Cross-posted from our sister organisation the Global Alliance for Tax Justice The Global Week of Action for #TaxJustice, which will take place in June 16-23, 2015, aims to encourage and cross-promote diverse activities that are initiated across our tax justice communities, to … [Read more...]

Corporate Tax

Are the G7 really suggesting compulsory arbitration on international tax disputes?

Christian Aid sent us this email yesterday, and it's a shocker. Back in 2013, the G7 made some pretty strong commitments to tax justice, and we said then we'd be watching them carefully to see if they'd deliver. Well, on this evidence, they haven't: quite the opposite, in fact. It is worth … [Read more...]

Links Jun 9

Gender and tax justice Open Democracy An article from the Tax Justice Focus: the Gender Edition New Oxfam report: ‘Africa: Rising for the few’ Global Alliance for Tax Justice U.S. Tax Informant Dodged Prison, Now Seeks $22 Million Reward Bloomberg BVI gives UK non-doms four more months to … [Read more...]

Luxembourg: the campaign on corporate tax has only just begun

From Eurodad: a wonderful sign that people are starting to gear up to challenge the many corporate tax abuses run out of secrecy jurisdictions like the European Dodgy Duchy of Luxembourg. … [Read more...]

Links Jun 8

End transnationals' 2 billion tax dodge on poorest countries The Ecologist Legal but secret: the story of tax rulings Europarl TV See also: Eurodad: Statement to the European Parliament’s Special Committee on Tax Rulings and Other Measures Similar in Nature or Effect Blowing the whistle on … [Read more...]

OECD country-by-country reporting: Strangled at birth

Sigh. Country-by-country reporting, an idea first mooted and pushed by Richard Murphy for TJN - is making slow but steady headway, in various fora internationally. The OECD, which only relatively rarely fails to disappoint, has been weighing in on this weighty affair. We now report on the latest … [Read more...]

TJN in The Economist: on the precious corporate income tax

Recently, we wrote an article welcoming a major intervention by The Economist magazine, which was arguing that rules allowing people and corporations to set interest payments against their tax bills is a historical anachronism whose time has now gone. … [Read more...]

Links Jun 5

Tax haven: Belgium to blacklist Luxembourg Luxemburger Wort Belgium targets £390m in unpaid tax as HSBC considers job cuts The Guardian How the Cayman Islands Became a FIFA Power The New York Times See also: A U.S. Tax Investigation Snowballed to Stun the Soccer World The New … [Read more...]

Links Jun 3

Support-antoine.org - newsletter: We support Antoine Deltour, the whistleblower of the Luxleaks revelations! Your can donate to the Support Committee for Antoine Deltour here. Luxleaks whistle-blower Deltour wins broad support in European Parliament European Parliament News Luxleaks … [Read more...]

International commission calls for corporate tax reform

When we look back, might today be the day that momentum swung decisively against current international tax rules? An independent commission made up of leading international economists, development thinkers and tax experts (see the graphic) has called for a radical overhaul of international … [Read more...]

Tax Justice Research Bulletin 1(5)

May 2015. Welcome to the fifth Tax Justice Research Bulletin, a monthly series dedicated to tracking the latest developments in policy-relevant research on national and international taxation. This issue looks at a fascinating thesis on the different people and organisations that influence the … [Read more...]

Quote of the day – tax incentives as official tax evasion

This headline may seem odd. Conventionally tax evasion involves cutting taxes by breaking laws; using tax incentives is a different creature altogether: it involves cutting taxes by using the law. But this useful new report from the European parliament contains a twist on the conventional … [Read more...]

World No Tobacco Day: Marching to Big Tobacco’s tune?

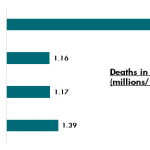

Cross-posted with the Uncounted blog, by TJN's research director Alex Cobham. World No Tobacco day was on Sunday (yesterday.) World No Tobacco Day: Marching to Big Tobacco’s tune? Has World No Tobacco Day 2015 – this Sunday – been manipulated by Big Tobacco’s lobbying agenda? Where the tobacco … [Read more...]

Links May 29

How to tackle tax evasion and tax avoidance? The case for tax transparency to contain and end tax wars Presentation by TJN's Markus Meinzer at the ALDE seminar: How to tackle tax evasion and tax avoidance? Paving the way for fair tax competition in Europe. Reflecting on Progressive Realisation … [Read more...]

The other FIFA scandal: poor countries and the tax-free bubble

We've just written about the role of Goldman Sachs in distorting U.S. sports and harming smaller players via tax cheating. Well, here is yet another thing to make you choke on your cornflakes: FIFA hurting poor countries though what we'd describe as aggressive, idiosyncratic tax cheating. … [Read more...]