From the 2016 budget speech in South Africa, from Finance Minister Pravin Gordhan: "We will continue to act aggressively against the evasion of tax through transfer pricing abuses, misuse of tax treaties and illegal money flows. Drawing on the work of the OECD, the G20 joint project on base … [Read more...]

Corporate Tax

Report: The treaties that cut taxes in poorest countries

New analysis: The treaties that cut taxes in some of the world’s poorest countries A guest blog by Lovisa Möller, ActionAid Today ActionAid releases battery of resources for academics, negotiators and activists that want to know more about the tax treaties that some of the world’s poorest … [Read more...]

Links Feb 23

UN panel chief, Thabo Mbeki, urges action plans to tackle illicit financial flow from Africa UN News Centre Video: How to reform the global tax system Global Economic Governance Programme Wind of Change: IMF Chief Calls For New International Taxation System Sputnik International See also: … [Read more...]

Links Feb 22

Tax Dodging MNCs to Lose Assets in Australia Australia Network News New Zealand Consults Public On Automatic Exchange Of Info Tax-News India: Government notice to HSBC for abetting tax evasion Times of India See also: HSBC’s Swiss, Dubai units under lens for abetting tax evasion by Indians … [Read more...]

Call for articles: corporate tax reform, value theory, post-capitalism

We are calling for expressions of interest in contributing to an issue of Tax Justice Focus, dedicated to exploring the relationship between corporate tax reform, value theory, and the global transition to a post-capitalist, post-patriarchal, post-work society. An introductory essay is available … [Read more...]

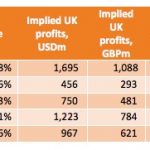

New analysis: why Google is paying just 2% tax rate in the UK

The Daily Mirror newspaper in the UK is running a story entitled Google is paying even LESS tax than thought as UK deal is just 2%. This is based on a new TJN analysis, based not on current tax rules but on what Google might pay if the UK were to adopt a fairer tax system that we've … [Read more...]

Global Tax Fairness: new book from Oxford University Press

This new book from Oxford University Press, edited by Thomas Pogge and Krishen Mehta, publishes fifteen chapters by leading tax justice scholars on different topics ranging from country-by-country reporting to unitary taxation, from automatic information exchange to tax wars, with clear and … [Read more...]

Image of the day: IKEA

From the European Green Party: The full report finds that IKEA structured itself to dodge €1 billion in taxes over the last 6 years using onshore European tax havens. … [Read more...]

Links Feb 18

Breaking the vicious circles of illicit financial flows, conflict and insecurity Uncounted Fair taxes, fighting inequality essential for Peru Oxfam America Financial transparency - The biggest loophole of all: Having launched and led the battle against offshore tax evasion, America is now … [Read more...]

Links Feb 17

Ikea accused of evading over 1 billion in tax payments Global Alliance for Tax Justice Apple issues bonds worth estimated $12bn The Guardian "Move would allow the company to pay shareholders without having to repatriate any of $177bn it holds overseas at lower tax rates than in US". See also: … [Read more...]

Why Google (and other multinationals) are still not paying their fair share of corporation tax

This guest blog by Tommaso Faccio of Nottingham business school complements a guest blog we ran on Friday by Sol Picciotto, also about Google's all-important tax affairs. Why Google (and other multinationals) are still not paying their fair share of corporation tax Google says that it pays the … [Read more...]

HSBC opts to stay in ‘competitive’ London. (It was never going to leave anyway)

From the Fools' Gold blog, yesterday: There's been a lot of talk for a long time about a threat from globe-trotting HSBC to move its headquarters from London to Hong Kong. It seems there's been a resolution of the question for now, of sorts. As Bloomberg puts it: "HSBC Holdings Plc … [Read more...]

TTIP threatens ability to enforce fair taxes on corporations – report

In light of a new report showing how corporations are using secretive corporate courts to undermine national tax sovereignty, TJN has signed a letter to British Prime Minister David Cameron calling on him to call a halt to negotiations on so-called Investor-State Dispute Settlement provisions … [Read more...]

Which countries have the right to tax Google’s income?

Recently, amid the furore over Google's surprisingly low tax payments in the UK and in other countries, it has been suggested, as one observer put it to us: "The claim is that international tax law accrues profits to where products are created, and not where sales are made. For example, a UK … [Read more...]

Links Feb 11

Mbeki Panel to meet with US Officials on illicit financial outflows from Africa United Nations Economic Commission for Africa Redistributing Unpaid Care Work – Why Tax Matters for Women’s Rights Institute of Development Studies The global impact of tax dodging - Are trillions stored in tax … [Read more...]