out today which is well worth reading. We've written and commented extensively on the Big Four accountancy firms and the damage they do, you can read more in our 'enablers and intermediaries' section. As our CEO Alex Cobham has said, they're "not the … [Read more...]

New report: is Apple paying less than 1% tax in the EU?

We're pleased to share this new study commissioned by GUE/NGL members of the European Parliament’s TAX3 special committee on tax evasion, tax avoidance and money laundering. You can read more about their very important work here. The report was written by Emma Clancy and Martin Brehm Christensen and … [Read more...]

Addressing profit shifting in the mining sector through excessive interest deductions: our advice

The Tax Justice Network has responded to the following call by the OECD’s Centre for Tax Policy and the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development: For many resource-rich developing countries, mineral resources present an unparalleled economic opportunity to … [Read more...]

Video discussion: ‘Taming Digital Capitalism’ through public country by country reporting

There were some important debates in Brussels recently where Hans Böckler Stiftung held a two-day symposium with the European Trade Union Institute looking at the changes citizens in Europe are facing in the workplace and examining the challenges for the new leaders who will be in place as a result … [Read more...]

New report: The Global Battle for Corporate Transparency

On 25 May 2018, the European Council will meet in Brussels and will likely consider new rules on corporate transparency, the introduction of public country by country reporting. The meeting will take place 40 years to the day since the OECD sabotaged attempts to introduce similar transparency … [Read more...]

The bell tolls for arm’s length pricing

Listen closely, and you might just hear the beginning of the end of the international rules that have made tax more or less voluntary for multinational companies. This weekend, as part of their regular spring meetings, the International Monetary Fund and World Bank will hold a day-long conference … [Read more...]

A lower effective corporate tax rate is associated with a lower rate of job creation: new research

We're often told that cutting corporate tax rates will lead to the creation of more jobs. We all want to see more jobs created but what does the evidence say about that? Australian economist and Member of Parliament Andrew Leigh has recently published new research on the subject which makes for … [Read more...]

How come Mauritius is the biggest foreign investor in India?

We’re pleased to share a new study by Suraj Jaiswal for the Centre for Budget and Governance Accountability on Foreign Direct Investment in India and the role of tax havens. As their summary of this study says: Governments across the world are trying to attract Foreign Direct Investment (FDI) as a … [Read more...]

PRESS RELEASE: European Commission digital tax plan is a nail in the coffin for OECD tax rules

The Tax Justice Network welcomes the European Commission’s new measures to combat tax abuses in the digital economy – in particular, the intention to ensure taxes are paid in the places where business is done, and where profits are really made. For the last decade, some of the worst offenders in … [Read more...]

Video: discussion on tax revenue losses, Apple’s tax avoidance and ‘state aid’

We're sharing here the opening panel discussion of the June 2017 European Financial Congress, Eastern Europe's largest finance congress in Gdansk, Poland. The theme of the panel was "Tax solidarity in the world and in the EU" and it features visiting Professor at Oxford University Philip Baker QC … [Read more...]