Latin America and Caribbean Tax Administration Dialogue on International Taxation in Quito Global Alliance for Tax Justice Country-by-Country regime passed by Australian Parliament Global Alliance for Tax Justice New Study: Illicit Financial Flows Hit US$1.1 Trillion in 2013 Financial … [Read more...]

Corporate Tax

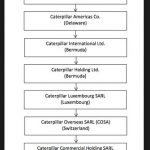

Tax havens and the role of multinationals running care services

Guest blog: an opportunity to Fight Tax Havens in the EU By Johannes Kananen, Thomas Wallgren, Matti Ylönen, and Matti Kohonen The EU’s new Directive on public procurement (2014/24/EU) is currently being implemented in many countries, and the fate of one small article in the directive may … [Read more...]

Lazonick: tax cheating is just part of Pfizer’s corrupt business model

Recently the U.S. pharma giant Pfizer announced a merger with the drugmaker Allergan, in a deal heavily motivated by tax cheating via a 'corporate' inversion - a corporate relocation to take advantage of (in this case Ireland's) lax tax regime. Much has been said on the topic, with U.S. … [Read more...]

Links Dec 7

The determinants of tax haven FDI Science Direct Paper examines the determinants of a multinational enterprise's (MNEs) decision to set up tax haven subsidiaries. Cayman Islands fraudsters may have moved $450 million to Cuba Caribbean News Now! Very interesting report by Kenneth Rijock, a … [Read more...]

The chaser’s guide to tax havens: a simple 1,413-step guide

Some offshore humour for a Monday morning: The Chaser's Guide to Tax Havens, from Australia. The magazine has an interesting history: "Ever since The Chaser started, back in 1999, we have strived to build our company on a solid foundation of inexplicable and highly technical tax losses." Back … [Read more...]

Quote of the day – on Mark Zuckerberg’s ‘charitable donation’

For those who don't know, Facebook founder Mark Zuckerberg this week pledged, on the birth of his daughter, to donate 99 percent of his billion-worth of Facebook stock to good causes. Which has generated adulation and love, from around the world: just look at the Great and the Good lining up to … [Read more...]

French parliament approves public country-by-country-reporting

Updated with new analysis. Update 2: on a third round, the proposal has failed in the national assembly. This is far from the end of it. STOP PRESS: We've just heard that the French National Assembly has voted in favour of public -- yes, public -- country-by-country reporting. As a member of … [Read more...]

Three Tax Whistleblowers Who Changed The Game

The following blog was first published as part of a longer article in the Whistleblower Edition of Tax Justice Focus (available here). The article was authored by Professor William Byrnes, Associate Dean (Special Projects) Texas A&M University Law. A lawsuit filed by Daniel Schlicksup, a … [Read more...]

Links Dec 3

Revealed: how Southeast Asia’s biggest drug lord used shell companies to become a jade kingpin Global Witness For Facebook’s Zuckerberg, Charity Is in Eye of Beholder Bloomberg Gabriel Zucman points out: “A society where rich people decide for themselves how much taxes they pay and to what … [Read more...]

Links Dec 2

Art & Money Laundering in Switzerland - secrecy is weakening Bilan (In French) Article in English here. EAC states adopt new measures to curb tax loss The East African European Parliament tax investigation continued: Strong mandate for new committee to continue tax investigation Sven … [Read more...]

Links Dec 1

HSBC whistleblower given five years’ jail over biggest leak in banking history The Guardian See also: 'Sentencing Changes Nothing, Will Help Black Money Probe,' Says Herve Falciani NDTV, The Snowden Of Swiss Bank Accounts Is Sentenced To Prison While White Collar Criminals Go Free ThinkProgress, … [Read more...]

New study: corporate tax cuts may have been ‘the greatest blunder’

The Canadian Center for Policy Alternatives has just published a new study entitled Do Corporate Income Tax Rate Reductions Accelerate Growth? It summarises: "This study examines the relationship between the Canadian corporate income tax (CIT) regime and various dimensions of economic growth. The … [Read more...]

How the U.S.A. became a secrecy jurisdiction

This month we published our fourth Financial Secrecy Index (FSI), complete with a series of reports about each of the biggest tax havens and secrecy jurisdictions, looking into the political and economic histories of how and why they went offshore, who was involved, and where the bodies are … [Read more...]

Links Nov 26

An uneven playing field: inequality, human rights and taxation inesc "The Latin American experience shows that progressive tax systems are crucial to reducing inequality." EU lawmakers step up pressure to tackle tax dodging Reuters See also: EP tax investigation: EP president Schulz blocking … [Read more...]

Links Nov 25

European Parliament tax investigation: Special committee extension blocked to protect Juncker and Dijsselbloem Sven Giegold Special Report: Greek shipowners talk up their role to protect tax breaks Reuters Wanted: central bank boss to fix 1,700-year-old European tax haven Reuters So Pfizer … [Read more...]