From Bloomberg BNA: "Since 2013, the Organization for Economic Cooperation and Development [OECD] has been working on a 15-item BEPS action plan under Group of 20 authority with the aim of closing “loopholes” that allow multinationals to drastically reduce their taxes. Along the way, the project … [Read more...]

Corporate Tax

Links Sep 21

Singapore Urges Need For Tax Competition After BEPS Tax-News But tax competition, or rather tax wars, are harmful, see the Fools' Gold blog on What is (tax) competitiveness? Hunt for Tax Cheats Leads U.S. Government to Banks in Belize Bloomberg Apple Inc., Amazon See Mounting Tax … [Read more...]

The march of the international tax treaty arbitrators

From Martin Hearson, a (somewhat wonkish) post about tax treaties and developing countries, entitled The tax treaty arbitrators cometh: "There are lots of reasons why eliminating all forms of double taxation faced by cross-border investors is a sensible thing to try to do. It is what tax treaties … [Read more...]

Country by country reporting: lessons from Finland

A guest blog by Henri Telkki, Finnwatch. This concerns country-by-country reporting, a concept explained here. The CbCR piloting of Finnish state-owned companies – lessons to learn Finland acted as a front-runner in tax transparency by requiring those companies where the state holds more than a … [Read more...]

New Christian Aid poll: 70% believe ‘legal’ tax avoidance is wrong

From Business World in Ireland: "Only 36% of people trust multinational companies to provide accurate tax information, while 70% believe multinational tax avoidance schemes to be morally wrong even if they are legal according to a new . . . survey, conducted on behalf of the charity Christian … [Read more...]

Links Sep 17

Bank lobby decries regulation “overload” swissinfo 'The Swiss Bankers Association has waded into the ongoing anti-tax evasion political debate' U.S. tax-evasion probe expands to Belize USA Today See also: IRS Hunts Belize Accounts, Issues John Doe Summons To Citibank, Band of America … [Read more...]

The G20/OECD BEPS Project on corporate tax: a scorecard

In 2013 the G20 world leaders mandated the OECD, a club of rich countries, for its Base Erosion and Profit Shifting (BEPS) project to produce reforms of international tax rules that would ensure that multinational enterprises could be taxed ‘where economic activities take place and where value is … [Read more...]

C20: new civil society policy paper on tax justice

Adapted from the Global Alliance for Tax Justice. Organisations from 91 countries from around the world, representing close to 500 civil society organisations and almost 5,000 individuals, have been working together for the last 18 months via the Civil 20 (C20) to engage with G20 governments on … [Read more...]

Links Sep 16

President Juncker must endorse public scrutiny of multinational tax payments Transparency International European Parliament tax investigation: Lobbyists from non-compliant firms to lose access to EU Parliament Sven Giegold Finland: Minister on board of tax haven firm YLE Minister of … [Read more...]

Links Sep 15

EU must force more transparency from companies in Africa - Piketty Reuters Event: Gabriel Zucman presents “Hidden Wealth of Nations: The Scourge of Tax Havens” Washington Center for Equitable Growth Taxing Africa’s richest and poorest Ventures Africa Swiss firms avoiding tax on gold, says … [Read more...]

Country by Country Reporting: lobbyists eviscerate OECD project

From the Uncounted blog: "The governments of G8 and G20 countries gave the OECD a global mandate to deliver country-by-country reporting, as a major tool to limit multinational corporate tax abuse, and with particular emphasis on the benefits for developing countries. New evidence shows that – … [Read more...]

Links Sep 11

Greens call for stronger recommendations to fight corporate tax avoidance in Europe The Greens / European Free Alliance in the European Parliament Transparency & the State of the Union Transparency International On Jean-Claude Juncker giving his first annual ‘State of the European Union’ … [Read more...]

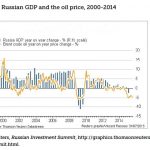

Russia’s offshore financial nexus, threatening financial stability and security

We have for years remarked on the role of the offshore system in promoting financial instability, not least for its propensity to enable financial players to get out from under financial regulations they don't like, then taking the cream from risky activities and shifting the risks onto others. … [Read more...]

Links Sep 10

Poor countries worry that developed nations drive tax agenda Business Day Live UK: Revenue & Customs 'winding down' inquiries into HSBC Swiss tax evaders The Guardian "After reopening investigation into HSBC clients hiding money in Switzerland, HMRC admits it has still only prosecuted one … [Read more...]

Links Sep 9

EU tax haven blacklist—a misguided approach? LexisNexis TJN's Markus Meinzer and Andres Knobel on the misleading nature of the EU tax haven blacklist, and why blacklists might not be the right approach to tackle tax dodging. (This article was first published on Lexis(r)PSL Financial Services on 7 … [Read more...]