Upcoming EU presidency faces whistleblows and calls for transparency Eurodad See also: Letter to Ambassador of Luxembourg in Denmark, on tax avoidance and whistleblowers Exposing South Africa's "Lettergate" Scandal World Policy Blog See also: recent TJN blog South Africa’s diamond companies: … [Read more...]

Corporate Tax

Do real investors chase corporate tax cuts?

Cross-posted with Fools' Gold. From the Financial Times, a report on a survey by the Tolley Tax Journal of businesses' responses to the UK's policy of savage cuts to the corporate income tax. It's about the UK, but it has wide international relevance. "More than six out of 10 respondents … [Read more...]

Links May 8

Turkish finance minister Mehmet ?imsek: World should fight against tax evasion like it fights against terror Daily Sabah Estimating illicit funds in global tax havens moneylife Taking on the banks: a conversation with Anat Admati The New Yorker Lawmakers Embrace Patent Tax Breaks The Wall … [Read more...]

Links May 7

Optimistic about the state: Martin Wolf’s searing attack on the Competitiveness Agenda Fools' Gold - rethinking competitiveness Tax probes frustrate EU competition chief EU Observer Unitary Taxation: Tax Base and the Role of Accounting International Centre for Tax and Development Former JP … [Read more...]

The Tax Justice Research Bulletin 1(4)

Corrected: the earlier version referring to a Banque de France Report said "$8bn revenue loss" when it should have referred to an $8bn loss in tax base. The Tax Justice Research Bulletin By Alex Cobham. TJN (April 2015) - The Tax Justice Research Bulletin is a monthly series dedicated to … [Read more...]

Britain goes to the polls: the tax avoidance election

An interesting thing about the forthcoming UK election is that the subject of 'tax avoidance' has risen up the agenda so far and so fast. This guest blog briefly reviews the main parties' manifestos, with a look out for their uses of the term. [We should add, by the way, that 'tax avoidance' is a … [Read more...]

Why Gender Equality Requires More Tax Revenue

This is the third post this week on the topic of gender, and to celebrate our arrival in the modern world we have created a new topic page, where you will permanently be able to access news and analysis in this area. Now we're delighted to host a guest blog by Diane Elson, Chair of the UK … [Read more...]

The Celtic Tiger: the Irish banking inquiry and a tale of two booms

Cross-posted from Fools' Gold: One of our inaugural articles on this site was a post in March looking at the causes of the "Celtic Tiger" boom in Ireland. It contained a striking graph and a wealth of analysis suggesting strongly that what caused the boom was, above all, Ireland's accession to … [Read more...]

How do tax wars affect women?

Cross-posted from Fools' Gold: From the Association for Women's Rights in Development, a post related to a landmark meeting in Lima on tax justice and human rights: "The current “race to the bottom” in which tax competition among developing countries takes place to attract corporate and … [Read more...]

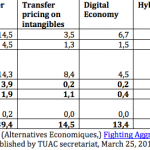

Two new reports challenge the OECD’s work on corporate tax cheating

The OECD, the club of rich countries that dominates international tax, is running a project known as Base Erosion and Profit Shifting (BEPS) which is supposed to fix some of the gaping holes in the international tax system. As we all know, transnational corporations (TNCs) are running rings around … [Read more...]

Lima: TJN director Christensen speech on tax justice and human rights

From John Christensen, TJN's director, a speech about tax justice and human rights. It begins like this: "Why the tax justice movement should embrace human rights. And vice versa The history of economic and social rights in most countries can be discovered in their tax codes. Tax is at the … [Read more...]

Why must tax treaties starve developing countries of revenue?

Martin Hearson, who has just been at a parliamentary hearing in Denmark, asks a very good question about tax treaties and developing countries: why exactly is it necessary for them to insist on stiffing developing countries of tax revenue? … [Read more...]

Singapore spin: “we are not a tax haven.” They all say that

From the Twittersphere, our Director of Research: … [Read more...]

Shareholder value and the fiduciary duty of company directors: a view from Israel

This is our second Israel-related blog in the past week. From TJN-Israel and the Corporate Responsibility Institute at the College of Law and Business, a new report looking at a subject dear to our hearts: whether or not company directors are bound by their fiduciary duties to avoid tax. … [Read more...]

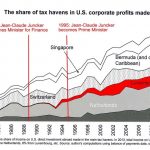

The Offshore Wrapper: a week in tax justice #59

Our quirky weekly news round-up from the topsy-turvy world of tax havens. The piratical Duchy of Luxembourg charges journalist over LuxLeaks What does Jean-Claude Juncker think of this? Luxembourg, the country he led for 18 years and steered in the direction of becoming one of Europe's biggest … [Read more...]