(Updated with a reference to Google's scary "Patent Purchase Promotion" initiative.) From the Wall St. Journal, a story entitled Pharmaceutical Companies Buy Rivals’ Drugs, Then Jack Up the Prices: "On Feb. 10, Valeant Pharmaceuticals International Inc. bought the rights to a pair of … [Read more...]

Corporate Tax

Working people pay taxes – corporations must pay their share!

Public service trade unions and the Global Alliance for Tax Justice invite members to join in marching this May Day under the banner “Working people pay taxes – corporations must pay their share!” … [Read more...]

Transfer pricing: what developing countries are doing, China edition

Last December Krishen Mehta wrote us a longish article entitled Developing Countries and Tax - Ten Ways Forward. It outlines a series of measures that developing countries can consider as they seek to curb tax cheating by multinational corporations. This blog is really just a pointer to an article … [Read more...]

Links Apr 24

Shock at Luxembourg’s decision to charge LuxLeaks reporter Reporters Without Borders Responsible Tax Practice by Companies: A Mapping and Review of Current Proposals ActionAid Towards a Common African Position on Financing for Development: Governments and Civil Society Debate in Addis Ababa … [Read more...]

The Tax Justice Network podcast, April 2015

In the April 2015 Tax Justice Network podcast: How just are our tax systems towards women? A Taxcast chat with award-winning filmmaker Michael Winterbottom, about his new Russell Brand film The Emperor's New Clothes. Plus: one of the US' biggest corporations (and tax avoiders) is repatriating … [Read more...]

Links Apr 23

Luxembourg court charges French journalist over LuxLeaks role Reuters See also: Charges against #LuxLeaks reporter by Luxembourg authorities threaten press freedom ICIJ, Luxembourg court charges LuxLeaks journalist EU Business, and recent ICIJ article by Edouard Perrin ‘This story is global, it … [Read more...]

The Rumble Down Under: democracy v multinationals in Australia

This is just one part of what one might call the 'mega-capture' of political processes, around the world, by the Big Four accountancy firms. … [Read more...]

Report: a proposal to adopt unitary tax in Israel

From TJN Israel, a new report entitled A Proposal to Adopt a Reform in Taxing Multinational Corporations in Israel - Unitary Taxation. The summary is here, in English, and the longer report, in Hebrew, is here. The report explores why Israel's existing tax regime has difficulties in combating … [Read more...]

Links Apr 20

Combatting Tax Havens: What has been done, and what should be done Eva Joly and Alternatives Economiques (In French, with English version available soon) EU must pull its weight to help create a better global financial system The Guardian Indian Finance Minister Arun Jaitley: Automatic info … [Read more...]

Links Apr 17

Joint May Day statement: Working people pay taxes – corporations must pay their share! Global Alliance for Tax Justice Angola’s sovereign fund pays $100 million to a shell company index Commodity giants' Singapore trading hubs under fire in tax probes Reuters Christine Lagarde, scourge of … [Read more...]

Links Apr 16

"Developing countries" Is it or isn’t it a spillover? Martin Hearson Too much focus on ‘spillover effects’ of tax policies might lead to an too-narrow analysis of the impacts of a jurisdiction’s tax policies on developing countries. America’s Most-Wanted Swiss Bankers Aren’t Hard to Find … [Read more...]

Links Apr 15

How anonymously owned companies are used to rip off government budgets Global Witness Taxing Multinationals: Is There a Pot of Gold of Finance for Development? Center for Global Development CSO Response to the Zero Draft of the Outcome Document of the Third Financing for Development … [Read more...]

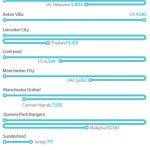

Veblen and Keynes comment on the UK Premier League

We've just written about the new Offshore Game report, covered extensively in The Guardian newspaper, and thought we'd note one of the nice little graphics about offshore ownership that The Guardian has created. … [Read more...]

The Offshore Game – new TJN report on offshore finance in football

From The Guardian, a major new story whose introduction runs as follows: "Research by the Guardian and the Tax Justice Network reveals 28 English clubs with substantial shareholdings overseas, opening up the football leagues to criticism for allowing ownership structures that could be used for … [Read more...]

New U.S. report: Offshore Tax Havens Cost Small Businesses $3,244 a Year

From the U.S. Public Interests Research Group (PIRG): As tax day approaches, it’s important to remember that small businesses end up picking up the tab for offshore tax loopholes used by many large multinational corporations. U.S. PIRG joined Senator Bernie Sanders, Bryan McGannon of the … [Read more...]