Last Saturday The Guardian broke a story about the U.S. multinational Amazon: "From the start of this month the online retailer has started booking its sales through the UK. . . The group made $8.3bn (£5.3bn) of worldwide sales from British online shoppers but for 11 years all these internet … [Read more...]

Corporate Tax

Links May 22

Special Report - Britain's home-grown tax haven Reuters Costa Rican bill would allow tax authority to seize assets without court order STEP See the article in Spanish here. Swiss Bankers Respond To Privacy Initiative Tax-News … [Read more...]

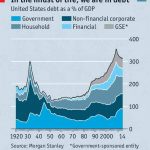

Economist: why it’s time to stop making debt tax-deductible

We've said this before, and we may have felt radical saying it at the time - but now it's The Economist saying it. It has an article entitled and subtitled A senseless subsidy: Most Western economies sweeten the cost of borrowing. That is a bad idea. Quite so. And the potential rewards it … [Read more...]

Links May 21

Alan Rusbridger: press can't afford to cover corruption and tax avoidance The Guardian "Guardian editor-in-chief says newspapers retain the power to hold companies to account, but their declining fortunes are making it difficult" Lux Leaks Scandal. Juncker Gets A Step Closer to Hot Seat … [Read more...]

Tax wars: seminar at European parliament

A seminar at the European parliament in Brussels, featuring TJN's Markus Meinzer: … [Read more...]

Farewell, Margaret Hodge

Margaret Hodge, the fiery head of the UK's Public Accounts Committee, has been hauling the bosses of large multinational corporations over the coals for their egregious abuses of the UK tax system. Now, post-election, she is stepping down. Many tax professionals in the UK dislike, hate, or even … [Read more...]

Bill Gates: corporate tax rates at 35% won’t stop the innovators

Via the Fools' Gold blog: A Bloomberg report on a Bill Gates interview: 'Gates scoffed at comparisons linking taxes and regulation to slower growth. “The idea that there’s some direct connection, that all these innovators are on strike because tax rates are at 35 percent on corporations, … [Read more...]

Auditor rotation: the new merry-go-round

From Prof. Prem Sikka, via email: "Auditing itself has become one of the biggest frauds of modern times. When was the last time company auditors drew attention to fiddles, tax dodging, money laundering or their own complicity in financial misdemeanours? The penalties for delivering duff audits, … [Read more...]

Links May 18

Should tax targets for post-2015 be rejected? Uncounted - Alex Cobham's Blog Uncounted: has the post-2015 data revolution failed already? Uncounted - Alex Cobham's Blog UNESCAP and Government of Indonesia - Asia Pacific High Level Consultation for Financing for Development Equity BD Links … [Read more...]

A short FAQ on the European Parliament’s probe into tax rulings

We have just mentioned a demonstration today in Luxembourg, in the context of a visit there by the European Parliament committee tasked with following up on the LuxLeaks affair. (It's known as "The Committee on Tax Rulings and Other Measures Similar in Effect" or TAXE for short.) Christian Hallum … [Read more...]

Tax Justice demonstration in Luxembourg as EU tax body visits

Update 2: with a report on the demonstration in Luxemburger Wort, which in contrast to our earlier experiences of Luxembourg media, was quite balanced. Update1 : with a photo (below) of today's protest in Luxembourg. Some 50-60 people are reckoned to have attended, a good turnout … [Read more...]

Links May 15

OECD insists tax playing field will be level swissinfo See also: OECD approval uncertain over tax transparency request procedures STEP (note references to "stolen" rather than leaked data), and see recent blogs: When a tax haven invokes the ‘level playing field’, run for the hills, and Swiss … [Read more...]

Links May 14

Live! Tax justice TV drama! Global Alliance for Tax Justice View recent sessions of the UN Financing for Development negotiations, including the paragraph by paragraph debate of text relating to tax justice Lessons and legacies of the financial crisis in Latin America Global Alliance for Tax … [Read more...]

Is France’s economy really less ‘competitive’ than Britain’s?

This post is just a reminder, really, about all the nonsense that is spoken in the name of 'competitiveness.' Of course, this is just quarterly data, and the UK was recently growing faster than France. We aren't going to get into details in this short blog. … [Read more...]

Links May 13

European Parliament's special tax committee running out of time The Parliament LuxLeaks special committee’s first country visit: Belgium is breaching EU tax law Sven Giegold Charged LuxLeaks journalist calls for more whistleblower protection Europe Online Magazine See also: Members of … [Read more...]