From the Financial Times, our quote of the day: "investors were viewing the aggressiveness of a company’s tax planning as a proxy for accounting risks and the company’s broader management style." Which is just as we have always said. Tax avoidance is shortcut behaviour: the opposite of … [Read more...]

Corporate Tax

Links Apr 13

‘HSBC has specifically targeted Argentina’ Buenos Aires Herald "Tax Justice Network head John Christensen warns about the bank’s lobbying power" Getting the EU response to the tax dodging scandal right Eurodad See also: Corporate Tax Avoidance Crackdown, a Missed Opportunity for the EU … [Read more...]

Links Apr 10

Despite Investment, Luxembourg Costs EU 'Billions' in Tax Breaks Sputnik International Transparency International Zambia Cautions Government Against Bending Too Much On Arriving At A Revised Tax Regime For Mines Foreign funds brace for India’s alternative tax demand FinancialTimes … [Read more...]

Links Apr 8

Tax justice to end inequality: World Social Forum 2015 Declaration Global Alliance for Tax Justice WSF: Activists call for governments to end inequality and deliver tax justice Global Alliance for Tax Justice Getting the EU response to the tax dodging scandal right Eurodad Eva Joly on a … [Read more...]

Links Apr 2

Tax havens told to drop opposition to UK call for central register Financial Times (paywall) See also: UK demands ownership registry Cayman News Service Australia sovereign wealth Future Fund refuses to appear before Senate tax avoidance inquiry The Guardian Human Rights Institute: Rule of … [Read more...]

Quote of the day – on attitudes to corporate responsibility

Our quote of the day comes from Jolyon Maugham, a UK tax barrister. Our quote of the day is the bit in bold, which is a sign of how much success we and our allies have had in changing the debates: "Survey after survey places tax first amongst CSR concerns. Tax structured transactions are in near … [Read more...]

‘National Competitiveness’: a crowbar for corporate and financial interests

This was originally posted yesterday at the new Fools' Gold site, which is dedicated to understanding how nations do or don't 'compete'. The term "UK PLC" -- the 'PLC' bit standing for Public Limited Company -- evokes notions that whole countries behave like corporations. It is routinely trotted … [Read more...]

Tax Justice Research Bulletin 1(3)

By Alex Cobham, TJN's Director of Research March 2015. Welcome to the third Tax Justice Research Bulletin, a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international tax. This issue looks at new papers on the responsibilities … [Read more...]

Links Mar 30

The Emperor's New Clothes A Russell Brand and Michael Winterbottom film, highlighting tax justice. See also the trailer, facebook, and twitter. Also the Cassetteboy rap (which is going viral) promoting the film. What is (tax) competitiveness? #3: Tax Justice Network Fool's Gold - rethinking … [Read more...]

Tax Justice Network – Changing the World

We have just put together a promotional video for TJN, to help explain our role in the fast-growing tax justice debates. We'll place this video permanently on our home page, below the blogs, and on our Tax Justice TV page. We have also just started soliciting testimonials from various people … [Read more...]

Do lower tax rates curb tax cheating? Really?

It's a good question. Now, an Australian story, via The Guardian: "Treasurer Joe Hockey has said Australia is “losing control of our destiny from a taxation perspective” because of “holes” in the tax treatment of multinational corporations, as a parliamentary committee prepares to grill global … [Read more...]

The Price We Pay – interview with director Harold Crooks

Watch the Canadian Brodcasting Company interview with film director Harold Crooks discussing his film The Price We Pay. … [Read more...]

Links Mar 27

With people power, we can achieve change! Report from the World Social Forum Global Alliance for Tax Justice Kenya Revenue Authority Requests Removal Of Tax Incentives For Foreign Investors CNBC Africa Tax risk and the corporate responsibility to respect human rights - seminar David Quentin's … [Read more...]

UNCTAD: multinational tax avoidance costs developing countries $100 billion+

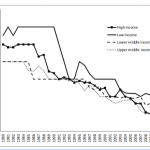

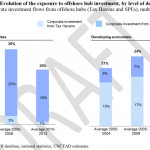

The UN Conference on Trade and Development (UNCTAD) has just published a major new study on corporate tax in developing countries, which contains a wealth of new information analysis as well as some important headline numbers: notably that developing countries lost around $100 billion per year in … [Read more...]

An African civil society perspective on Financing for Development

From the Uncounted blog, run by TJN's Director of Research, Alex Cobham The African regional consultation on Financing for Development (FfD) took place at the start of the week (like the European one). The submission from TJN-Africa puts particular emphasis on inequality, including women’s rights, … [Read more...]