New Swiss-EU treaty will replace Savings Tax Agreement STEP Mauritius promises India full-cooperation on tax treaty issues IBN Live Die Welt: The Greek Government Ignored 800 Bln In Black Money Transferred to Swiss Banks Greek Reporter … [Read more...]

Corporate Tax

Links Mar 24

Tax transparency can work for companies if they do it right The Conversation Life After Loopholes Forces Luxembourg to Rethink Its Future Bloomberg Ex-Greek finance minister found guilty of tampering with tax list Reuters A tax haven crackdown would help the developing world Politics.co.uk … [Read more...]

What is competitiveness? #1 – Robert Reich

From the Fools' Gold blog, an article that speaks for itself What is Competitiveness? #1 Robert Reich This is the first in an ongoing series of articles we are planning, to explore what competitiveness is, from the perspective of particular public figures or intellectuals. For the first in this … [Read more...]

Links Mar 23

China steps up fight against tax evasion with new regulations on multinationals South China Morning Post See also recent blog: Developing countries and corporate tax – ten ways forward Demand for ‘equal’ tax regime for MNCs The Independent Bangladesh Development and Taxes, a Vital Piece of … [Read more...]

The Tax Justice Network Podcast, March 2015

The Tax Justice Network Podcast, March 2015 In the March 2015 Taxcast: Democracy for sale - how our politics rely heavily on tax haven-friendly donors. Also, we ask: why is HSBC shutting down offshore accounts in Jersey? Are we in the final few years of the corporate income tax? Is Australia's … [Read more...]

Links Mar 19

New ruling highlights ongoing secrecy around Glencore tax case in Zambia Christian Aid The world can’t afford to exclude developing countries from new anti-tax evasion system Financial Transparency Coalition European Commission’s Tax Transparency Package keeps tax deals secret Eurodad See … [Read more...]

New Report: Ten Reasons to Defend the Corporate Income Tax.

UPDATES 2018 - Tax incentives in mining: minimising risks to revenue, OECD/Intergovernmental forum on mining, minerals, metals, and sustainable development. "Tax incentives are costly, leading many countries to forgo vital revenues in exchange for often illusive benefits. . . there is little … [Read more...]

Links Mar 17

Banks Say “Thanks for the Bailout,” Now We’ll Park our Profits in Overseas Tax Havens AllGov Tax Justice in Europe - time to stop hiding and start acting ActionAid UK: ‘Hard core’ tax dodgers to face strong crackdown Financial Times (paywall) Tax Cheat Hid $300 Million In Swiss Accounts … [Read more...]

New study outlines trillions handed out in U.S. corporate welfare bonanza

From Good Jobs First in the U.S., a new study looking at the many and varied grants, tax credits and subsidies harvested by large companies. (Also see our Taxcast interview of Greg Leroy, along with an interview with Kevin Farnsworth, who has done similar work on corporate welfare for the … [Read more...]

Links Mar 16

Special committee on tax dumping in the EU has started Sven Giegold Africa’s top billionaire uses Malta shell companies to hold diamonds ‘conflict’ Malta Today "Daughter of Angola’s president, Isabel dos Santos, uses Malta shell companies to hold her major interests in state-owned diamonds, … [Read more...]

Pulling the plug: how to stop corporate tax dodging in Europe and beyond

From Oxfam, a new report whose headline we've copied. As the introduction notes: "Making tax fair is one of the key solutions if we want to tackle the growing problem of inequality. Data from 40 countries shows the potential of well-designed, redistributive taxation and corresponding … [Read more...]

Links Mar 13

The Passport King: Christian Kalin's business is showing poor countries they have at least one resource worth selling: citizenship. Bloomberg What Directives Were Given To HSBC Staff? Financial Times (paywall) HSBC's Swiss private bank: French prosecutor formally requests trial The … [Read more...]

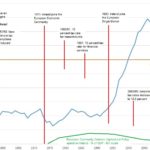

Did Ireland’s 12.5 percent corporate tax rate create the Celtic Tiger?

From the Fools' Gold Blog, a new TJN-backed project on 'competitiveness'. This article has also been cross-posted with Naked Capitalism. Update 2, 2020: New World Bank measures of wellbeing show Ireland lagging significantly behind its major European peers. Update 1, 2019: This issue is explored … [Read more...]

Links Mar 11

The Levin Center is official -- at the Wayne State University School of Law Detroit Free Press Levin himself will teach classes, beginning this fall with a course on tax policy, its effects on society and, as Levin put it, "how tax avoidance activities have punched a hole in our income tax … [Read more...]

New Expert Global Commission Responds to One-Sided Tax Debate

This press release was put together by a group of organisations including TJN. Expert Global Commission Responds to One-Sided Tax Debate; Inaugural Meeting to drive changes ahead of Post-2015 Ambition Responding to widespread anger about corporate tax avoidance, the impacts of such avoidance … [Read more...]