Investors responsible for trillions of dollars of assets have called on the OECD to ensure that the country by country reporting of multinational companies is made public. With leading experts, standard setters and civil society groups fully in agreement, the only remaining opposition to this most … [Read more...]

Corporate Tax

Edition 11 of the Tax Justice Network’s Francophone podcast/radio show: édition #11 de radio/podcast Francophone par Tax Justice Network

We’re pleased to share the eleventh edition of the Tax Justice Network’s monthly podcast/radio show for francophone Africa by finance journalist Idriss Linge in Cameroon. Nous sommes fiers de partager cette nouvelle émission de radio / podcast du Réseau Tax Justice, Tax Justice … [Read more...]

Getting the short end of the stick again and again

Guest blog author: Cassandra Vet, Teaching Assistant and PhD Candidate, Global Governance and Inclusive Development, Institute of Development Policy, University of Antwerp Now the reform to curb corporate tax avoidance gets up to speed with the outdated principles of corporate taxation, it … [Read more...]

The financialisation of child and elderly care: the Tax Justice Network December 2019 podcast

This month we ask - what's going on with our pre-school childcare and elderly care home services? We take a long hard look at the financialisation of our services and what we can do about it. Plus: the Conservative party in the UK has won a major victory in the general elections. With major … [Read more...]

Austrian parliament seizes opportunity for public country-by-country reporting

Just two weeks ago, a resolution on country-by-country reporting at the EU Competitiveness Council missed the qualified majority needed by just one vote. Among those who voted against the resolution was Austria's Minister of Economic Affairs, Elisabeth Udolf-Strobl. But only a few days later the … [Read more...]

Edition 10 of the Tax Justice Network’s Francophone podcast/radio show: édition #10 de radio/podcast Francophone par Tax Justice Network

We’re pleased to share the tenth edition of the Tax Justice Network’s monthly podcast/radio show for francophone Africa by finance journalist Idriss Linge in Cameroon. The podcast is called Impôts et Justice Sociale, ‘tax and social justice.’ Nous sommes heureux de partager avec vous cette … [Read more...]

Unitary taxation for multinational companies: what it is and why it matters

We blogged recently that the UK's main opposition party has committed to introducing unitary taxation by the end of the next parliamentary term. As we've said, it represents an important further normalisation of unitary taxation, and a potentially important step to ending the great damage done by … [Read more...]

Unitary tax explained: infographic

The Labour party in the UK has today committed to introducing unitary taxation by the end of the next parliamentary term. This is significant internationally because it marks the first such manifesto commitment from a major political party, with a realistic prospect of election success, in a … [Read more...]

A historic day for unitary taxation

Today sees the crystallisation of two potentially pivotal moments in the development of international tax rules towards the Tax Justice Network’s long-favoured approach: unitary taxation. In Paris, the OECD is hosting a public consultation on the biggest reform to the taxation of multinational … [Read more...]

Global Day of Action: digging the dirt on extractives

As global capitalism continues to lurch from one crisis to the next, massive levels of tax abuse and avoidance are robbing governments of the resources they need to provide basic social services while also contributing to economic instability, fuelling gender inequalities and undermining human … [Read more...]

Taxing multinationals: a new approach

Our headline is also the title of an important new report by Public Services International, a global trade union federation, looking at the fast-changing international tax system. Co-authored by Public Services International's Daniel Bertossa and Sol Picciotto, a Tax Justice Network Senior … [Read more...]

Taxing wealth – how to triumph over injustice: Tax Justice Network October 2019 podcast

In this month's episode we speak to Gabriel Zucman about his new book with co-author Emmanuel Saez - The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay. Plus, as Extinction Rebellion holds protests around the world over the climate emergency, we point the finger at the … [Read more...]

‘Terrible Transactions’: How much does mining benefit the Brazilian state?

We're sharing here details of a study by the Instituto Justiça Fiscal (the Tax Justice Institute) in Brazil researched by economist Guilherme Spinato Morlin with coordination and advice from the Instituto Justiça Fiscal. Instituto Justiça Fiscal directors Clair Hickmann and João Carlos Loebens take … [Read more...]

The Corporate Tax Haven Index: solving the world’s broken tax system in our monthly podcast, the Taxcast

In this month's June 2019 podcast we look at the new Corporate Tax Haven Index released by the Tax Justice Network. What does it tell us about the global economy and the international tax system? And how can we fix it? We also look at how India is pushing the G20 into action on global tax rules - if … [Read more...]

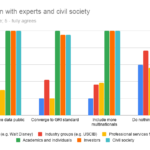

We asked our stakeholders to challenge us on our work

Should we at the Tax Justice Network be doing more to engage with organisations in the global south? Should we be focusing more on high-level advocacy or talking more about progressive taxes instead of tax avoidance? These questions and more were put to us at our organisational retreat this spring … [Read more...]